COVID-19 will postpone the recovery in the number of SMB PC shipments until at least 2021

The number of PC1 shipments in the small and medium-sized business (SMB) segment was growing at a CAGR of 3.8% until 2019, but we expect that this growth rate will decline to 1.0% in 2020. This is a result of manufacturing shutdowns and supply chain disruptions due to the widespread COVID-19 illness. Our latest forecasts assume that the impact of COVID-19 will subside by June 2020, and if this is correct, the number of PC shipments should start to return to previous levels in 2H 2020 and into 2021.

The increase in the number of PC shipments that was expected in 2020 will now happen in 2021

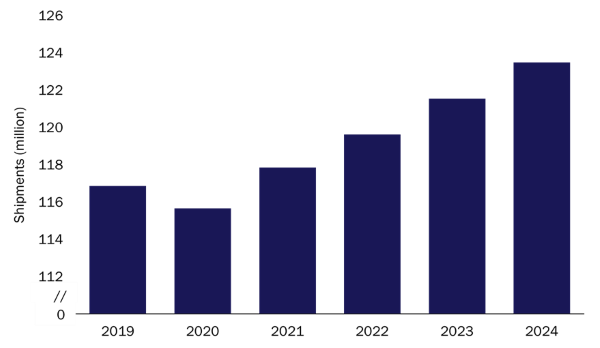

Analysys Mason’s ICT Global Model forecasts that the number of SMB PC shipments will grow at a CAGR of 1.1% during 2019–2024 to reach 123.5 million units in 2024 (Figure 1).

Figure 1: SMB PC shipments, worldwide, 2019–2024

Source: Analysys Mason, 2020

The transition to Windows 10 was a major factor supporting the growth in the number of PC shipments in 2019 because Microsoft ended its support of Windows 7 in January 2020. SMBs were expected to continue upgrading in 2020, so similar growth was expected. However, the spread of COVID-19 and the resulting supply shortages mean that sales will fall in 2020 as SMBs delay the upgrade process until 2021. Some SMBs may buy more PCs in the short term (especially in 1Q 2020) to enable more employees to work from home. Stock is expected to run out quickly, and supply chain issues will continue to affect sales until the end of 2020.

The growth in the number of PC shipments is primarily expected to come from 2-in-1 PCs, convertibles and slim form factors. SMBs intended to buy more PCs in total in 2019 than in 2018, but less than in 2016 and 2017. SMBs are purchasing an increasing number of slim and lightweight devices because mobile computing is one of the top drivers for PC purchases among SMBs.

The number of 2-in-1 PC shipments is growing much more quickly than that of other form factors

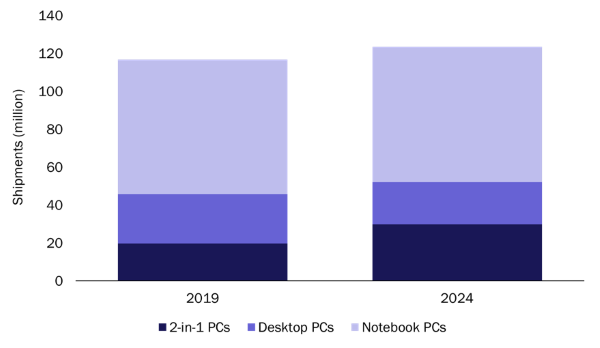

We forecast that the number of SMB 2-in-1 PC shipments will grow at a CAGR of 8.6% during 2019–2024 to reach 30 million units in 2024 (Figure 2).

Figure 2: SMB PC shipments, by form factor, worldwide, 2019–2024

Source: Analysys Mason, 2020

2-in-1 PCs have found their niche in specific user types such as people on the go, creatives and senior executives. Our survey found that 45% of senior executives in SMBs own a 2-in-1 PC and the top-five industries using 2-in-1 PCs are professional services, banking/finance, insurance, real estate and manufacturing. SMBs that are upgrading from desktop PCs and traditional notebooks also favour 2-in-1 PCs given the increasing need for mobility and competing price points.

Desktop PCs continue to decrease in popularity, and the number of desktop PC shipments fell at a CAGR of 3.1% during 2019–2024. Businesses that do not need touch screens or do not have use cases for 2-in-1 PCs have a strong demand for ultrabooks and lightweight notebooks. The lack of demand for traditional notebooks and mobile workstations will result in flat sales for notebook PCs during the forecast period.

The transition from Windows 7 will drive growth in the number of PC shipments following the decline in 2020 due to COVID-19

Vendors need short-term plans to handle supply shortages and a lack of inventory, but they also need to set plans in place to ramp up production in the second half of 2020 in order to meet the higher-than-normal demand that is expected in 2021. The number of SMB PC shipments grew strongly in 2019 thanks to the introduction of new form factors and sleek and lightweight devices that were affordable and met specific business needs. It is crucial for vendors to meet the demand in 2021in order to keep the market momentum and maintain SMBs’ upgrade cycles.

1 PCs include all form factors of desktops, notebooks and 2-in-1 PCs, but not tablets.

Downloads

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Receive the latest news and research on SMB IT buying behaviour and forecasts

Authors