Decommissioning legacy networks will be key to reducing operators’ energy usage

17 August 2022 | Research

Article | PDF (3 pages) | Wireless Infrastructure| Fibre Infrastructure

Operators worldwide have been decommissioning, or are planning to decommission, their legacy wireless (2G and 3G) and fixed network (PSTN, copper, local exchanges, FTTC and HFC) assets due to a decline in the number of subscribers and rising operational costs. In most cases, this is also part of operators’ wider sustainability and environmental, social and governance (ESG) strategies because decommissioning legacy networks can lead to significant cuts in energy usage.

The phase-out of legacy networks can be initiated by regulators or it can be part of government policy, but most shutdowns have been operator-led. However, the process of decommissioning a network can be slow, particularly for fixed networks. There are considerations that may complicate the process including competition regulation, consumer protection regulation and the need to accommodate critical services. As such, it is key that operators ensure good communication during the whole process.

In this article, we discuss the information found in Analysys Mason’s Wireline decommissioning tracker and Wireless decommissioning tracker, which provide details on planned and completed legacy network shutdowns.

The number of 2G/3G network shutdowns is expected to peak in 2025 as resources are shifted to more-efficient networks

Most mobile network operators (MNOs) have plans to switch off their 2G/3G networks to benefit from potential opex savings, lower power consumption and the opportunity to refarm spectrum for 4G and 5G services. Most MNOs are decommissioning their 3G networks first, particularly in Europe, though MNOs in Asia–Pacific are more inclined to switch off their 2G networks first (for example, Japanese operators switched off their 2G networks as early as 2008). A large proportion of MNOs are planning their 2G and 3G shutdowns for between 2023 and 2028. Orange is a notable exception; its European 3G shutdown plans extend out to 2030.

MNOs that are decommissioning a wireless network must reach out to the small group of customers that heavily rely on 2G/3G networks well before the date the shutdown. In most cases, MNOs have offered such users discounted tariffs and have provided device and SIM card swap/subsidy programmes to ease the upgrade to a 4G-/5G-compatible device. A large proportion of MNOs are continuing to leave 2G networks running because they are often critical for legacy voice messages and IoT and M2M technologies that require low data rates. Indeed, when MNOs phase out 3G only, subscribers on 2G-capable 3G devices will fall back onto a 2G network for basic voice and SMS. MNOs will need to investigate upgrading or replacing these technologies to work with newer networks.

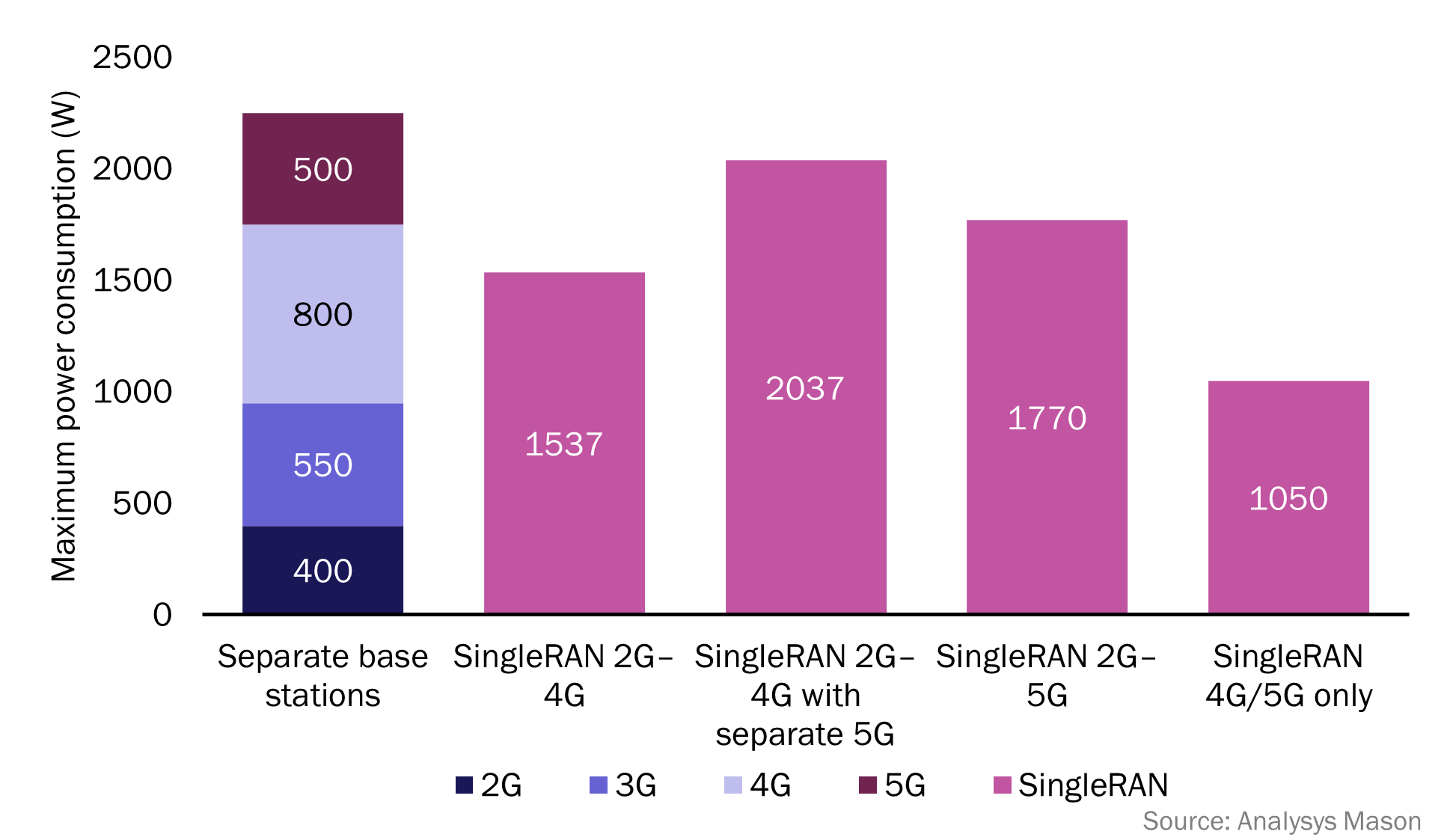

MNOs that run 2G, 3G, 4G and 5G with separate base stations could potentially reduce their energy consumption by up to 40% at each macro site by switching off 2G and 3G (Figure 1).1 Telefónica Germany reported, at the end of 2021, that switching off its 3G network saved 60GWh per year (about 8% of its annual consumption).

Figure 1: Maximum power consumption of separate 2G, 3G, 4G and 5G base stations versus that of cell sites with various SingleRAN implementations1

The transition from legacy fixed networks to FTTP could significantly lower operators’ energy costs

Decommissioning fixed networks can also provide energy and operational savings. Indeed, running an all-FTTP access network could reduce operators’ energy usage by up to 80%. To decommission a legacy fixed network, operators must switch off (in roughly this order) PSTN/ISDN, exchange-based copper services, exchange facilities and all cabinet-based copper services (FTTC).

The use of fixed voice services is declining, and several operators have already migrated from PSTN to cheaper VoIP. Indeed, all of Deutsche Telekom’s European subsidiaries have done so, as has A1 Telekom Austria. A PSTN switch-off is not conditional on copper decommissioning, but copper decommissioning requires a PSTN switch-off. Most planned PSTN switch-offs are expected in or before 2025, but the PSTN shutdown will broadly follow the cadence of copper decommissioning in some countries. The energy benefits of switching off the PSTN are substantial; alternative soft switching consumes under a quarter of the power.

Operators have also been actively phasing out other exchange-based copper services such as ADSL and VDSL-CO. These services are largely obsolete and have plummeting numbers of subscribers. Most operators are looking to transition customers to FTTP/xPON, primarily because FTTP has lower energy costs than any alternative broadband infrastructure; by BT’s estimates, it uses about 13% of the energy per line of FTTC and just 6% of that of DOCSIS3.1. Most operators are obliged to wholesale raw copper, so they must get buy-in from their wholesale customers, which slows the process of decommissioning. Nevertheless, many operators have plans to massively reduce or phase out their copper networks by 2030. Telenor reported that it expects to save up to 100GWh of electricity per year after the switch-off (about one eighth of its total).

Only a handful of operators worldwide have set timescales for FTTC/VDSL decommissioning and have considered the complete removal/repurposing of street cabinets. Most of these operators are in Western Europe; Proximus and KPN have started to remove FTTC as part of their on-going FTTP upgrades. Many cable operators (for example, Virgin Media O2 in the UK and Altice USA) have indicated that they will self-overbuild their HFC with FTTP, which inevitably leads to the decommissioning of HFC in the future, but very few have indicated when they expect to shut down HFC. Starhub in Singapore stopped using HFC back in 2018, and Optus in Australia has reached the stage where it is physically removing HFC.

Analysys Mason’s new Wireline decommissioning tracker and Wireless decommissioning tracker cover the decommissioning of 2G, 3G, PSTN/ISDN, copper, local exchanges, FTTC and HFC networks worldwide. In the future, we will add non-network assets such as stores and administrative offices.

1 For more information, see Analysys Mason’s Driving down energy usage across telecoms networks: 5G RAN and beyond.

Author