COVID-19: Chinese operators’ 1Q 2020 results provide lessons to others about the impact of the crisis

11 June 2020 | Research

Article | PDF (3 pages) | Global Telecoms Data and Financial KPIs| Asia–Pacific

Chinese operators’ 1Q 2020 results provide insights on the impact of the COVID-19 outbreak. The operators reported that their businesses were disrupted due to the outbreak, but they have adapted to the new consumer and business demands. This comment analyses the effect of the pandemic on the telecoms market in China and shows how operators in other countries can work to offset the worst of the impact.

The COVID-19 pandemic has affected the Chinese telecoms market

Chinese lunar new year typically begins in January or February, and around 0.7 billion citizens return to their home cities each year during this time. However, the Chinese government discouraged travelling between cities during the lunar new year celebrations this year, and several large cities went into lockdown in early-February. The 1Q 2020 telecoms market results published by the regulator, the Ministry of Industry and Information Technology (MIIT), provide insights on how these changes affected the Chinese telecoms market.

The total telecoms revenue in China in 1Q 2020 was CNY338 billion (USD48 billion), representing 1.8% year-on-year growth and 6.2% quarter-on-quarter growth. The total fixed service revenue for the three main operators grew to CNY115.9 billion (USD16.3 billion) in 1Q 2020 (9.8% year-on-year growth and 2.5% quarter-on-quarter growth), while the total mobile service revenue dropped to CNY222.4 billion (USD31.3 billion; –1.9% year-on-year growth and –1.0% quarter-on-quarter growth). Fixed service revenue was therefore more resilient to the pandemic than mobile service revenue, and we expect that this trend will be repeated in other countries.

The largest mobile operator, China Mobile, reported a 2% year-on-year decline in operating revenue, despite its 1.8% year-on-year growth in total service revenue. This decline was due to a 34.9% fall in revenue from the ‘sales of products and others’. This in turn was mainly caused by falling handset and IoT device sales as a result of the COVID-19 pandemic. Again, this is a pattern that may be replicated elsewhere.

The total number of mobile subscribers in China dropped by 0.7% quarter-on-quarter to 1.59 billion in 1Q 2020, and the number of 4G mobile subscribers dropped by 1.6% to 1.27 billion. Over 80% of all mobile service users were mobile internet users in 2019, but the number of mobile internet users declined by 1.6% quarter-on-quarter to just under 1.3 billion during 1Q 2020. However, the total mobile data traffic increased by 7.2% quarter-on-quarter (versus 0% in 4Q 2019) to 35.7EB, despite the decrease in the number of mobile internet users. This may suggest that mobile subscribers that typically used only small amounts of data terminated their subscriptions during lockdown as their need for mobile internet fell. In contrast, the total number of fixed broadband and IPTV subscriptions grew by 1.4% and 2.5%, respectively, in 1Q 2020, following a slight fall in the previous quarter. This growth may have been caused by some consumers anticipating spending a greater amount of time at home due to the pandemic.

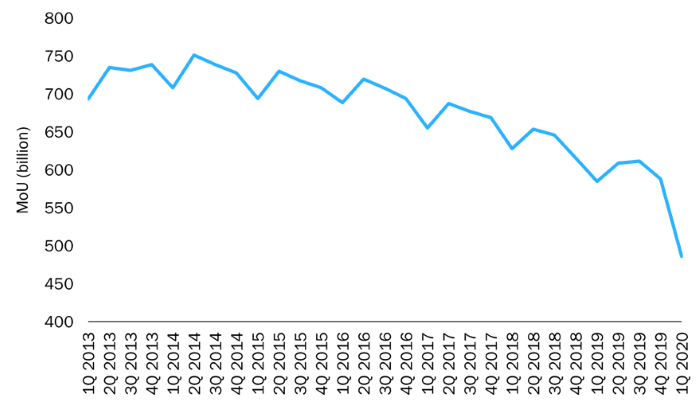

The total mobile minutes of usage (MoU) fell significantly in 1Q 2020 (–17% quarter-on-quarter and year-on-year growth; Figure 1) due to substitution by mobile social media applications, which have a user base of 896 million as of mid-March 2020. Indeed, the use of local social media applications WeChat and Weibo reportedly increased by 58% in March 2020 as a result of social distancing and the increased need for digital communications due to the COVID-19 pandemic. The decline in voice traffic helps to explain some of the mobile service revenue decline. China Unicom also reported a 15.6% year-on-year decline in interconnection charges in 1Q 2020 (versus a 7.5% year-on-year decline in 1Q 2019) due to reduced voice traffic.

Figure 1: Total mobile minutes of usage (MoU), China, 1Q 2013–1Q 2020

Source: MIIT, 2020

The China Internet Network Information Centre reported increased usage of digital services (including mobile payment, m-commerce, mobile education, online gaming/mobile gaming and online video) in 1Q 2020. The COVID-19-induced lockdown increased the popularity of online gaming as a means of entertainment, leading to increased revenue in the segment. The number of online video subscribers and the time spent watching online video also rose as a result of the outbreak. Indeed, 94.1% of all internet users in China in 1Q 2020 were online video users. Online video service providers include third-party OTT players (Iqiyi, Tencent video, Bilibili and Youku) and short-form video players (TikTok and Kuaishou).

Operators in China are actively adapting to the new market demands and remain optimistic

Operators in China acted swiftly during the initial COVID-19 outbreak, and enhanced their communications networks (including 5G network deployments) in the areas that were affected. They reported an increase in demand for informatisation services from the government and enterprises. The changed ways of living and working during the outbreak meant that operators’ digital and cloud-based services for remote offices (such as SME cloud and cloud conference services) and remote education (such as education cloud and cloud classrooms) increased in popularity.

Fixed value-added business revenue in China grew by 18.9% year-on-year to CNY43.9 billion (USD6.2 billion) in 1Q 2020. Fixed value-added business has become the main driver of the telecoms market in China and accounted for 13% and 38% of the total and fixed service revenue, respectively.

Chinese operators also applied their big data, AI, 5G and cloud services to epidemic prevention and control (COVID-19 case tracking) and remote medical diagnostics and treatment during the crisis. For example, they rolled out innovative applications of 5G related to medical diagnostics and body temperature screening using thermal imaging. There may be further opportunities for operators in these areas in the future.

Chinese operators remain optimistic for 2H 2020, partly because the worst of the pandemic appears to have passed in China. They are focused on continuing their 5G network deployments, providing more-affordable 5G handsets and developing innovative 5G applications in order to increase their 5G user bases and data usage. The operators will also continue to focus on expanding into informatisation services (big data and AI), cloud network services (remote offices, remote education and gaming) and network security.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Authors