Vendors should encourage MNOs to upgrade their IMSs to reduce costs and provide a basis for 5G services

Voice remains a strategic service that mobile network operators (MNOs) must deliver, not only to meet customer requirements, but also for regulatory reasons such as for access to emergency numbers and legal intercept. However, voice services have become commoditised over the last few years in response to competitive pressures from over-the-top (OTT) applications such as WeChat and WhatsApp. IP multimedia subsystem (IMS) infrastructure is a key requirement for delivering voice over LTE (VoLTE) services and enables MNOs to shut down legacy networks in order to save costs and deliver new revenue-generating services using rich communications services (RCS), but many MNOs have been slow to deploy or upgrade their existing systems.

This comment discusses the importance of IMSs to MNOs. It highlights the benefits that IMS solutions will bring and explains why vendors should engage with a variety of MNOs, especially those that have been slower in embracing IMS upgrades. For a full discussion on voice and messaging challenges faced by MNOs, please refer to our report, IMS: vendors must support MNOs’ voice strategies during the migration to 5G standalone.

MNOs’ voice revenue is in decline and messaging revenue is under pressure as competition with OTT players intensifies

Voice services are strategic for MNOs, but retail voice revenue has fallen in most countries in the last 5–7 years. Increasing smartphone penetration and the growing adoption of data services and OTT applications (such as Facebook Messenger, WeChat and WhatsApp) have resulted in the substitution of legacy voice calls with IP-based calling and messaging. Regulators have also started to reduce mobile termination rates (MTRs), thereby further reducing revenue from incoming calls that originate from another network.

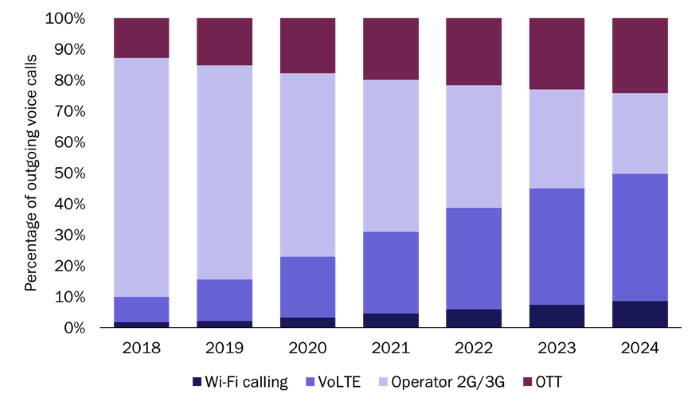

MNO-led voice services remain dominant worldwide and accounted for 85% of all outgoing voice traffic in 2019; this will fall to 76% by 2024 (Figure 1).1 MNOs may not eliminate OTT voice competition, but our forecasts indicate that the penetration of OTT services will grow the most slowly in the regions in which MNOs deploy VoLTE the fastest. VoLTE will not just deliver high-definition (HD) voice; it will also allow MNOs to reduce their operational costs and transfer the savings to customers through improved voice propositions.

Figure 1: Outgoing voice traffic by technology, worldwide, 2018–2024

Source: Analysys Mason, 2020

The number of application-to-person (A2P) messages and the A2P revenue are growing as brands add mobile and digital channels to interact with their existing customers and recruit new ones. Person-to-person (P2P) SMS traffic has progressively been overtaken by that from OTT services. We forecast that the volume of A2P SMS traffic will stop growing in 2022, even though SMS is the most-used channel for A2P messaging and will remain so until 2024.

MNOs’ lack of IMS deployments will risk jeopardising 5G investments and limit resource reutilisation and cost savings

Many MNOs have deployed IMS infrastructure in response to the declines in voice and messaging revenue and their need to save costs. However, in the 4G era, those MNOs that have not done so will depend on legacy 2G and 3G circuit-switched infrastructure to deliver voice services. This is an inefficient use of resources. It not only requires MNOs to maintain multiple generations of networks, but will prevent valuable resources such as spectrum from being reallocated to the more-efficient 4G (and later, 5G) networks.

MNOs must implement VoLTE roaming features on their 4G networks in order to plan for the shutdown of legacy networks. Without these features, an inbound roamer, even one with a 4G VoLTE-enabled handset, would have to rely on a 3G circuit-switched fallback mechanism and use legacy networks for all incoming and outgoing voice calls. Many MNOs in developed markets have maintained their legacy networks in order to deliver voice services to both customers without VoLTE-enabled handsets and inbound international travellers; this strategy will start to make less and less sense as we move towards the 5G era.

In addition, MNOs will risk jeopardising their 5G investments if they do not make the relevant IMS investments. We forecast that vendors’ IMS virtualised network functions (VNFs) revenue will be substantially lower than their RAN revenue by 2025 (21% of RAN revenue). However, an IMS implementation will be essential in the 5G standalone (SA) era because handover mechanisms to legacy networks will cease to exist (there are currently mechanisms in place for a 4G handset to use 3G networks to connect a voice call).

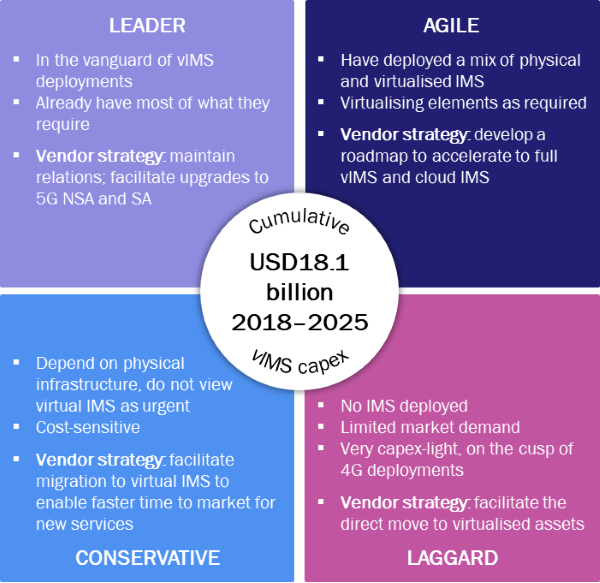

Vendors should understand the IMS requirements of each of the four main categories of MNOs and plan accordingly

The speed at which each MNO will upgrade its IMS infrastructure depends on market conditions, network deployment strategies and the availability of ecosystem suppliers (such as smartphone chipset providers, which are necessary for voice over new radio (VoNR) using 5G SA architecture).

We conducted a survey of 72 MNOs and a number of interviews and analysed public information in order to calculate the propensity of MNOs to invest in further upgrades (such as to migrate from virtualised solutions to cloud IMS or to migrate from physical to virtualised infrastructure) between 2018 and 2025.2 Four main MNO categories emerged, and vendors should familiarise themselves with the requirements of each (Figure 2). Vendors should devise specific roadmaps (which could include the option of offering RCS messaging platforms) and marketing messaging for each group of MNOs in order to improve their sales success.

Figure 2: Descriptions of the four groups of MNOs in terms of their IMS deployments and an overview of how vendors can support them

Source: Analysys Mason, 2020

1 For more information, see Analysys Mason’s IMS: vendors must support MNOs’ voice strategies during the migration to 5G standalone.

2 The survey was carried out in 2Q 2020. 60 of the 72 respondents had deployed some form of IMS.