US operators should focus on FMC as consolidation boosts competition and reshapes the fixed market

24 October 2025 | Research and Insights

Article | PDF (3 pages) | Fixed–Mobile Convergence| North America Metrics and Forecasts

The limited overlap in US fixed networks has historically smothered competition. This has resulted in low fixed–mobile convergence (FMC) adoption, as well as one of the highest values for fixed broadband ASPU in the world.

However, the current wave of consolidation is reshaping the market dynamics; mergers and acquisitions such as those of AT&T and Lumen Technologies (Lumen), Charter Communications (Charter) and Cox Communications (Cox), and Verizon and Frontier Communications (Frontier) are all scheduled to be finalised in 2026. This should boost competition by increasing network overlap in the long term, thus giving consumers more choice in terms of fixed broadband provider. It will also give operators a broader reach, which will facilitate faster growth in the take-up of FMC.

The details of some of the most significant transactions in the US fixed broadband market are shown in Figure 1.

Figure 1: Summary of the main M&A deals in the USA in 2026

| Acquirer | Target | Deal value | Coverage acquired | Customers acquired |

|---|---|---|---|---|

| AT&T | Lumen | USD5.75 billion | 4 million fibre locations (2.8% of households), leading to total coverage of 60 million fibre locations by 2030 (around 40% of households) | 1 million fibre customers |

| Charter | Cox | USD34.5 billion | 12 million fixed broadband locations (8.3% of households), leading to total coverage of nearly 70 million broadband locations (approximately 47% of households) | 5.9 million fixed broadband customers |

| Verizon | Frontier | USD20 billion | 8.5 million fibre locations (5.9% of households), leading to total coverage of 26 million fibre locations. (approximately 17% of households) | 3.2 million fixed broadband customers, including 2.6 million fibre consumers |

Source: Analysys Mason

There is also a lot of activity among smaller broadband providers, with at least a few transactions happening every month. Some of the more notable deals include T-Mobile/KKR’s acquisition of Lumos, Metronet and US Internet, Ezee Fiber’s acquisition of Tachus Fiber Internet, Shentel’s acquisition of WideOpen Blacksburg and Ripple Fiber’s acquisition of BridgeNET Fiber.

Consolidation will alter the market structure, drive competition and increase fibre and FMC take-up

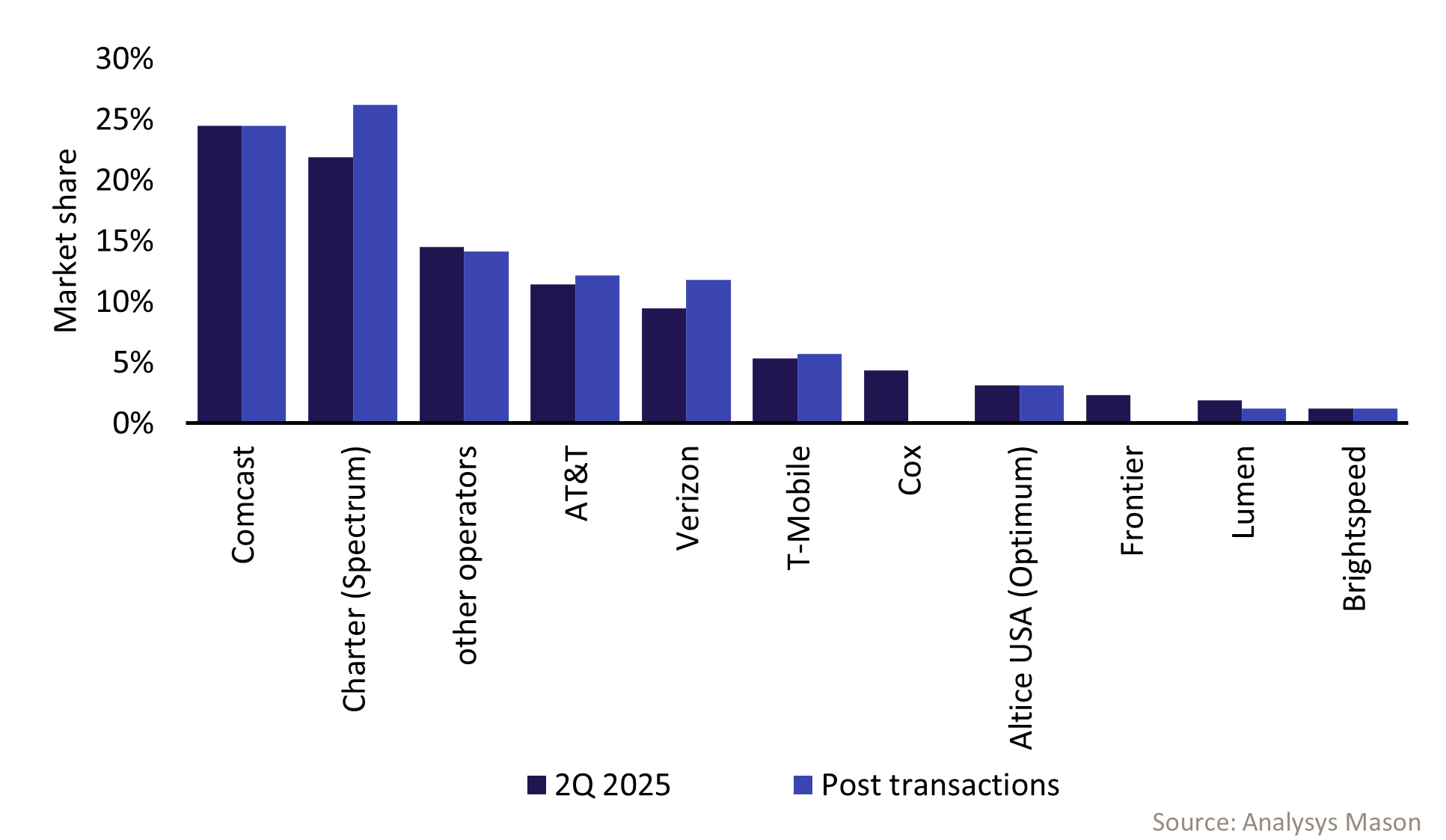

Comcast accounted for the largest share of fixed broadband connections in the USA in 2Q 2025 (Figure 2). However, the Charter–Cox deal will result in a new market leader, with 26.2% of connections, and Comcast will take second place. AT&T will remain the third-largest broadband operator in the market, with 12.2% of connections.

Figure 2: Fixed broadband connection market shares (including fixed-wireless access)1

Fourth-place Verizon will close the gap in market share with AT&T following the deal with Frontier; the difference will fall from 2.1 percentage points (pp) in 2Q 2025 to 0.4pp after the deal. T-Mobile completed the acquisition of Lumos in April 2025, so any benefit is already reflected in its 2Q 2025 market share. However, we expect a further increase of around 0.4pp due to the acquisitions of Metronet and US Internet.

Combined, the ‘other operators’ category will account for over 14% of all connections, which translates to nearly 20 million fixed broadband connections. The large number of smaller fixed broadband providers in the market leaves considerable room for further M&A. We could also see a significant market player emerging from these smaller operators in the future due to organic growth and M&A. Indeed, we are already seeing some activity involving these smaller players. Ezee Fiber acquired Tachus in 2025, and also grew organically in Houston, New Mexico, Washington State and the greater Chicagoland area. Ziply Fiber was acquired by Bell Canada in August 2025; the backing of a bigger company should help it to accelerate its fibre roll-out and attract more customers. Starlink is also emerging as a significant player, seeing a strong growth in its satellite broadband connections.

The transactions will have the following impact on the market.

- Competition will increase in the long term. The number of providers will decrease due to M&A activity, but consumers’ choice of provider will rise due to a growing amount of network overlap. This will lead to an increase in direct competition.

- Fibre should be rolled out more rapidly. The combined, larger entities are likely to roll out broadband networks more quickly than their smaller counterparts due to greater access to funding and other resources.

- Fibre take-up will increase. AT&T, Verizon and T-Mobile possess significantly stronger retail capabilities than the broadband operators they acquired. This means that the proportion of homes passed that take a fibre connection is higher for AT&T, Verizon and T-Mobile than for the acquired operators. As a result, we would expect an increase in fibre adoption among the households passed by the acquired providers.

- FMC take-up will increase. The increased fixed network footprint enabled by the acquisitions will allow AT&T, Verizon and T-Mobile to extend the reach of their FMC offerings. It will also allow them to upsell broadband services to existing mobile customers in these new areas.

The telecoms market in the USA will see a marked shift towards FMC

The telecoms market in the USA has been evolving in recent years; all three major mobile network operators have focused on expanding their fixed networks and boosting their FMC capabilities. Operators are prioritising FMC as mobile and fixed broadband markets near saturation to improve customer loyalty (customers tied into a bigger contract are less likely to churn) and increase customer spend.

The network expansions realised via M&A will enable operators to reach more subscribers with their FMC propositions. In June 2025, we estimated that the FMC share of total telecoms revenue would reach 24.5% by 2030. We now expect that the adoption of FMC will grow more rapidly and align more closely with that in Western Europe. The transactions listed in this article are unlikely to be the last because operators will seek further growth in their fixed network coverage.

To learn more about the fixed broadband and FMC markets in the USA, see Analysys Mason’s North America Metrics and Forecasts research module and Fixed–Mobile Convergence research programme.

1 Based on data from Analysys Mason’s DataHub. For more information, see Analysys Mason’s North America Metrics and Forecasts research module.

Article (PDF)

DownloadAuthor

Jakub Konieczny

Senior AnalystRelated items

Podcast

Analysys Mason’s research topics for 2026

Tracker

Fixed–mobile convergence quarterly metrics 3Q 2025

Survey report

Fixed–mobile customer satisfaction and experience: consumer survey