UK FTTP: is the success of alternative networks impacting Openreach’s broadband connections?

BT Group (BT) recently announced its half-year financial results for FY2024. One interesting feature was the accelerated decline in the customer base of its infrastructure arm, Openreach, for broadband services. This is an important trend to track because, despite Openreach’s impressive fibre-to-the-premises (FTTP) progress, the reduction in its overall broadband connections (including its copper broadband products) could indicate that FTTP competitors are gaining market share. A key question to ask is, what is really driving this line loss?

Line loss acceleration

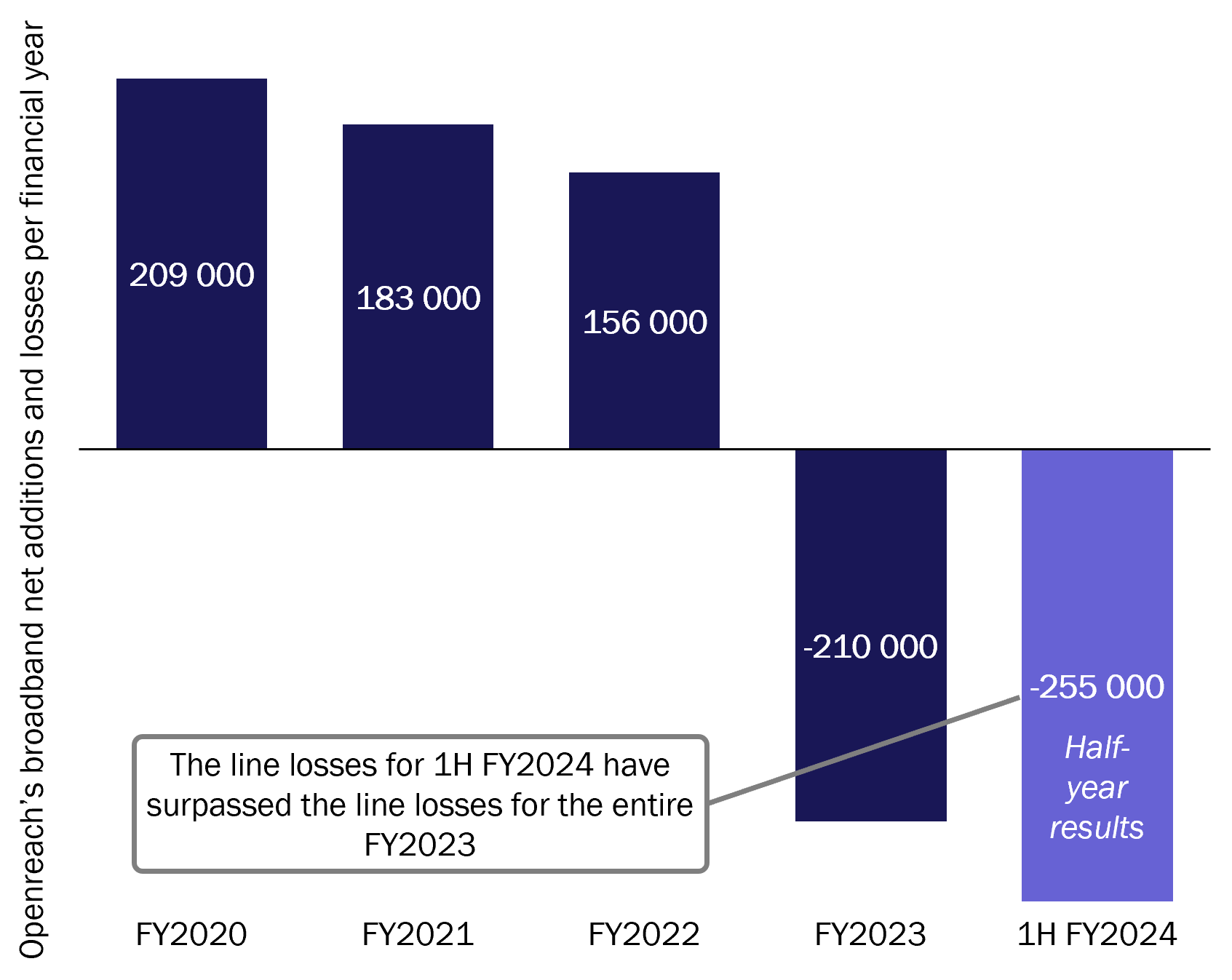

BT stated in its FY2023 end of year financial results presentation (May 2023) that the impact of market competition on its FY2023 line losses was ‘modest’, but indicated that additional market factors, such as slow recovery in the overall broadband market and limited new home build, were the main drivers. BT also stated in May 2023 that it expected broadband line losses to peak in FY2024 at around 400 000 lines, driven by increased competition but also due to internal adjustments related to the double counting of lines.1 Openreach’s net broadband additions since FY2020 are shown in Figure 1.

Figure 1: Openreach’s broadband net additions and losses per financial year

Source: Analysys Mason

As shown in Figure 1, Openreach’s line losses in the first half of FY2024 had already exceeded more than half of its projected full-year estimate for FY2024, and now total 465 000 lines lost (or 2% of its overall broadband customer base) since the start of FY2023. It is also important to note that in the period before Openreach started losing lines, its broadband growth slowed. Openreach’s broadband base grew by around 0.8% per year between FY2020 and FY2022, which does not seem to be consistent with the overall broadband market. Data from Ofcom shows a market growth rate of double that of Openreach’s in the same period (around 1.6%), and historically, Openreach’s growth rate has been much closer to that of the overall market.2 Therefore, it does appear that competitive pressures on Openreach are causing line losses.

Competition bites?

FTTP alternative network (altnet) coverage is closing in on nearly a third of UK premises. Struggles among some FTTP altnets have been widely reported throughout 2023, with job losses and roll-out slowdowns taking place (for example, Broadway Partners, LightSpeed Broadband). However, these setbacks are not experienced by all altnets. Recent public announcements from Fibrus, Gigaclear and Hyperoptic, for example, show solid customer bases, and we now know that many altnets are placing increased emphasis on driving take-up to accelerate growth in customer connections.3 In addition to those public announcements, we are also aware, through our ongoing strategic advisory and transaction work, of altnets that are performing well across a range of geographies and competition dynamics. So, while the narratives of altnet challenges are important, they are overshadowing certain altnet successes.

Ultimately, as Openreach is the largest network operator in the UK, its legacy copper network customers will be a major source of FTTP connections for altnets, and we believe this is now being shown through the data being reported. Openreach’s total line losses from the past 18 months (and its previous slowdown in net additions growth) is approximately in the same magnitude as the customer numbers reported in the public domain by altnets.

Will this rate of losses continue to increase?

Openreach’s broadband line losses to date have been modest and BT stated in its half-year financial update that it continues to target a decline of around 400 000 lines this year, although it does note that there is a risk this could be higher. We agree that it looks likely to be higher. The big question for Openreach, and the rest of the market, is: will line losses continue to grow beyond this?

There are a number of factors that will likely influence this trend. For example, the potential easing of debt markets could allow the established altnets to finance larger roll-outs, further increasing the share of Openreach’s network that will face competition from one or more altnets. In addition, Openreach’s largest rival, VMO2, is continuing to expand its footprint through nexfibre. Another factor could be growing M&A activity across the market, which is likely to lead to a number of ‘regional’ networks, allowing altnets to realise operational synergies and potentially create stronger local brands and propositions.

Finally, another significant risk to Openreach is the possible opening up of regional networks, or consolidated networks (via the integration of investors’ assets), to wholesale services. The increased scale of these aggregated wholesale networks may mean they start to become a potential alternative for Openreach’s largest ISP customers. A recent example of this wholesale consolidation is Fern Trading, who consolidated its four fibre assets in September 2023, creating a single wholesale network. It is likely that other investor groups will follow suit here, which could further increase pressure on Openreach.

Analysys Mason can assist FTTP companies in strategy, financing and M&A activity. We offer in-depth analysis of market trends and consolidation drivers, helping companies to identify potential acquisition targets or merger partners. Our expertise extends to conducting commercial and technical due diligence, and valuations, as well as developing integration plans, post-merger strategies, cross-functional integration programme assurance and transformation support. For more information, contact Oliver Loveless or Matt Yardley.

1 Openreach’s internet service providers (ISPs) used a small number of metallic path facility (MPF) copper lines to offer voice services alongside their FTTP lines. Openreach expects these to be removed during FY2024 (ahead of the planned PSTN switch-off in 2025), which, according to the operator, accounts for around 50% (around 200 000) of expected line losses across the year.

2 Total market broadband lines data taken from Ofcom’s Telecommunications Market Data quarterly updates.

3 According to Hyperoptic 2022 accounts, Gigaclear and Fibrus press releases from August/September 2023.

Article (PDF)

DownloadAuthors

Oliver Loveless

Principal, expert in broadband intervention

Matt Yardley

Managing Partner, expert in business planning and rural broadband strategyRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Article

Operators could maximise the capabilities of existing in-home equipment by offering Wi-Fi motion sensing