MVNOs 2.0: new pricing models in a data-driven environment

Traditional MVNO models may struggle to compete in an environment of high competition and data-driven services. This article considers how MVNOs need to adapt their pricing structures, and examines the new models that are emerging to meet this challenge, including capacity-based pricing and inside-out MVNOs.

Unit-based approaches to pricing are losing relevance in a data-driven environment

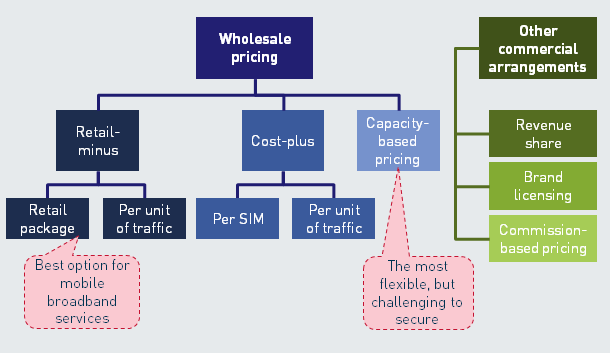

MVNO pricing models have evolved during the past 15 years since their inception and now cover a wide range of approaches, each of which has its advantages and disadvantages. The models are summarised in Figure 1.

Figure 1: Summary of MVNO pricing structures [Source: Analysys Mason, 2015]

Other than revenue-share arrangements, the most common forms of MVNO wholesale pricing agreements are based on units of usage by service – for example, per minute, per megabyte or per SMS. This was a logical approach to charging for voice services in situations where operators needed to pay interconnection charges to third-party networks. Regulated prices for interconnection could be used as a convenient benchmark for MVNO pricing, as a representation of the cost to the network of carrying incremental traffic. (It should be noted that not all interconnect rates reflect network costs, this depends on the regulatory regime.)

However, this approach is losing its relevance in a data-driven environment because of the rapidly falling unit price of data and the high risks associated with forecasting proportional usage of a bundle.

The price of data has declined by more than 80% in the UK between 1Q 2010 and 2Q 2014, and similar trends are seen across Europe (see our Telecoms Market Matrix: Western Europe 2Q 2014). Wholesale pricing would require constant updates to manage this trend, which is unfeasible, particularly in a cost-plus model. Retail-minus models provide some protection, but only if the retail price benchmark is accurate, and even in this case, the frequency of adjustments required may make this unfeasible. Operators’ own costs of carrying data are also declining rapidly with significant improvements in efficiency through use of LTE and LTE-Advanced, as well as larger spectrum holdings (see Analysys Mason’s article Bringing down the cost of mobile data traffic: investing in new technologies and more spectrum).

We recommend using a pricing model better suited to data bundles

Retail data services are rarely sold per unit, but rather in a bundle with a usage cap. The proportion of this bundle that any one subscriber consumes is hugely variable. A host operator may share or disclose their average bundle usage in order to support proposed unit-based pricing. However, we strongly recommend that MVNOs do not build their business model on this basis. In many (not all) cases, MVNO subscribers are more likely to be aware of their usage, and to monitor it more carefully. It is likely that their proportional consumption of a data bundle will be significantly higher than the market average. In addition, the MVNO user base will be smaller than the host’s and a small number of heavy users can easily sway the average.

As such, we recommend approaching wholesale pricing differently. The most straightforward approach is a retail-minus price per retail package, for example 500MB, 1GB or 3GB. This can even include ‘unlimited’ bundles, which are common in the USA, even for MVNOs (for example Red Pocket Mobile, although we note that the fair usage cap is 2.5GB, and usage thereafter is throttled to 256Kbps). In this way, any risk associated with high usage of the bundle is carried by the operator not the MVNO.

A special case is the capacity-based pricing model agreed between Liberty Global and Three Ireland (Hutchison). This provides Liberty Global with 30% of Three’s network capacity for a fixed fee. In this way, Liberty Global has significantly more flexibility in data pricing, with no link to unit consumption. However, this arrangement is very challenging to implement and even more challenging to negotiate (in this instance, the European Commission (EC) mandated the arrangement as a condition of its approval of the merger of Three and Telefónica Ireland (O2) in Ireland). As such, this is unlikely to become a widely adopted model.

The ‘inside-out’ model is another way of addressing wholesale data costs

In addition to amending wholesale pricing structures, another way of addressing the challenge of wholesale data pricing is to divert traffic away from the host operator’s network. This ‘inside-out’ MVNO model is a valid option for fixed-line and cable operators with a large installed base of small cells. The concept is to extend the already extensive user-initiated offload (choosing to connect to a Wi-Fi network), and use in-home and office networks as network hotspots, open to all users. This may use unlicensed spectrum (namely Wi-Fi) or licensed spectrum (where MVNOs have purchased pieces of spectrum themselves). These models present many challenges. Initial examples of this model include BT’s One Phone in the UK and Free in France (Free is not an MVNO, but is using the same approach), and an increasing number are likely to emerge (see Analysys Mason’s report Inside-out wireless networks for fixed operators: the technical and commercial challenges of HetNets).

Established MVNOs are advised to review their contract pricing for data in order to remain competitive in the emerging environment. For new entrants, opportunities are emerging for content-based and inside-out models.

Analysys Mason can support both MVNOs and operators in developing their strategy, proposition and business plan, as well as negotiating the wholesale agreement.