A changing spectrum landscape offers new opportunities for creative financial sponsors

22 September 2025 | Transaction Support

Janette Stewart | Alessandro Ravagnolo | Julia Allford

Article | PDF (3 pages) | Spectrum

Regulators’ efforts to encourage long-term investment in mobile network infrastructure are changing key attributes of spectrum licences. Lifting usage constraints and extending the duration of licences opens up wider possibilities for their future use and, more specifically, potentially interesting and new opportunities for innovative investors.

Spectrum licence holders are re-assessing future spectrum needs in light of changes in regulation, market structure and demand

Mobile operators around the world are battling to find the right strategies to support ongoing investment in network infrastructure at a time when revenue growth has been lethargic. Regulators are responding by adopting a ‘pro-investment’ position, through new spectrum management frameworks that are reshaping investment opportunities and priorities. One approach regulators have adopted is the potential for longer or indefinite licence durations, which offers some risk (notably underutilised spectrum), but some important advantages, especially in terms of flexibility in potential usage.

The shifting landscape is also triggering readjustments elsewhere in the ecosystem. The market is responding with structural changes that amplify the effects of regulatory shifts. Consolidation and network sharing are reducing the number of active players in many markets, concentrating mobile spectrum among fewer players as well as altering competitive dynamics within future auctions. The phasing out of legacy technologies – such as 2G- and 3G-based mobile deployments, and some older generations of fixed-wireless access (FWA) – creates a changing spectrum landscape in which some bands are becoming obsolete in their original configuration.

Looking forward, the picture is muddied by strategic uncertainty over the relative importance of different future spectrum bands, in terms of their technological capability and relevance, and changes in demand. Expectations of demand for new spectrum has historically been based on forecasts for wireless data growth. The slowing of data growth (which both the industry and regulators are now lowering in their forecasts) means that future demand for additional spectrum is limited to locations where traffic is highly concentrated.

Spectrum trading and leasing provide mechanisms for redistribution but are not always suitable. If the interests of all operators are not aligned, or if reconfiguration is complex, alternative approaches are needed. With the easing of regulatory constraints, it becomes easier to reconfigure and/or re-package spectrum in a way that makes it better suited for future services.

Financial sponsors are better placed to absorb the risks associated with spectrum redistribution

Innovative investors, who perceive spectrum resources very differently to mobile operators, see a whole new landscape of possibilities opening up as a consequence of these changes to licence conditions. With greater financial resources and a longer-term perspective, investors can acquire spectrum resources with a view to overseeing the reconfiguration of spectrum and characteristics of the licences. Investors typically have fewer operational constraints and greater flexibility than service providers when it comes to holding high-value spectrum licences that are not being deployed immediately. They are therefore well positioned to absorb risk, reconfigure assets and unlock latent value.

By acquiring or leasing excess spectrum from existing spectrum holders, investors can work with other market players to repackage or repurpose the spectrum assets to be better suited for emerging technologies, niche applications and other users, either in the short term, or in the longer term, as demand evolves. This not only improves the potential for excess spectrum to be deployed in new ways (for example, in locations where larger operators are not present) but also generates returns from assets that might otherwise remain dormant.

This approach will not be applicable to all spectrum: licences sometimes include stringent conditions that are designed to promote the original use. For example, some licences may impose penalties for non-deployment or include obligations to meet coverage targets by a certain date, and not all licences are service- and technology-neutral. Limiting spectrum use to specific services and technology constrains the opportunity for future value to be increased (that is, by being able to monetise a licence for a different, higher-value, use).

Financial sponsors have played a key role in spectrum transactions

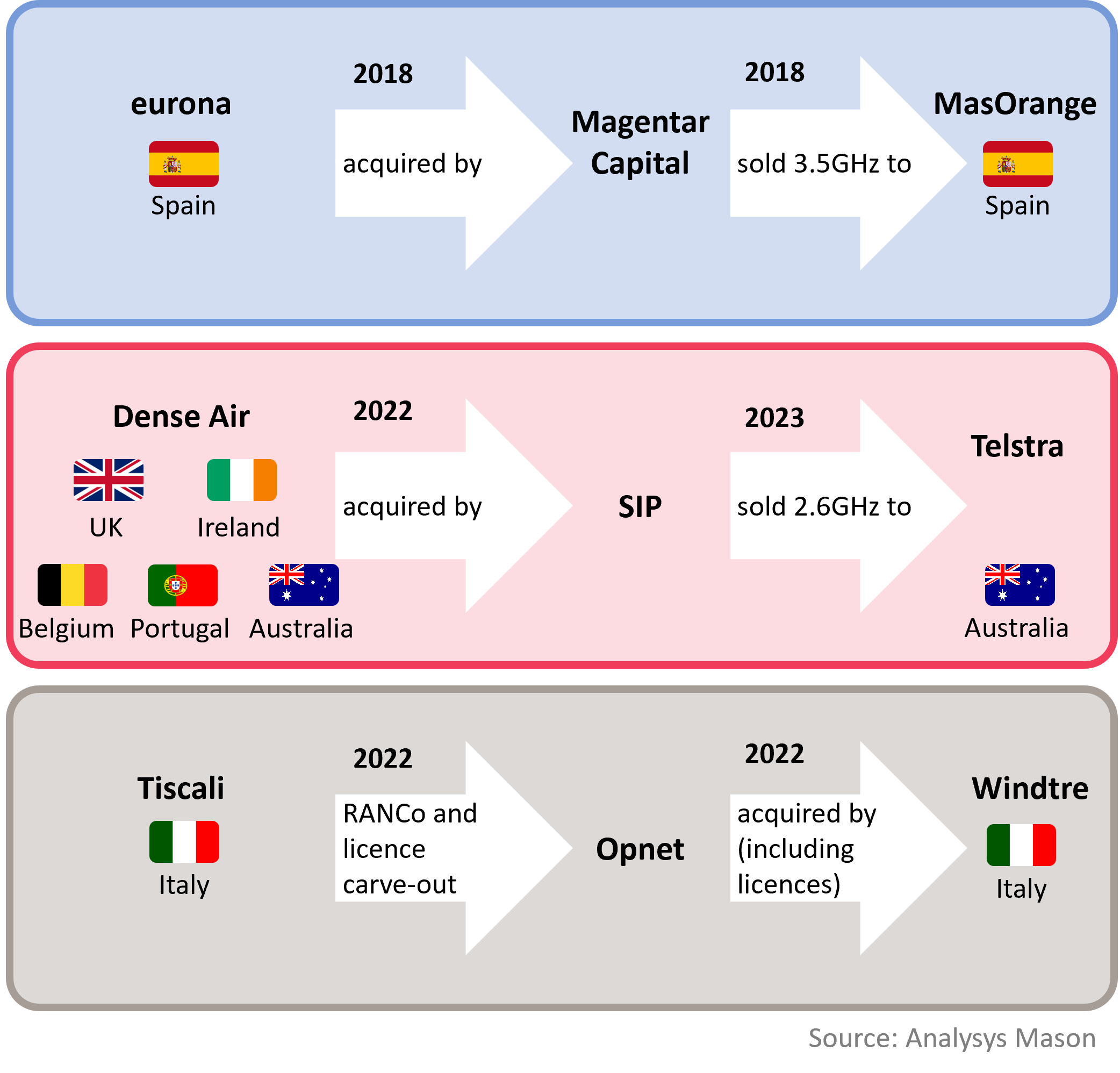

The purchase and resale of legacy 3.5GHz FWA businesses and associated spectrum licences is one such example of where investors have played key roles in spectrum licence transfers benefitting both the buyer and the seller. Other specific examples are illustrated in Figure 1.

Figure 1: Examples of recent spectrum licence transfer transactions

In addition, there is a growing list of investors that have also acquired underutilised cellular spectrum with a view to repurposing for other use cases. In 2025 Grain Management (Grain), partnering with a technology and infrastructure company, purchased T-Mobile USA’s 800MHz spectrum portfolio with the intention of marketing the spectrum to enterprises, utilities and other critical infrastructure operators. The transaction also included the sale of Grain’s 600MHz spectrum licences to T-Mobile USA. The utility sector stands to gain from this transaction if the 800MHz spectrum can be used to meet the telecoms needs of critical smart-grid infrastructure.

In Europe, discussions are also taking place about telecoms needs for smart-grid infrastructure. The 450MHz band has been used for this purpose in a few European markets; in other markets, this band has been largely underutilised and could be a candidate for repurposing for private 5G use by utilities.

Financial sponsors need to approach spectrum valuation carefully

An operator’s standard approach to valuing spectrum looks at the cost of deployment and operational perspectives, measuring expenditure against revenue in a commercial business plan – the value of the asset is tied to its utility in expanding network capacity, enhancing customer experience and maintaining a competitive advantage.

Financial sponsors, however, can approach spectrum valuation as a more nuanced value proposition. It is not uncommon for financial sponsors to participate in US spectrum auctions as bidders for regional lots, but it is far less common outside the USA. In Europe, for example, it has traditionally been network operators who purchase spectrum directly from the regulator, with the auction designed to take place at a point when demand exists from network operators to deploy the new spectrum. Licence obligations or other commitments may also pose challenges for bidders that do not operate networks.

Even if financial sponsors have a general strategy for monetising specific spectrum licences – through leasing, resale or future partnerships – the timeline for realising value may be long and less predictable. Thus, investors will benefit more from a spectrum valuation approach that helps assess not just a value range but also liquidity of the market, the longer-term risk and potential downside/upside scenarios.

Analysys Mason’s experience of advising on spectrum valuation can help financial sponsors to value potential investments

Analysys Mason’s spectrum credentials stem from a long history of advising on spectrum valuation for operators participating in auctions or for regulators setting auction designs, as well as advising financial sponsors and investors on wireless market acquisitions. From this experience, we have deep expertise in valuation methods as well as a strong understanding of wireless ecosystems and business models. We have a comprehensive database of spectrum value benchmarks. Analysys Mason is well positioned to help financial sponsors to apply established valuation methods to different spectrum licensing situations including spectrum trades, where spectrum is being appraised by financial lenders as part of a business’s asset base or where spectrum is being used as collateral to lenders. For more information, please get in touch with Alessandro Ravagnolo or Janette Stewart.

Article (PDF)

DownloadAuthor

Janette Stewart

Partner, expert in spectrum policy, pricing and valuation

Alessandro Ravagnolo

Partner, expert in transaction services

Julia Allford

ManagerRelated items

Predictions

Satellite D2D will benefit early adopter MNOs in 2026

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies

Article

Why spectrum renewal policy matters for network investment and service quality