Open RAN: increased collaborative efforts and a realistic view of timing will be needed to deliver the full benefits

24 April 2023 | Subscription research

Article | PDF (3 pages) | Wireless Technologies

New technologies are almost invariably greeted with early enthusiasm, followed by a period of disillusionment when they do not deliver on all their promises immediately. Open RAN is the latest example. After 5 years of industry initiatives, many supporters expected it to have significantly shaken up the RAN supply chain by now, yet commercial progress has been limited. However, this reflects over-ambitious timeframes rather than a failure of the whole concept. This is not the time to despair of the idea of an open, multivendor, cloud-based network, but to redouble collaborative efforts to address the significant challenges, while setting realistic timings.

Analysys Mason’s upcoming webinar, Open RAN: translating the hype into revenue, will outline the reasons to persevere, and the key solutions that the industry needs to develop to turn Open RAN hopes into revenue and profit.

Open RAN initiatives bring hopes of increased choice for operators and new opportunities for vendors

Organisations such as the O-RAN Alliance and Telecom Infra Project initiated the idea of a virtualised network based on standard interfaces, to enable elements from different suppliers to be combined easily within the same RAN. Instead of the single-vendor, proprietary RAN solutions that power current cellular networks, operators could choose different suppliers for each of the main elements of the RAN, the radio unit and the baseband unit. Furthermore, the baseband unit could be virtualised and would then run on cloud technology from yet more vendors.

This goal has been pursued by the following three main groups.

- Large operators that want to have an increased choice of suppliers when they take the challenging step of moving to a cloud-based RAN architecture. This would boost innovation and competition, and make it possible to change vendors in future without replacing the entire network. The issue is particularly urgent for operators in countries where governments have restricted access to Chinese equipment for 5G.

- Small or new operators, such as private network operators, that want to select equipment and software at lower price points than the top vendors usually support.

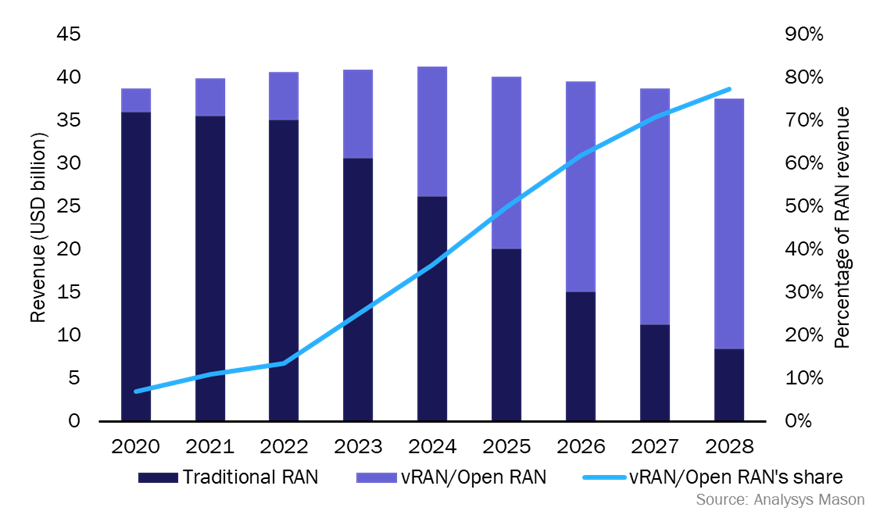

- Vendors that have been unable to target the RAN market, because the barriers to entry have been so high. Whether these companies are moving from the cloud and IT world, like Dell, or are specialised start-ups, like Mavenir, they are aiming to secure a share of a market worth USD40 billion in 2022, according to Analysys Mason’s most recent forecast.

So far, progress has been disappointing, and intensive efforts have not translated into significant change to the status quo

Despite a large number of technology developments and some large trials, to date there have been very few commercial deployments of Open RANs at scale. The most high-profile projects are by two greenfield operators, Rakuten Mobile in Japan and DISH Network in the USA, but these provide limited indicators for the rest of the market. As new entrants, they do not face one of the biggest challenges of Open RAN, integration and co-existence with established networks. And although both are working with several suppliers, their biggest radio and baseband providers are not new to the RAN market. NEC is the biggest vendor for Rakuten, and Samsung for DISH, and although these large companies have not been global RAN players before, they do not represent the vision of a mobile network ecosystem made up of a large number of suppliers, many from outside the sector.

Even Tareq Amin, CEO of Rakuten Mobile and its vendor arm Symphony, said at this year’s Mobile World Congress that he was “really, really disappointed” with the limited adoption of Open RAN by brownfield operators. Some operators, notably Deutsche Telekom, NTT Docomo and Vodafone, have started to deploy Open RAN in a few small areas, but according to a survey of 75 operators, conducted by Analysys Mason in 4Q 2022, over 80% do not expect to implement multivendor Open RAN in the urban macro network until 2026 or later. That leaves a hiatus during which operators cannot achieve the supply chain disruption and cost savings that they were targeting from Open RAN, and challenger vendors cannot generate significant revenue.

The emergence of common network and chip platforms will help Open RAN to deliver on its promises in the coming years

As we will argue in the webinar, the challenges are real but not insurmountable. Our operator research indicates that there are three main barriers to adoption of Open RAN, as we described in a recent report. These are the immaturity of cloud platforms when handling demanding RAN tasks such as beamforming; the cost and complexity of integrating elements from multiple vendors; and the difficulties that new suppliers face in scaling up their offerings for massive roll-outs.

However, solutions are emerging, and there is strong collective will across the ecosystem to address the challenges. For instance, five large semiconductor vendors showed off Open RAN acceleration solutions at Mobile World Congress. These solutions are designed to offload demanding RAN processes from the central processor in a cloud server in order to boost overall performance.

The other two challenges will be most effectively addressed by a platform approach to the RAN in which hardware and software elements are designed within a common framework of specifications and APIs, so that there can be significant amounts of pre-integration, to reduce cost and time for the operator. In this environment, vendors of all sizes can co-operate to drive solutions to the scale required by large operators. Rakuten Symphony is one example of an emerging RAN platform, but others may develop around large ecosystem players such as Dell or Intel, or through open initiatives such as TIP.

We believe that if the industry effort that is currently being made to address these challenges continues, there will be a tipping point for virtualised and Open RAN in 2025–2026 (Figure 1), which will then start to deliver significant commercial benefits to the entire ecosystem.

Figure 1: vRAN/Open RAN revenue in RANs, worldwide, 2020–2028

Author