Full-fibre networks in Europe: state of play and future evolution

Internet access has come a long way since the 1990s, when it was effectively a ‘dial up’ phone call. Over the past two decades, optical fibre has been extended towards end users, and all the way to homes and offices in the last five to ten years. Full fibre allows operators to meet not only the current demand for high-speed internet, but to provide a medium for tomorrow’s even more demanding applications.

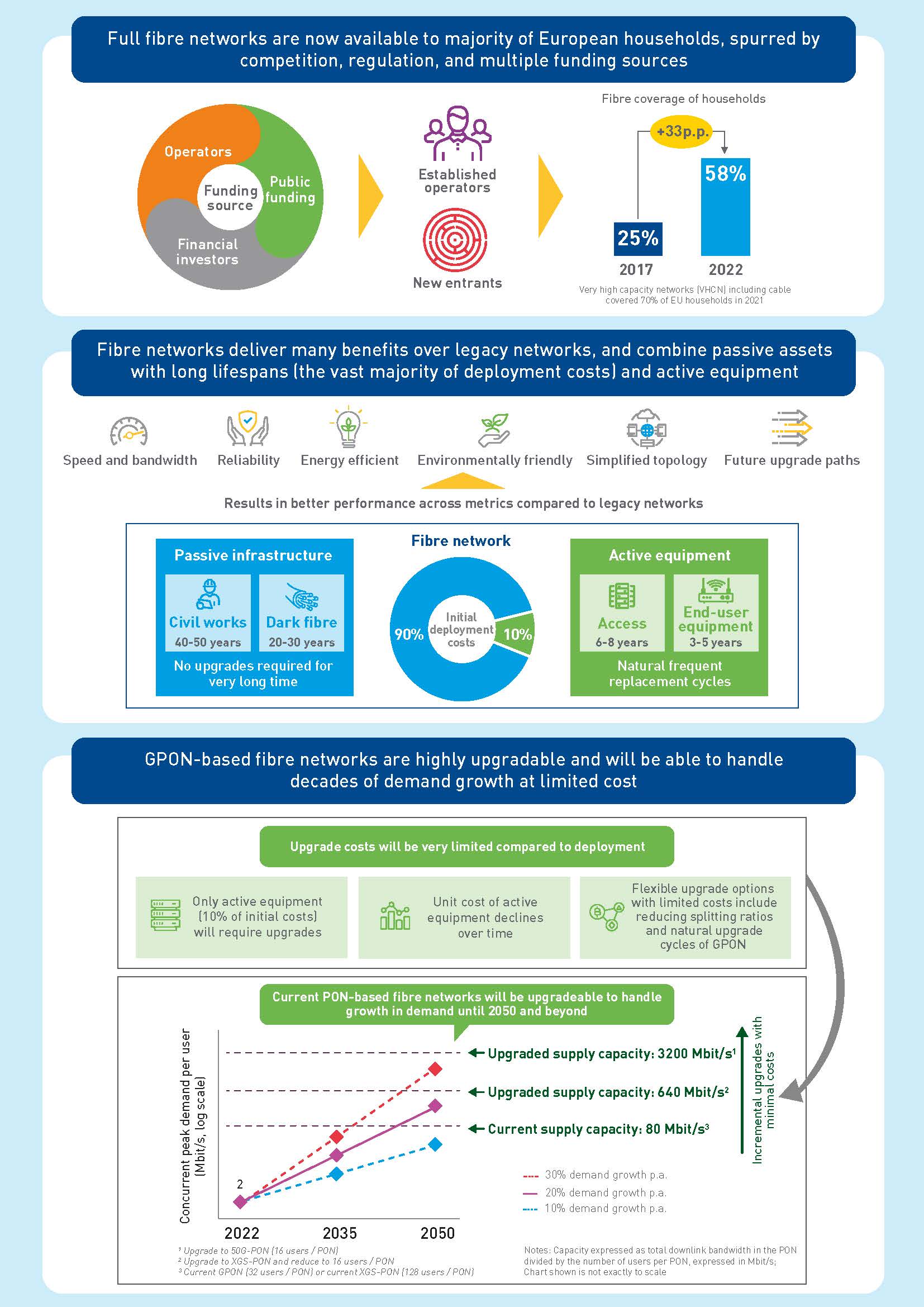

Europe is no exception: fibre networks have been expanding, driven by a combination of private investment and competition, and by ambitious policy targets to connect every European to a gigabit network by 2030. Full-fibre networks are now available to a majority of Europeans. Nearly everyone in Spain, Portugal and France has the option to buy full-fibre-based connections; in Germany, where DSL and cable perform relatively well and deployment costs are reportedly high, fibre investment and roll-out has been slower to materialise.

This rapid increase in full-fibre network coverage can be ascribed to investment by established telecoms operators, financial investors, and the public sector. Roll-out has been remarkably fast in countries where regulatory policies, new private investment and competition came together to reduce deployment costs and put competitive pressure on legacy networks. In other countries, where competitors face greater costs or non-cost barriers, deployment has been slower.

Public funding and subsidies have played a crucial role, particularly where the business case for private investment has been weak, resulting in a mix of publicly-owned and subsidised infrastructure in many European countries. Throughout Europe, new investors including pension funds, infrastructure funds, private equity firms and utility companies have also been attracted to fibre by a combination of factors: stable returns, long-term upside from ongoing growth in demand, and the potential to monetise existing network assets outside of telecoms.

These investments span ‘passive’ infrastructure, primarily the fibre-optic cables (dark fibre) and the poles and ducts that carry them, and ‘active’ network equipment that allows electronic communications to be transmitted to and from end users.

- Passive infrastructure represents 75% of deployment costs on average. These assets have very long lifespans: they will support networks for decades without the need to be replaced.

- Active equipment includes equipment in the network to transmit data on the fibre-optic cables, and equipment in homes and other premises that act as a gateway for customers. These assets are shorter-lived than passive infrastructure, and will be replaced more regularly, typically with more efficient, higher-capacity equipment.

In addition to supporting fast broadband speeds and increased capacity, full-fibre networks also offer additional benefits: simpler network topology, as well as lower energy consumption compared to legacy networks that help bring down the costs and environmental footprint of operating fibre networks.

Since broadband access networks have become widespread in the early 2000s, the demand for data traffic over fixed networks has grown as a result of increased adoption of richer and more varied online services. This growth in demand has been stable and sustained over time throughout Europe, but more recent growth has slowed, despite the adoption of gigabit-capable broadband. Demand is not just (or even primarily) traffic-related, however: the benefits of full-fibre networks for end users stem from the higher peak speeds they enable, and the plentiful capacity they offer.

In fact, we estimate that even current full-fibre networks, including 10Gbit/s-capable networks that are fast becoming the norm in ongoing deployments, will remain capable of delivering very high speeds with no material congestion until well after 2030. As traffic grows, ongoing upgrades will be needed outside the access network, in the core and backhaul networks; these account for a small proportion of total network costs.

Future demand is uncertain of course, but one thing is clear: the promise of societal and economic benefits from gigabit connectivity, and therefore the policy rationale for seeking to get full-fibre networks throughout Europe will be realised only through the emergence and diffusion of high-bandwidth applications.

These new applications are very unlikely to overwhelm network capacity for decades: full-fibre networks are designed to be highly upgradeable, with standards and network architecture choices that will allow significant improvement in network capacity, at costs much lower than initial deployment costs for full-fibre networks in the first place. Capital investment in full-fibre networks will continue for several years, but private investment may have already reached its peak in several European countries, due in part to the speed at which fibre has been deployed in recent years, and the challenging business case associated with less dense areas still to be covered. Once deployment is complete, maintenance and upgrade costs will be sustainably reduced.

Authors

David Abecassis

Partner, expert in strategy, regulation and policy