Space situational awareness service vendors must challenge uncertainties in the market to grow revenue

The satellite industry is set to launch thousands of satellites over the next 10 years. This expanding launch activity will accelerate government concerns around space sustainability, as well as the risks of operating in orbit due to the increasing chances of interference and collision. Space Situational Awareness, a global initiative that provides satellite operators with the ability to monitor their satellites and predict space hazards, serves a market with strong but, as yet unrealised, potential. Despite the risks associated with interrupted satellite services, demand from commercial operators for SSA vendors’ services has not yet materialised, primarily because of confusing government regulations about space sustainability, unactionable industry guidelines (on satellite mission design and manufacturing) and the challenges that operators face with integrating and proving the value proposition of the service. As a result, Analysys Mason forecasts that SSA players will capture only 35% of the serviceable addressable market to 2034.

The article aims to help key players in the SSA market to shape their growth strategies by examining the conflicting requirements of the government sector, the ambiguous terms and conditions of the satellite insurance sector and the potentially high, yet currently restrained, commercial demand for SSA services.

Despite a large addressable market and low barriers to entry, the opportunity for SSA service vendors will be limited in the near term

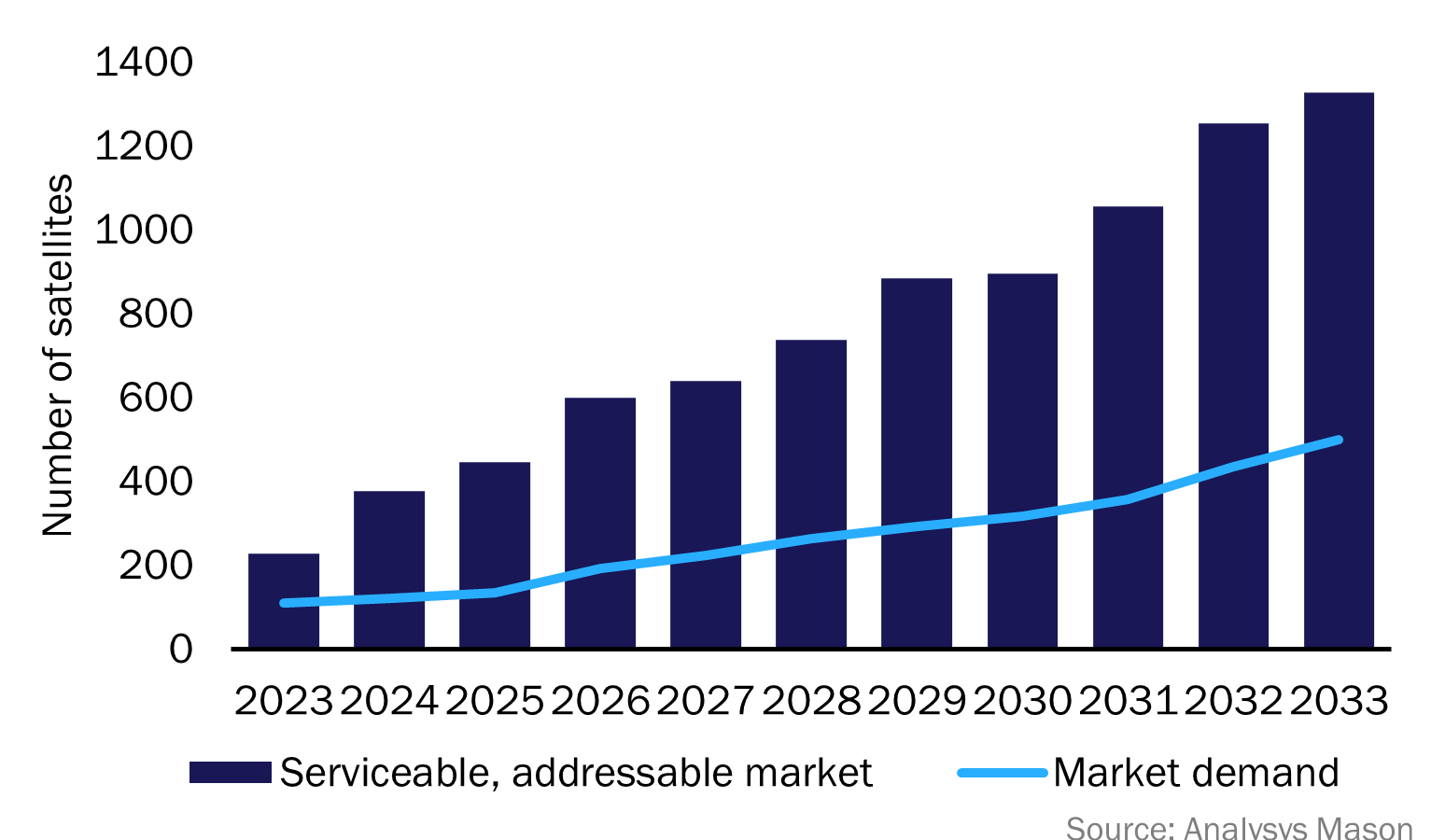

Figure 1: Space situational awareness market forecast, worldwide, 2023–2033

Analysys Mason’s In-orbit satellite services, 7th edition report forecasts that SSA vendors will provide services for monitoring nearly 3000 satellites over the next 10 years, which is expected to generate a cumulative USD5.5 billion in revenue. Commercial customers represent 60% of the satellites served, but revenue remains evenly divided between the commercial market and the government and military sector. The SSA market does not generally face the same types of growth challenges that other satellite and space markets face (in particular, slow revenue growth due to high infrastructure costs and emerging, untested services), but the SSA revenue opportunity remains restricted. The potential customer base for SSA services holds the key to understanding the uncertain state of the market.

Governments are defining and enforcing space sustainability, but must balance their goals against economic concerns

In early April 2024, NASA published its new space sustainability strategy, outlining the main challenges and goals for space activities to remain accessible and environmentally responsible. While this is a new document, sustainability is not a new challenge; NASA and other space agencies have published similar reports and strategies for years. For example, the European Space Agency (ESA) announced its Clean Space initiative in 2009, and while efforts continue to be made to support more-sustainable satellite manufacturing, launches and operations, the market capture here has not grown significantly since then. In the USA, the Federal Communications Commission (FCC), which is responsible for much of the management of satellites and satellite constellations, has been slowly adding more detailed requirements in their satellite licences, recently reaffirming its stance on orbital debris rules in January 2024. However, Analysys Mason has argued that these efforts are not enough because they are being outpaced by the growing risks.

For the civil government sector, space sustainability remains a mostly environmental goal. Similar to other environmental initiatives, progress with sustainability remains slow, and can even restrain the commercial market. As noted in NASA’s own strategy, one of the challenges in developing a stronger definition for, and enforcement of, space sustainability practices is that “space sustainability may be in tension with other mission interests” such as meeting cost and schedule constraints.

As such, public institutions such as NASA and ESA must balance conflicting priorities and ensure that the push for environmental sustainability does not come at the cost of environmental progress. Governments have increasingly sought space solutions from the private sector, especially to stimulate the commercial market, to whom space sustainability may look more like a restriction than an opportunity.

Similarly, governments, satellite operators and vendors have all strongly considered the role of space insurance in the SSA market, yet this area remains poorly defined. Even as the risks continue to grow, insurers are unable to increase their limits beyond industry standards and regulatory pressures, and still remain in business. While new initiatives introduced by governments and insurance companies have begun to expand insurance coverage, the definition of what is and is not sustainable remains too vague to be actionable.

SSA vendors must approach the challenges that their customers face and take advantage of changing customer perceptions

From a commercial standpoint, the time to market and cost are the prime considerations for everyone involved in the SSA market, from satellite manufacturers, launchers and operators to SSA vendors and end-user customers. Government initiatives, licences and insurance coverage all feed into the costs and time needed to develop and sell satellite missions and services. In addition, commercial vendors are pushing back against stronger requirements, arguing that these new definitions “excessively encumber” the industry.

SSA vendors are primarily targeting satellite operators, not government regulators or manufacturers. As is the case with all other in-orbit services, SSA vendors’ main challenge is integrating their services with their customers’ mission designs and operations. Similarly to antivirus software, customers simply want the service to work without having to think about it. For decades, satellite operators have either denied that in-orbit risks were growing, or assumed that free, government-run programmes, combined with their own satellite operation teams, would be sufficient to protect their interests.

The perception among satellite operators that in-orbit is not at risk is now changing and they are now beginning to engage the SSA industry. Over 20 SSA vendors worldwide actively offer, or are currently developing, services. Announcements such as the two partnerships between Spire and Nanoavionics and Neuraspace, as well as fundraising efforts from LeoLabs, Aldoria, Kayhan Space, Look Up Space and NorthStar demonstrate tangible industry interest that will aid the growth of this sector.

SSA’s main advantage over the rest of the hardware-driven space industry is that it is mostly software-driven, which allows SSA vendors to lower the costs to entry and to support faster innovation. However, customer buy-in can be challenging, as operators may either downplay the risks or believe they can be mitigated internally. Analysys Mason forecasts the SSA serviceable addressable market will consist of over 8000 satellites during the next 10 years, but less than 3000 of these satellites will be engaged by SSA services. In other words, 8000 satellites will be launched in medium-to-high risk orbits by operators that either have the potential budget or willingness to pay for SSA services, but SSA vendors will only land 35% of their target market.

To grow their market share, SSA vendors must understand and approach such challenges in multiple ways. Vendors must work with government and military entities to help shape and drive the definition of space sustainable practices because this will enable stronger buy-in from the deep-funded public sector and lead to policy changes for space insurance and satellite licensing. In turn, such developments will raise awareness and buy-in from the commercial side, eventually opening the doors to more invested customers. Finally, vendors must stay ahead of their competition by embracing technologies such as artificial intelligence (AI), machine learning (ML) and other methods of lowering costs and increasing both the value and ease of integration of their services for their customers.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Article

Europe should bridge the gap between various international lunar efforts

Forecast report

Civil government satellite communications: trends and forecasts 2024–2034