Video providers should consider using a hybrid business model in crowded markets

Analysys Mason’s Connected Consumer Survey 2019 shows that video service stacking is reaching saturation point in Europe, meaning that video providers will have to look elsewhere for future revenue growth. European video providers should take a cue from their peers in the USA and consider using advertising to diversify their income streams and strengthen their subscriber relationships.

Consumers are losing their appetite for stacking additional services on top of their current subscriptions and several major services have yet to launch in Europe, so local video providers should anticipate the coming and going of nomadic subscribers that are trying out new market entrants or are following different hit series and league seasons as they are available. To thrive in this increasingly fluid market, video providers should reconsider the traditional measures against churn in favour of strategies aimed at providing value on both sides, both during and outside of subscriptions.

Progressive providers are already adapting to this new dynamic and are putting an increased focus on advertising-funded video as an integral part of their offerings. By facilitating downgrades to an ad-supported tier instead of allowing consumers to churn from the service altogether when they cancel their subscription, video providers can retain the relationship with the consumer outside a paid subscription. Further fuelling this trend, industry advancements in addressable TV advertising are delivering higher income per impression and increased value for the advertiser by reducing tune-away compared to that for traditional broadcast ads.

The return of ad-supported premium content

The major opportunity for the video industry in the coming years is in advertising; this will account for more than 50% of the projected USD95 billion growth in TV and video revenue between 2019 and 2024.1 This is in stark contrast to the recent widespread understanding that Netflix had conditioned a fickle millennial crowd to monthly subscriptions and ad-free experiences, and that there was little consumer interest in ad-supported models. The shift was highlighted at the 2019 MIPCOM conference, and AVoD services took centre stage with the announcement of two new major initiatives from Rakuten TV and Lionsgate-backed Tubi. These announcements represent the latest developments in a year of significant activity in the AVoD space; notable other examples include the acquisition of Pluto TV by Viacom, launches by Amazon and Sinclair and announced plans from Comcast/NBCUniversal and WarnerMedia.

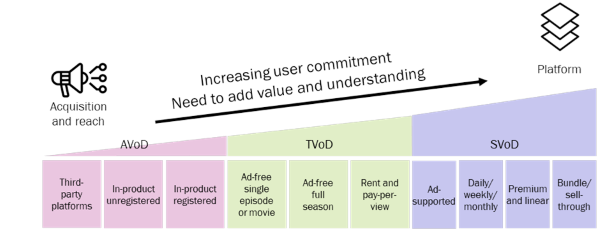

In order to embrace opportunities in advertising, video providers should consider customer journeys where subscribers move freely across their various business models and should prioritise long-term relationships over short-term profits. By combining advertising, transactional, subscription-based and aggregator business models, video providers can address the entire spectrum of user needs from offering a single piece of content to becoming the go-to platform for content and recommendations. When implemented successfully, this will enable providers to add value for both themselves and their customers in an increasingly nomadic market.

Dynamic markets call for dynamic business models

With such a sliding scale for user commitment, free or advertising-funded models can serve as the entry point to customer journeys and can be used to identify user pain points and preferences. This data can then be used to build the upgrade path along a ladder of increasing engagement and commitment in a hybrid business model. Increased user commitment along the ladder needs to be underpinned by a matching increase in value and user understanding, as illustrated in Figure 1 below. Successful services will be based on users’ needs and intents, rather than the underlying business models, which should be adapted to fit the offering, not the other way around.

Figure 1: Hybrid business model for video

Source: Analysys Mason, 2020

Major hurdles to overcome when moving customers along the ladder in Figure 1 include enticing users to move from third-party aggregation platforms to in-product experiences and encouraging them to register an account and complete their first direct payment. By making recurring payments in subscription models, a user can move up the ladder to reach the top. This can be described as the platform position for the provider, where users are deeply committed to the service and use it to discover and pay for experiences from other players.

Allowing users to move freely up and, importantly, down the ladder of business models in a single offering based on their changing needs and wishes can remove the friction that could make customers churn out of the relationship and significantly lengthen the journey to them becoming paying customers again. Creating products and experiences that fit into users’ lives on their terms is the key to success in the years to come, and the tools to do so are found in the inspired use of data and the re-thinking of existing business models.

Analysys Mason has broad experience in the audio-visual, telecoms and digital sectors. We work with media, telecoms and internet players, regulators and investors on specific issues such as assessing consumer attitudes to new flexible TV propositions, regulatory challenges that new digital platforms pose to the TV market and how the future value of traditional broadcasting company assets depends on the diversification and mitigation strategies of these companies. For further details, please contact Christopher Ryder or Martin Scott.

1 For more information, see Analysys Mason’s Subscription, advertising and transactional models for TV and video: opportunities for revenue growth.

Downloads

Article (PDF)Authors

Jenny Robertsson

PartnerLatest Publications

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Forecast report

France: pay-TV and streaming video forecast 2024–2030

Forecast report

New Zealand: pay-TV and streaming video forecast 2024–2030