More wins for Starlink maritime – but, can momentum continue?

This past June SpaceX’s Starlink competitor OneWeb, in partnership with Speedcast, entered the maritime market. As LEO broadband connectivity is a new market, the key factors that end-users value have yet to be solidified. Nevertheless, both Committed Information Rate (CIR) and the Service Level Agreement (SLA) alongside CAPEX and OPEX will determine the “winner”. Ultimately, the absence of a CIR and SLA may result in Starlink headwinds over the next 5 years as “SLA-focused LEO” offerings come online.

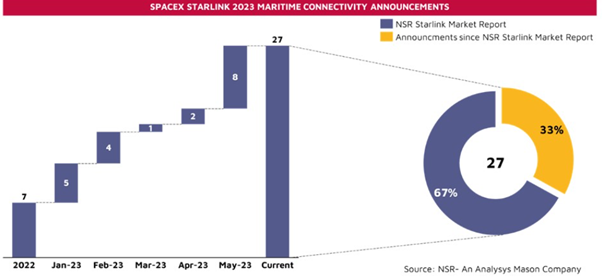

Since the release of the NSR Starlink Maritime Strategies Report in mid-April, an additional 9 SpaceX’s Starlink announcements have been made. As the first provider of LEO broadband connectivity, Starlink has gathered a large amount of interest across the maritime market. Nevertheless, as of June 2023 OneWeb, in collaboration with Speedcast, announced the first commercial OneWeb maritime deployment onboard the German research vessel RV Polarstern. The demand for connectivity providers such as Starlink and OneWeb arises from the need to address maritime’s notorious low-quality connectivity. Looking ahead, mariners will have to decide if their vessel requires two or more LEO connectivity options. Next year will be key in determining if these ‘cancel any time’ services can be sustained. If not, LEO’s success may be dependent on the comfort to end-users brought on by CIRs and SLAs.

The LEO battle may ultimately depend on CIRs & SLAs

When assessing the two maritime LEO connectivity providers, SpaceX’s Starlink and OneWeb, both have different approaches towards CIRs and SLAs. CIRs provides end-users a guaranteed bandwidth even in periods of heightened demand. Starlink does not offer a CIR, whereas, maritime GEO connectivity typically provides some form of connectivity assurances. Nevertheless, OneWeb stands apart from Starlink as they can provide CIR to their maritime customers, giving them a (potential) competitive advantage.

In the enterprise-class maritime connectivity market, customers place great importance on SLAs. SLAs provide assurance of defined quality and scope of service, alongside things like front-line Tier 1 help desk support. These services are particularly crucial for mariners as it serves as the initial point of contact to trouble-shoot mission-critical connectivity that enable vessel optimization applications. Presently, SpaceX’s Starlink does not provide an SLA, however, they do offer attractive pricing packages for maritime ranging from $250 a month for 50GB to $5000 per month for 5TB. At these price-points, the market is asking itself, “How much am I (really) willing to spend on SLAs and CIRs?” For OneWeb which provides an SLA to their maritime customers but has yet to publicly disclose pricing as of May 2023, the answer hopefully is, “more than no SLAs.”

Ultimately, mariners will determine how much value there is to SLAs and CIRs. More importantly, they will determine if there is a need for parallel LEO services or if LEO is a “winner take all” market in maritime. Today, merchant, passenger, and offshore maritime customers see the benefit of using a multi-dimensional network connectivity approach as evidenced by the success of services like Inmarsat’s Global Xpress Multi-Dimensional Ka-band backed-up by L-band. For mariners they will most likely make their decision based on the total cost of ownership – including their own valuation of the CIRs and SLAs. SpaceX’s Starlink may be adequate going forward. However, today merchant, passenger, and offshore vessels require the assurances provided by CIRs and SLAs. In the near term, these NGSO services will not live onboard alone.

The bottom line

SpaceX’s Starlink has been the dominant player in the maritime LEO market. However, a new competitor, OneWeb, has ‘officially’ entered this arena. Ultimately the key to leading the LEO connectivity market lies in providing a superior service, that manages CAPEX and OPEX. Sometimes that includes CIRs and SLAs, but mostly for enterprise-class maritime customers it will require a multi-dimensional network approach lead by service providers delivering a combination of connectivity, support, and value-added services.

Article (PDF)

DownloadRelated items

Article

Predictions for the space industry in 2025

Article

Satellite communications: assessing the addressable market for mobile and fixed broadband services

Forecast report

Connected vehicles via satellite: trends and forecasts 2023–2033