High inflation may force operators to accelerate copper decommissioning programmes

29 March 2023 | Research

Article | PDF (3 pages) | European Core Forecasts

Listen to or download the associated podcast

Economic uncertainty, high inflation and other threats related to the war in Ukraine will have prolonged effects on total telecoms revenue and capex in Central and Eastern Europe (CEE).

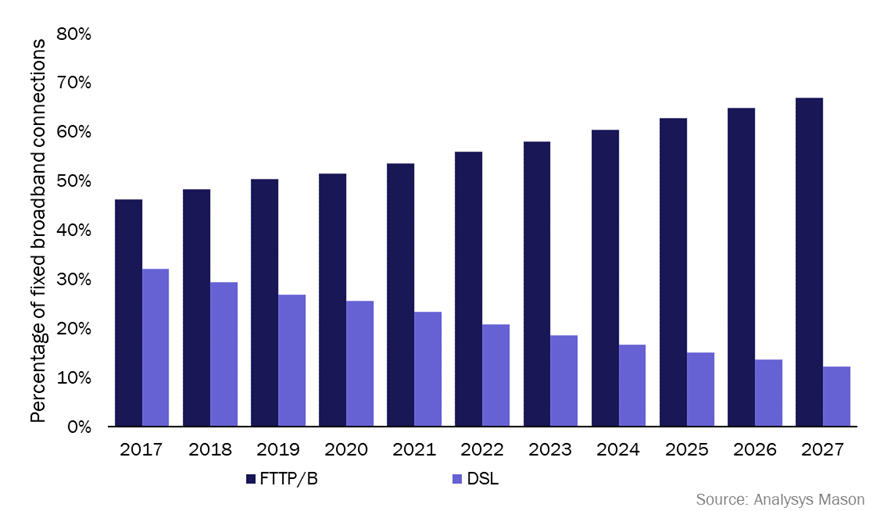

Operators will try to reduce the impact of the economic burdens, primarily related to inflation, by (among other things) accelerating the migration of DSL users to FTTP connections. This migration will allow operators to save on network maintenance and energy costs, and provide customers with higher speeds. As a result, FTTP/B access will account for 67% of total fixed broadband connections in CEE by 2027.

The increased adoption of fibre will be driven by copper-based networks being replaced by fibre, by cable operators replacing DOCSIS networks with fibre, and the deployment of new fibre networks in areas that have limited or no infrastructure today

This article is based on Analysys Mason’s Central Eastern Europe telecoms market: trends and forecasts 2022–2027 report. The forecast numbers are available in Analysys Mason’s DataHub.

The rising cost of maintenance and energy will prompt operators to accelerate the decommissioning of their copper networks

Operators intend to migrate their DSL users to FTTP/B to achieve long-term efficiency and remain competitive. FTTP connections may also generate higher broadband ASPU. Figure 1 shows our forecast for the transition to fibre across the region on average.

The progressing transition from copper to fibre puts competitive pressure on cable operators. It prompts them to self-overbuild with FTTP and migrate to fibre in the longer term, rather than as a tactical response to retail demand.

Figure 1: FTTP/B and DSL share of total fixed broadband connections, Central and Eastern Europe, 2017–2027

The migration of cable operators to fibre will help to extend fibre coverage; as a result, 78% of premises in CEE will subscribe to FTTP/B broadband services in 2027. This figure will include the services of cable operators that invest in fibre rather than continue with DOCSIS cable technology. In addition, we expect that more operators will decide on voluntary structural separation, and we will see new infrastructural joint ventures established to share fibre network roll-out costs and maximise infrastructure utilisation.

Connectivity in remote areas will remain a high priority for governments and operators in CEE

Governments will keep offering subsidies to operators that invest in fibre in locations where it is less attractive to deploy such networks. Regulators in the region typically perform an annual infrastructure mapping exercise to identify areas where services with speeds of at least 30Mbit/s are unavailable. The governments then define areas that are suitable for public intervention and set the terms for distributing subsidies.

Operators that want to expand their businesses and increase rural coverage often enter network-sharing agreements. As a result, we expect to see more shared network deals and joint ventures between operators, between operators and utility companies, and between operators and financial investors. Network-sharing deals with utility companies enable operators to easily roll out their networks to customers in remote and sparsely populated areas (Figure 2).

Figure 2: Examples of fibre network investments and roll-out targets, Central and Eastern Europe, 2022

| Investors | Targets |

| Eesti Energia using a loan from the European Investment Bank | Eesti Energia will use the EUR70 million loan from EIB to provide fibre to 266 000 households by the end of 2023, mostly in rural and underserved areas. |

| Orange and APG joint venture (Światłowód Inwestycje) in Poland | Plan to roll out a fibre-optic network to 1.7 million households in Poland by 2025. It will specifically focus on areas where access to high-speed broadband infrastructure is limited or non-existent. |

| United Group | United plans to invest EUR500 million by 2026 to roll out fibre networks in underserved areas in Bulgaria, Croatia, Montenegro, Serbia, and Slovenia. |

| UPC Poland (Iliad company) and energy provider Tauron | UPC will use Tauron’s network to provide services to customers in over 123 municipalities in remote areas. |

Source: Analysys Mason

Fibre roll-out will continue in CEE despite elevated inflation, because most operators regard investment in FTTP networks as a cost-saver eventually. Part of the build out of fibre networks will come from government intervention or subsidy. The increased pace of fibre roll-outs will enable operators to accelerate decommissioning programmes and migrate DSL subscribers to the FTTP network. As a result, the share of DSL connections will decline significantly, from 21% in 2022 to 12% in 2027.

Article (PDF)

DownloadAuthor