Cloud cost economics analysis is pivotal to accelerate the adoption of open, cloud-native networks

Communications service providers’ (CSPs) networks are undergoing significant changes with the adoption of cloud technologies and the transition towards virtualising network functions. Cloud-based network technologies enable more open and disaggregated network architectures, flexible deployment and commercial models, as well as new modes of automated operations, all of which alter the traditional network cost economics. This article examines the implications of the new cloud-based network cost economics for all industry stakeholders including CSPs, technology suppliers, and regulators/policymakers.

Analysing cloud cost economics is an integral part of formulating CSP network cloud and digital transformation strategies

Cloud is driving a major shift away from monolithic, closed telecoms functions to new network architecture and consumption models that are based on disaggregated and distributed network software and hardware layers. The 5G era brought further advancements with the introduction of cloud-native technologies, such as containers, microservices and Kubernetes, to address challenges in delivering high-performance, low-latency and scalable services to customers in the mobile core and vRAN/Open RAN. Network cloudification activities have also started to extend beyond mobile networks and 5G to transport networks which are increasingly becoming cloud- and software-based and disaggregated.

The network cloud market is seeing a proliferation of deployment and delivery models for building cloud platforms with disaggregated components, driven by the disruptive players in the supply chain such as public cloud providers (PCPs), Rakuten Symphony and challenger network functions and cloud software providers. CSPs in Europe are taking charge of their cloud future by developing a common cloud software framework called Project Sylva. In addition, hybrid (on-premises and public) clouds and as-a-service models are becoming increasingly available to give more options and flexibility to CSPs.

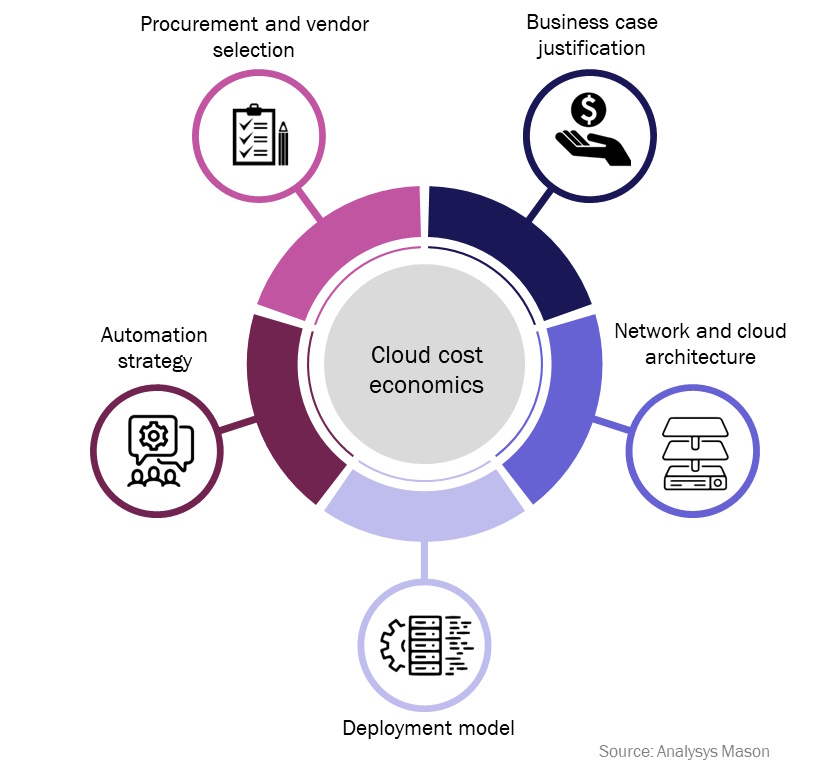

CSPs face crucial decisions on how to bring together these disaggregated network cloud components to create common, highly-automated digital platforms which will play a vital role in realising returns from cloud-based mobile and fixed infrastructure investments. As global network cloud infrastructure spend is projected to reach USD32 billion by 2027, CSPs need to understand the complete set of costs associated with various approaches to sourcing a disaggregated cloud platform to make informed decisions about their network cloudification strategies and roadmaps. This involves a series of complex steps and factors including the following.

- Building a business case justification for investment: Although CSPs are generally enthusiastic about open and disaggregated cloud network technologies like Open RAN, they need to secure internal-organisation support and investments for successful adoption of these technologies. To address this, CSPs should consider building holistic total cost of ownership (TCO) studies, such as Analysys Mason’s Open RAN model, to test and demonstrate economic viability in the short term to sign off cloud-native network investments.

- Identifying the most suitable network cloud procurement and implementation models: CSPs are evaluating multiple paths for building their cloud platforms including vertically integrated clouds from network equipment providers (NEPs), do-it-yourself private clouds using software-only IT vendors’ technologies and PCPs’ cloud technology stacks. Each model has its advantages and disadvantages which CSPs should evaluate carefully. For example, a recent Analysys Mason TCO study showed that taking a PCP-managed cloud platform approach to 5G standalone core networks could offer significant opex savings (44%) compared to a do-it-yourself cloud model.

- Increasing operational and organisational readiness: Successful implementations of the cloud-native and disaggregated networks require significant changes in CSPs’ current mode of operations and investments in acquiring cloud-native software skills in the organisation. Our TCO study on IP network disaggregation showed that while the use of white boxes in the network provide capex savings, CSPs need to make large upfront investments in operational automation and relevant skillsets for the end-to-end lifecycle management of disaggregated networks which has a considerable impact on TCO.

Figure 1: Strategic decision areas that require detailed analysis of cloud cost structures

There are several other key factors CSPs need to factor in when they are forming their network cloud strategy and investment decisions such as choosing the right vendor(s), identifying optimal network architecture (centralised versus distributed) and cloud delivery models (on-premises, hybrid and SaaS) which should be underpinned by holistic TCO studies and cost modelling exercises.

Vendors and regulators can use cloud cost and benefit analysis to overcome the barriers to cloud-native network adoption

Cloud-native, disaggregated networks are still at an early stage of adoption: we forecast that network cloud will reach 43% of its total addressable market in the mobile networks by 2027. The pace of CSPs’ adoption of cloud-native technologies lost some momentum in 2022 due to the delays in 5G standalone (SA) core deployments, partly stemming from uncertain business cases and increasing scepticism about the cost savings benefits of vRAN and Open RAN. These technologies offer several long-term, strategic benefits such as innovation and vendor choice but will struggle for mainstream adoption as long as CSPs do not have confidence that they can bring realistic, short-term cost and/or revenue benefits, especially under the current economic conditions. However, there is limited independent, holistic cost and business case modelling has been carried out to date and without clear guidance, CSPs will continue to move slowly, if at all.

Developing cost and benefit analysis of cloud-native networks and automated operations, and educating the market about it, should be a key priority for network technology suppliers such as NEPs, PCPs, OSS/orchestration and automation vendors and system integrators. This would help foster the adoption of cloud-native network technologies by providing industry guidance on realistic benefits, suitable investment and deployment strategies and best practices. Vendors can also benefit from these analyses to better position themselves in the market and direct their R&D efforts and product roadmaps to develop solutions that cater to CSPs’ needs, ultimately gaining a competitive advantage.

Regulators/policy makers also have a significant role to play to accelerate the adoption of cloud-native and open networks, which should be underpinned by comprehensive cloud cost economics analysis. They need to assess both the potential benefits and policy opportunities and challenges from cloudification to ensure a secure and thriving market. This includes, for instance, assessing the potential cost savings from cloudification and how they affect the cost of regulated services, how cloudification may allow new forms of network sharing and whether the disaggregation of control and data plane could potentially lead to cybersecurity threats.

Overall, the transformative impact of cloud technologies on the telecoms industry and future service ambitions, such as AI, metaverse and industry 4.0 use cases, demand immediate and informed action from CSPs, technology suppliers and regulators/policymakers. All stakeholders need to collaborate, learn and embrace the potential of network cloudification, leveraging cost economics studies and comprehensive market analysis to shape a sustainable and stable cloud-based networks market.

Author

Gorkem Yigit

Research DirectorRelated items

Article

NVIDIA GTC Paris 2025: digital twins and sovereign AI signal a new era for telecoms infrastructure

Article

GenAI in the network: who is making real progress, and what is driving it?

Article

Operators are set to invest USD77 billion cumulatively in AI cloud infrastructure between 2025 and 2030