Deutsche Telekom aims to preserve a pivotal role without owning all the FTTP infrastructure

Deutsche Telekom is ramping up its FTTP roll-out

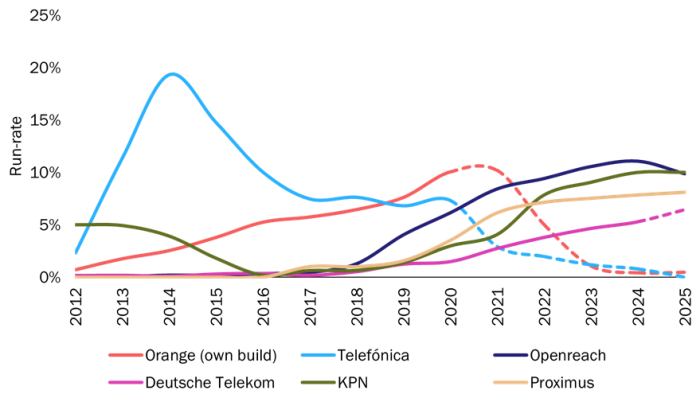

As was expected, FTTP (particularly German FTTP) occupied centre-stage at Deutsche Telekom’s May 2021 Capital Markets Day. Deutsche Telekom aims to pass an additional 1.2 million premises in Germany in 2021, and hopes to add a further 2.5 million each year by 2024. It aims to have 60% FTTP coverage on its own infrastructure by 2030. This plan is more ambitious than earlier iterations, but it still has a slower run-rate (premises passed per year divided by the total number of premises) than those of most of Deutsche Telekom’s peers (Figure 1).

Figure 1: FTTP build run-rate, selected operators, Europe, 2012–20251

Source: Analysys Mason, 2021

Deutsche Telekom’s average cost per premises passed (CPPP) is still over EUR1000 for the whole of Germany, although comments back in 4Q 2019 indicated that the unit costs in urban areas are substantially below this average.

“On FTTH […] the target is on average to get to below EUR1000. If you go into dense urban areas, obviously we’re seeking more towards EUR500 to EUR600. If you go into suburban areas, we’re more in the vicinity of EUR1000 to EUR1500.”2

These ranges are significantly higher than those in the UK (about EUR350–500 for urban areas) and Spain (about EUR200–250 for urban areas), and a little higher than those in Belgium (about EUR850–950 nationally). There is a set of cost problems that is unique to Germany, as Deutsche Telekom has previously pointed out. Copper distribution loops are usually directly buried, making it necessary to dig anywhere beyond the street cabinet, and there are significant barriers due to bureaucracy (permits differ between Länder (federal states)) and building restrictions.

Deutsche Telekom aims to reduce its unit costs by 25% by:

- creating a ‘Fiber Factory’ with 13 000 dedicated employees (standardised processes and a shift in the balance of work from in situ construction to pre-construction

- deploying local teams that are familiar with regional and local administrations

- applying turnkey models for joint ventures

- using micro-trenching and even poles (in the hope of changing building regulations)

- using new digital planning tools

- provisioning tools to reduce the number of interactions and visits (it aims to reduce the typical number of interactions between the first end-user contact and service activation from seven to two).

The FTTP business case in Germany appears to hinge on ‘more-for-more’ pricing for FTTP bitstream. Deutsche Telekom has managed to maintain that principle with FTTC L2-BSA, its main wholesale product. However, this could prove harder to maintain with FTTP if alternative infrastructure is also present; the business case of many passive-only fibre builders is to undermine the ‘more-for-more’ approach to wholesale pricing and replace it with a flat rate for unbundled access. However, the high cost of FTTP in Germany is likely to deter overbuilders. One type of area where overbuild could be a concern is where cable operators upgrade coax to FTTP and in doing so switch to a wholesale-oriented model.

More-for-more approaches can weaken demand, so it is interesting to see Deutsche Telekom’s analysis of how close end users are to buying the theoretically fastest service that is available to them, and therefore how soon they may be prepared to spend more for more with FTTP. Deutsche Telekom is also keen on developing more regional FTTP joint ventures, which may allow greater flexibility in setting rates.

Deutsche Telekom wants to take on the role of orchestrator

Deutsche Telekom CEO Tim Höttges also outlined a longer-term vision for the company at the Capital Markets Day. This was not elaborated on a great deal in the subsequent divisional presentations, but it provides a broader view of a dominant player that does not need to own all of the infrastructure on which its services are based.

Deutsche Telekom envisions itself as a ‘network of networks’, or as an orchestrator of (its own and) other infrastructure; it will build and provide APIs in a software-driven environment. It is not a netco, nor is it a digital service provider; its core role lies somewhere in-between. Höttges emphasised experience over connectivity, and acknowledged that not all of the connectivity will be self-provided. Additionally, he stated that the operator is unlikely to become a creator of use cases, so this leaves minimal potential for any push into adjacent markets.

This vision is supposed to take Deutsche Telekom back to holding a pivotal incumbent-like role (though now at a platform, rather than a pure infrastructure, level), despite disruptions in the fixed access market from the likes of Deutsche Glasfaser and Unsere Grüne Glasfaser. That platform could then be taken further into other markets where the operator lacks infrastructure. For example, where Deutsche Telekom has no fibre for fixed access, it would ideally buy wholesale at Layer 1 and resell either retail or bitstream (or in the future via slicing). Thanks to its scale and scope, its own retail and wholesale offers would, it hopes, trump any that the infrastructure owner might itself want to provide.

Underlying all of this is a view that Deutsche Telekom will be a guarantor of experiences by 2030: it will configure its network so that conference calls will not drop and 8K video will not pixelate, for example. Setting aside any regulatory concerns over this model (in particular, how revenue might be extracted from the providers that retail these services), there have to be question marks over just how much additional revenue this will generate.

European operators, especially the more-established ones, seem wedded to some kind of future opt-in-for-quality model. 5G network-slicing, in particular, appears to promise this decommoditisation of connectivity. This seems at odds with the more-mundane reality of the (fixed) telecoms utility. Consumers do not expect to pay more to power suppliers for a guarantee that kettles will boil more quickly, for example (though most will be prepared to spend extra if their current overall power supply is intermittent or inadequate). Perhaps the COVID-19 pandemic has made end users more prepared to pay more, but improving connectivity while at the same time expecting a premium for guaranteeing experience seems paradoxical at first glance, and maybe asks too much of the post-pandemic user. How better experience is tariffed and monetised by an orchestrator remains something of a mystery.

1 Solid lines indicate commitments, while dashed lines indicate estimates or looser ambitions.

2 Full year results 2019 (2019), Deutsche Telekom. Available at: https://www.telekom.com/en/investor-relations/publications/financial-results/financial-results-2019.

Article (PDF)

DownloadAuthor