Deals in Belgium highlight the new strategies used by operators in Europe for offering fixed–mobile bundles

Listen to or download the associated podcast

Competition in the fixed–mobile convergence (FMC) segment in Belgium has historically been fragmented, with only the incumbent Proximus offering FMC services nationwide. The situation will change from late 2023.

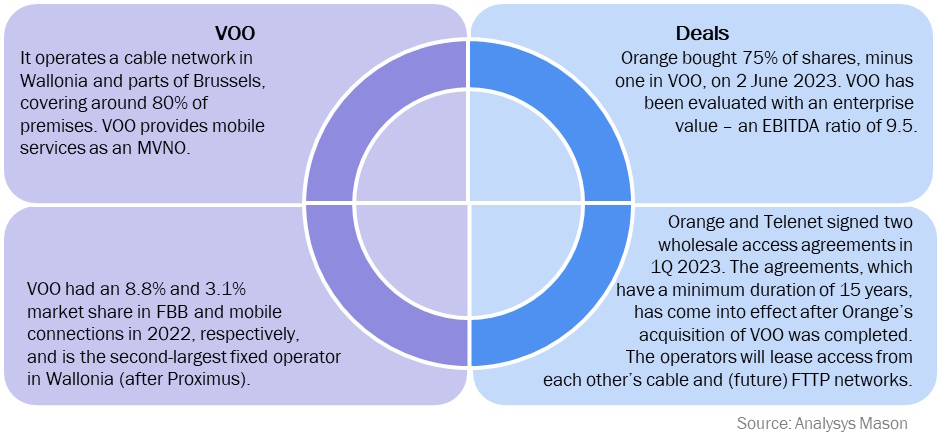

Orange, the third-largest mobile network operator (MNO) in Belgium, bought the regional cable operator VOO in 2Q 2023. To receive regulatory approval, Orange agreed to open up VOO’s network to Telenet. As a result, Orange and Telenet will be able to compete nationwide more effectively with Proximus.

These deals highlight that European operators are developing new models for offering FMC services that go beyond the approach of using proprietary fixed and mobile infrastructure. More and more operators are expanding their operations in the FMC segment by buying wholesale connectivity services.

This article draws on Analysys Mason’s Fixed–mobile convergence in Belgium: trends and forecasts 2023–2028 report. The report provides a detailed 5-year forecast for the adoption of FMC and multi-play services and an analysis of operators’ strategies.

Belgium has a high adoption rate of FMC bundles as the two largest fixed operators have used FMC to consolidate their user bases

FMC household penetration was 57.9% in Belgium in 2022, one of the highest rates among European countries.1

Proximus and cable operator Telenet, the two largest operators in terms of fixed broadband (FBB) connections, have used FMC bundles to consolidate their customer bases, also leveraging strong pay-TV propositions.

Regulatory interventions also stimulated the adoption of FMC. The MNO Orange launched FMC services in 2016, after that the regulator had opened up the networks of the cable operators Telenet and VOO. In 2017, the regulator introduced a new regulation to make it easier for customers to switch between FMC operators.

Proximus dominates the FMC segment though, accounting for 47% of FMC accounts in 2022. It offers fixed and mobile services across the whole country, unlike competitors that offer fixed services only in specific regions (Telenet in Brussels and Flanders; VOO in Brussels and Wallonia).2

Orange and Telenet will compete more effectively with Proximus, nationwide, from late 2023

Orange agreed to buy VOO in 1Q 2023. To receive the approval from the European Commission (EC), Orange opened up VOO’s network to Telenet (Figure 1). The EC was concerned that Orange’s takeover of VOO would have resulted in causing retail price competition to diminish in the fixed market in some areas, by reducing the number of fixed retail operators.

Figure 1: Overview of Orange’s takeover of VOO and of the Orange–Telenet wholesale agreement, Belgium, June 20233

These deals mark significant changes to Belgium’s FMC market structure.

- Telenet will introduce FMC services in Wallonia in 2024. It currently only provides mobile services under the brand BASE in this area, but it is now planning to upsell FBB services to its mobile customers.

- Orange will upsell and cross-sell mobile, FBB and pay-TV services to and between Orange’s and VOO’s customer bases. VOO’s acquisition allows Orange to introduce new FMC bundles and/or increase discounts to FMC customers in the Wallonia region.

Operators that do not have a large fixed and mobile network coverage have other options for offering fixed–mobile bundles

Historically, operators have offered FMC bundles over mobile and fixed infrastructure that they own. To expand their addressable market, integrated operators invested in network roll-out and/or bought smaller players. Mobile-only and fixed-only operators have managed to gain traction for FMC bundles almost exclusively by combining their operations via M&A.

The presence of infrastructure operators deploying FTTP networks has created new opportunities for operators that want to offer FMC bundles. In recent years, several mobile-only operators or mobile operators with a limited fixed network coverage have promoted FMC services by reselling fixed services over third-parties’ networks. For example, in Italy, the MNOs WindTre and Vodafone, which have historically had a larger mobile than fixed market share, pushed FMC reselling services over Open Fiber’s network. This go-to-market strategy allows them to upsell fixed services to their mobile customers with a relatively limited initial investment.

The Orange–Telenet agreement highlights the fact that fixed operators can also introduce FMC services in areas outside their network footprint through wholesale agreements. This approach is not completely new. For example, Vodafone, which has a strategy based on convergence, has used a similar approach in almost all of its European divisions. It combines its fixed network by buying wholesale services. In Europe, Vodafone’s fixed services were available to 123.4 million households in 1Q 2023, of which 46.8 million households were covered via its own network and the remaining households were covered via several wholesale agreements.

The situation of the Belgium’s FMC segment is not unique. It mirrors market developments in other European countries. It is becoming relatively less critical than before for operators to have a large network footprint with proprietary fixed and mobile infrastructure in order to promote FMC. Operators can successfully promote FMC bundles by combining their own infrastructure with wholesale services or by relying almost exclusively on fixed wholesale services.

1 For more information,see Analysys Mason’s DataHub.

2Orange offers FMC services nationwide, but it resells FBB services over third-parties’ networks (including those of the infrastructure operator Fluvius, Telenet and VOO).

3 For more information, see Analysys Mason’s DataHub and Analysys Mason’s European Telecoms Market Matrix.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Tracker

Fixed–mobile convergence quarterly metrics 1Q 2025

Article

M&As such as the recent XL–smartfren merger are reshaping Indonesia’s telecoms market

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market