Early innovation and a multi-technology approach will maximise operators’ revenue from cellular positioning

Cellular positioning (or localisation) refers to the use of mobile networks to support the precise geospatial location of network devices. The value of cellular positioning data for operator-supported, location-based services could increase significantly as part of the shift to 5G standalone (SA) and towards 6G. However, technical progress has been slow to date and cellular competes with a range of other positioning technologies. To maximise their revenue from cellular positioning, operators should begin commercialising their positioning capabilities as soon as possible, using private 5G and key vertical markets to create a competitive position for cellular solutions in the longer term. However, operators must consider adopting a multi-technology approach to maximise their share of the overall location-based services opportunity. The challenges and solutions outlined in this article are examined in more detail in our report Operator strategies to maximise the cellular location-based services opportunity.

5G Advanced and 6G could further enhance cellular positioning but the roll-out of advanced positioning is moving slowly

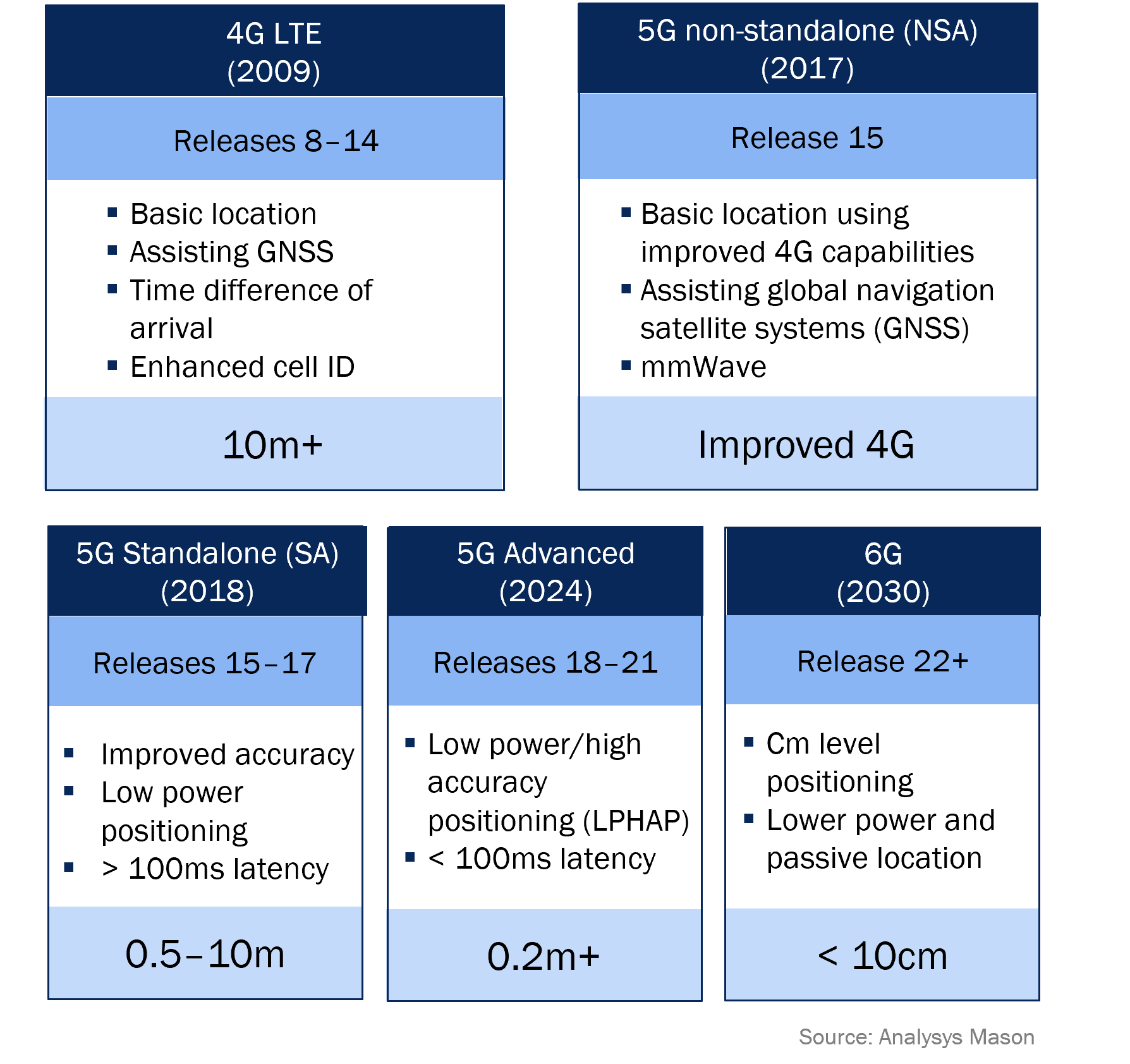

5G Advanced and 6G architectures are expected to bring enhanced accuracy to cellular positioning, with 5G Advanced potentially allowing for consistent and reliable sub-meter positioning in the near term (see Figure 1). However, operators’ abilities to realise these opportunities will depend significantly on when they deploy these architectures.

Figure 1: Cellular positioning capabilities, by 3GPP release stage

In Analysys Mason’s recent report Operator strategies to maximise the cellular location-based services opportunity, we categorised the key opportunities for cellular positioning based on accuracy and coverage requirements. A simplified version of this categorisation is given below.

Near term: low accuracy and wide coverage

- Location-based authentication

- Location analytics

- Low accuracy sensors/IoT

Medium term: indoor and private networks

- Sensors and industrial metaverse

- Indoor navigation

- Automated guided vehicles (AGVs) and robots

Long term: high accuracy and coverage

- Unmanned aerial vehicles (UAV)/drones

- Cars and C-V2X

5G Advanced and 6G will increase the potential for cellular to be used for high-accuracy/wide-coverage applications, but in order to monetise these capabilities and create a valuable ecosystem, these architectures must be adopted in both public and enterprise networks. In addition, the value of cellular positioning will only be fully realised in locations where high-band spectrum (such as mmWave) is used. However, progress towards 5G SA, and the adoption of mmWave, has been limited to date.

Cellular positioning is competing with a range of technologies that could evolve to limit the cellular opportunity

Cellular positioning faces a range of competing, and evolving, localisation technologies.

- Global navigation satellite systems (GNSS). This includes government-owned satellite infrastructure, the use of which is provided free of charge. Dedicated GNSS correction services are improving the accuracy of satellite positioning, with accuracies as low as 2cm. However, latency is increased significantly for accuracies below 1m, and correction services come with additional cost.

- Wi-Fi. Wi-Fi offers low accuracy in its standard form (approximately 2m using the latest fine-timing measurement standards from IEEE), but at a relatively low cost. Wi-Fi is already used for consumer indoor navigation but its results can be inconsistent. The recent standard from IEEE (802.11az) indicates that Wi-Fi could achieve sub-meter positioning using mmWave beamforming.

- Ultra-wide band (UWB). This is a high accuracy (cm-level), local-area technology. It is already used for wayfinding use cases in enterprise and could present competition for mobile in automated guided vehicles (AGVs) s/robotics. However, UWB’s use case is largely limited to localisation in smaller spaces and uses dedicated infrastructure. It is on an evolution path to become more accurate but does not facilitate a network connection.

- Bluetooth low-energy (BLE). This low-power local positioning solution requires a high number of anchors to achieve accuracy. It can achieve below 50cm accuracy with line of sight (LOS) of at least 3 anchors, but its typical level of accuracy is approximately 3m.

To be able to compete with these solutions, operators need to provide at least 5G SA positioning capabilities, and it will be essential to adopt relevant elements of 5G Advanced as soon as these are fully commercialised. As they evolve, the competing technologies could limit cellular’s share of the location-based services opportunity. This is especially the case given the slow adoption of 5G SA by operators.

According to Analysys Mason’s latest survey of over 64 Tier-1 operators worldwide, most will not achieve high penetration of 5G SA in their networks until 2028 and many factors will dictate their adoption timelines.

Operators should accelerate cellular upgrades ahead of wider roll-outs and adopt a multi-technology approach to maximise revenue

Operators should look for immediate opportunities to accelerate their support for 5G positioning, and they should aim to build their competitive position in the location-based services market ahead of their wider roll-outs of 5G SA and 5G Advanced. Analysys Mason’s key recommendations to operators include the following.

- Operators should use early cellular localisation opportunities, such as location analytics, location authentication and wide-area IoT, to gain experience and build relevant partnerships, establishing themselves as location-based services providers. They should strategically target near-term sub-applications such as traffic management for C-V2X and drone identification to improve their competitive position ahead of providing more-accurate services to these applications in the longer term.

- Operators should demonstrate the value of cellular positioning in applications where it has a long-term competitive advantage. These include services for indoor environments in which cannot be reached by GNNS, and where short-range technologies such as UWB, Wi-Fi or BLE fall short. They should also consider technologies such as network slicing and side link positioning to add value to the cellular propositions.

- Operators should take an active role in driving early innovation in private networks and should target public network hotspots such as retail complexes, transportation hubs and venues, where multiple use cases (such as mobile broadband, indoor navigation, high-accuracy location analytics and AGVs) could combine to optimise the business case for 5G. In such locations, early deployment of new 5G capabilities and mmWave can be most effectively combined to enhance the value of mobile positioning.

Operators must recognise that no cellular network will offer the optimal solution for every use case and they should therefore consider a multi-technology approach. For instance, in wide-area/high-accuracy applications, leveraging corrected GNSS data (using the mobile network to distribute it) could present a cost-effective solution. In low-cost indoor positioning, Wi-Fi will likely be good enough, given its expected evolution. By leveraging multiple technologies, operators could become turnkey providers of location-based services.

Article (PDF)

DownloadAuthor