6G R&D is underway, but operators need to understand the business case for investment

In December 2023, two important events happened that really kicked off the 6G standardisation process. The International Telecommunications Union’s Radiocommunication Sector (ITU-R) published a report setting out potential parameters, use cases and architecture for IMT-2030, its latest framework for next-generation wireless standards and radio technologies.1 It stated it would begin the process of defining technical requirements for IMT-2030 and, from 2027 onwards, would begin evaluating proposals with a view to approving the new technology standards by 2030. Meanwhile, 3GPP stated that it would begin work on new 6G specifications, as part of a multi-year project that will run concurrently with its ongoing work on 5G Advanced specifications.

ITU and 3GPP were not the first to begin work on 6G. Many of the biggest mobile technology vendors and operators had already published papers setting out their visions for the next generation of mobile networks and practical research and development work had also already started. In fact, some organisations began early R&D work on 6G-relevant technology projects even before 5G was launched commercially. The deployment of commercial 6G networks is unlikely to happen until the 2030s, yet nearly 400 organisations are already collectively investing billions of US dollars in R&D.

Analysys Mason’s new framework report 6G: emerging industry visions for the next mobile generation takes a detailed look at the R&D projects that are underway, or have been announced. Building on the data collected for our 6G R&D tracker, the new report provides a technology-based taxonomy to classify the R&D projects, and to show how much activity has been initiated on topics within the taxonomy. The analysis in the report shows that gaps are already emerging between different industry visions and efforts. More importantly, it shows that a gap is emerging between what the industry needs to do to make 6G a commercial success, and the research that is being undertaken.

Operators are not keen on a big RAN refresh, but most 6G R&D projects are focusing on new RAN technologies

Operators have been more reluctant to deploy 5G standalone (SA) technology than vendors originally hoped. Many have deployed 5G non-standalone networks but have then struggled to find a business case to justify upgrading their networks again to 5G SA. Even those that have only invested in 5G NSA have spent large sums of money on upgrading their RAN infrastructure.

Investment in 5G networks had cost mobile operators more than USD600 billion in cumulative capex by the end of 2023, and their investment is set to continue for years to come. 5G share of all telco capex is set to rise from around 40% in 2023 to 62% in 2028. At the same time, mobile operators have yet to unlock significant revenue growth from their 5G investments. For these reasons, operators have individually and collectively (for instance, through the NGMN Alliance (NGMN)) stated they are not interested in a full RAN replacement project at the end of the decade.

Perhaps cognizant of this, the ITU-R pointed out in its launch of the IMT-2030 standardisation process that 9 of the 15 capabilities it was considering for 6G are derived from 5G systems. Nonetheless, many of the projects that are underway are looking at new technologies for the RAN and it is not at all clear yet whether large parts of the network will need to be replaced to take advantage of proposed 6G network features.

Analysys Mason has identified over 180 initiatives to drive development of 6G technologies and standards, including governmental stimulus projects, technology R&D and specification working groups.

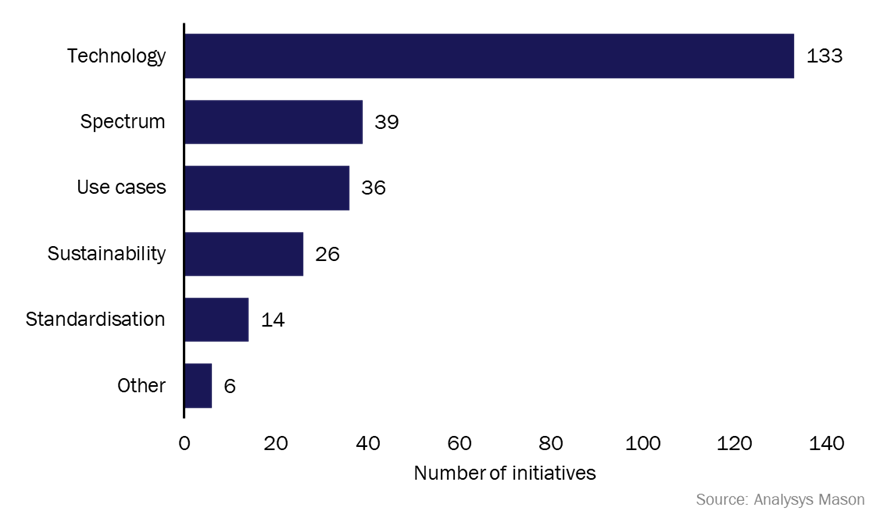

Figure 1: 6G R&D initiatives by project type2

Of these, over 133 of the initiatives identified (nearly 74% of them) are focused on technology development and nearly 22% of them are focused on utilising new spectrum bands (with overlap between the categories).

The scope of 6G R&D needs to be broadened

Very few projects are currently looking at business cases for 6G. Although more than 20% of the initiatives identified focus on use cases, so far there has been little analysis of what actual revenue or profit growth specific use cases could deliver for operators or for enterprises. It is critical for the industry to understand whether enterprises would (not could) use 6G enhancements to drive innovation within their own businesses, and crucially whether they would pay for them, or opt for lower cost technology alternatives. Doing this analysis once the technology has been down a 10-year development path is too late.

As the telecoms industry is still early in the process of defining 6G, there remains significant uncertainty about what it will eventually look like and what it will be able to deliver. Visions are beginning to crystallise though. If the industry wants to avoid repeating the mistakes of 5G, it really needs to engage in customer-led research, so that 6G technology developments are based on what customers want mobile networks to do for them, and to ensure 6G research develops technologies that customers will value. In that context it is somewhat disappointing that fewer than 10% of the nearly 400 organisations Analysys Mason has identified undertaking 6G research fall into the ‘enterprise and other’ category.

It is critical for the industry to ensure that 6G networks will deliver growth opportunities for operators and their customers and help them both to drive out cost. There must be a clear business case for investment by operators. This will require lots more enterprise and industry working groups, labs, and incubators, with representation from all sectors, including sceptics as well as enthusiasts. The mobile industry cannot afford to invest in increasing the capabilities of networks, if increased sales and profits will not follow.

1 ITU-R periodically defines a framework of capabilities for next-generation wireless networks, with which any candidate standards must comply. IMT-2030 is a foundation for 6G as IMT-2020 was for 5G.

2 Some initiatives cover more than one project type, in which case the initiative is counted more than once.

Article (PDF)

DownloadAuthor