COVID-19: 5G capex will bounce back after a short-term decline, but operators will have new priorities

Listen to or download the associated podcast

Analysys Mason has published an early-stage analysis of the likely impact of the COVID-19 pandemic on 5G supply and demand in 2020 and 2021. We believe that the fundamentals of the 5G business case remain largely intact. However, there will be disruption to network deployment and weaker demand from consumers and businesses in the middle quarters of 2020. The reduced demand is likely to persist for a longer period than the network disruption and will drive operators to intensify the focus of their 5G strategies on cost reduction rather than new, enterprise-driven revenue streams.

5G deployments will be disrupted in the short term in 2020, and demand will decrease

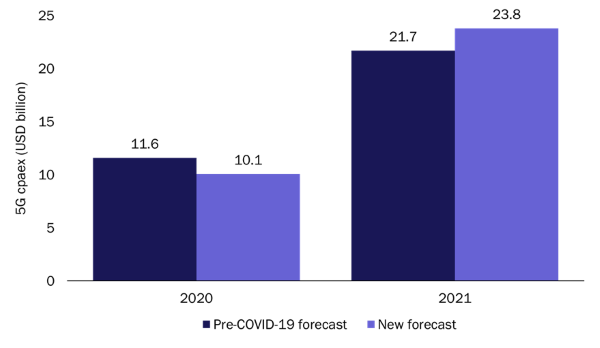

Planned network roll-outs will be disrupted in the short term, including delays to spectrum auctions and standards, and labour shortages in the supply chain. These and the wider economic uncertainty will drive some operators to rethink their investment priorities or timelines. However, most operators worldwide will remain committed to their existing overall capex envelopes for the next year or so, although we expect to see some reassessment of priorities within these envelopes, which in some areas, especially Europe, will be in favour of FTTP or 4G expansion at the expense of 5G. 5G capex will decline slightly in 2020, and we now believe that this will be 7% less than our pre-COVID-19 forecast (Figure 1). 5G capex will start to bounce back in 4Q 2020 and into 2021, and it will be 9.7% greater than our previous forecast for 2021 as a result. However, mobile capex overall will decline more sharply, and some non-5G investment will be permanently lost as operators intensify their efforts to capitalise on their existing assets.

Figure 1: 5G-related network capex forecasts before and after COVID-19 revisions, worldwide, 2020–2021

Source: Analysys Mason, 2020

The scale of the bounce-back in 5G capex will depend on stimulus funds and a revival in business demand

There are two key factors that are essential to the recovery in 5G capex that we foresee in late 2020 and 2021. One is that governments around the world emulate the Chinese government and include 5G in their stimulus funding and other recovery programmes. Indeed, the government in the USA and elsewhere have suggested that support to restart, or even accelerate, 5G build-outs will be part of such initiatives. Operators in China will spend 14/5% more than previously planned on their 5G roll-outs in 2020, thanks to support from various economic recovery initiatives.

The second, more fundamental factor is that the demand for 5G services recovers to somewhere close to the levels anticipated before COVID-19 (at least during 2021). This is crucial, given that the demand for any service will be weakened by the impact of the pandemic on business confidence and survival, and on consumer spending power.

Many operators were hoping to use 5G to monetise the demand for improved network performance from certain customer segments. This will now be harder to achieve. There are indications that some niche consumer use cases will emerge stronger (such as gaming and live-event streaming), but these have little overall effect on the business case.

More seriously for many operators, the business sector was expected to start to generate incremental revenue to improve the 5G investment case from 2021 or earlier. However, future plans for services such as private networks, smart manufacturing and IoT are now likely to be put on hold.

Operators will restart 5G roll-outs, despite demand-side challenges, and will focus on pockets of new revenue and reducing TCO

The factors discussed above do not mean that 5G deployments will be dramatically slowed down, but rather indicate that operators must rethink their business case priorities.

With fewer new revenue opportunities on the horizon, they will need to intensify their focus on 5G as a driver of cost efficiencies in order to make the case for investment in the short term. For instance, greater spectral efficiency and virtualised architecture may enable them to support higher capacity at lower cost, while switching off legacy networks.

Pandemic-imposed delays to the finalisation of the next release of the 3GPP standards, and to spectrum auctions in some countries, will increase previous timelines by 3–6 months, but will not derail 5G deployment plans. Indeed, it may provide a welcome breathing space for many operators, and could allow them to reduce their marketing expenditure, generate more mileage from FTTx and 4G and wait for more-efficient next-generation 5G platforms (notably the cloud-native core) to become fully mature.

There will also be pockets of new demand, including certain 5G-driven consumer services such as cloud gaming. When the dust settles a little, companies may prioritise their plans for digital transformation to manage the impact of future outbreaks. Operators should be able to generate new revenue in the areas where 5G can be proven to help this process (notably in telehealth) from 2021 onwards.

Overall, 5G’s role in longer-term mobile network rationalisation is secure. Most operators will pick up where they left off, but will use the pause in activity to reassess their business case priorities and consider how 5G fits into their overall investment plans.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Author