Differentiation in the fixed enterprise connectivity market is challenging, but operators do have options

Fixed connectivity is a major contributor to telecoms operators’ enterprise revenue and supports operators’ right to play in growth markets such as cloud and security. It is crucial for established operators to defend their position in the connectivity market, but differentiation is challenging.

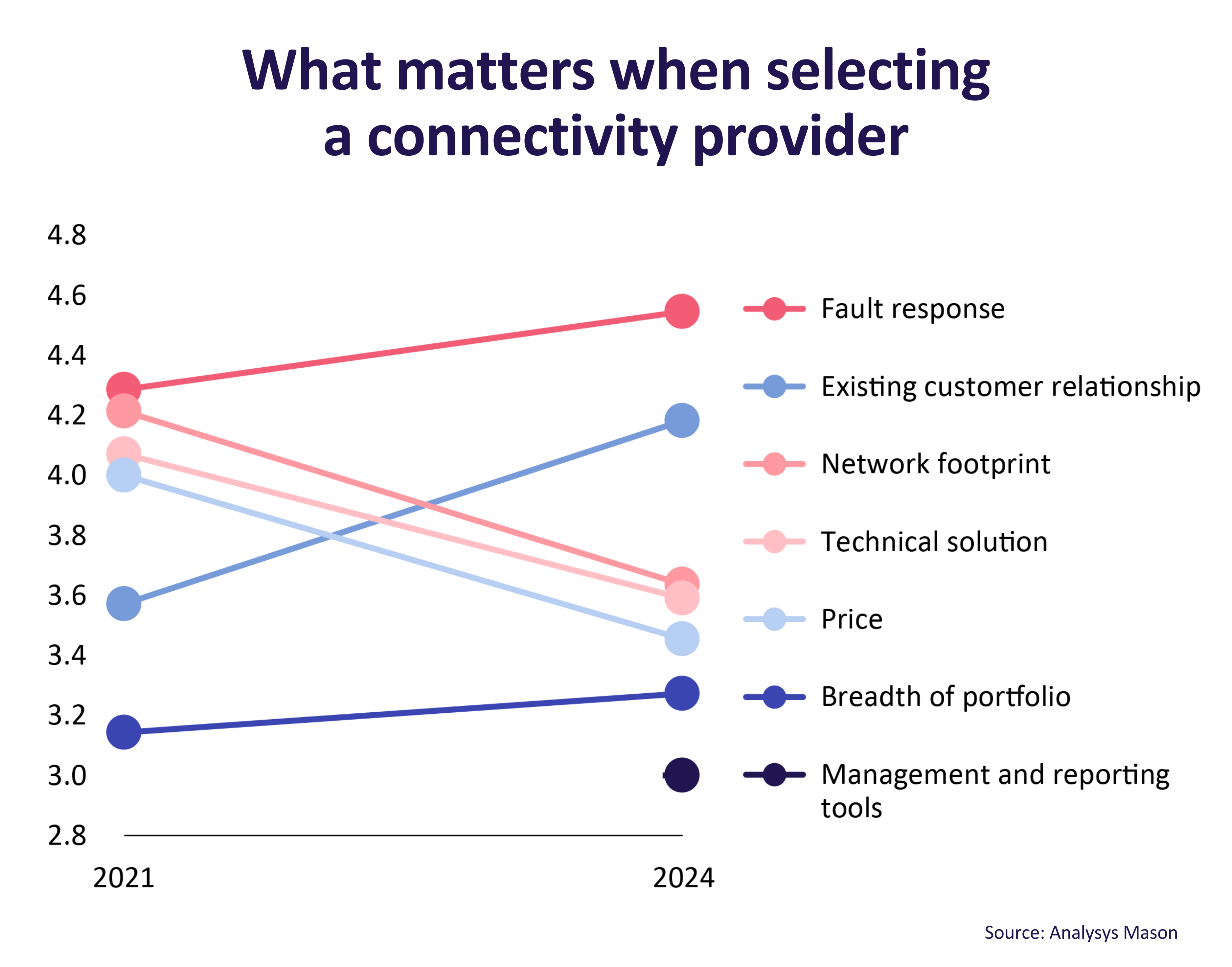

We recently interviewed a dozen operators about their provision of fixed enterprise connectivity. During the interviews, we asked them to rate how important various factors are to enterprise choice of connectivity provider. The results indicated the importance to operators of providing good fault response and customer satisfaction, and highlighted ways that operators could gain a short-term advantage in the market, for example via technical innovation or provision of managed services.

More details about the approaches taken by operators can be found in our report: Telecoms operator strategies for differentiating fixed connectivity for enterprises: case studies and analysis.

Fault response is perceived to be the most important factor for enterprise choice of connectivity provider

Only two operators rated fault response as being less than ‘very important’ to its business customers when they are selecting a fixed connectivity provider. The importance of this factor has increased since a similar survey we conducted in 2021, while other factors such as network footprint and price have declined in importance (Figure 1).

Figure 1: Perceived importance of different factors to enterprises when they are selecting a connectivity provider1

Good fault response is identified most easily in its absence. One operator commented that “Customers rate it low until it happens.” There is often little to choose between the service-level agreements (SLAs) of different operators on paper, but in practice their ability to meet these SLAs can vary and the failure to provide good fault response to existing customers is likely to result in significant churn.

Operators vary in the quality of their underlying network and their ability to deliver good fault response, but should make the most of what they have. Deutsche Telekom described its robust internal processes to ensure it does not commit to SLAs that it cannot meet; it says this has helped it not to lose any large managed services customers since the start of 2022.

Several operators told us their fault response capabilities had been tested by recent extreme weather events, and that they had been able to promote their success in dealing with these. All operators should seek opportunities to demonstrate their capabilities, perhaps by using analytics reporting to highlight the strength of fault response processes with existing customers.

The perceived importance of existing customer relationships has also increased since 2021, indicating that it is harder than ever for operators to win new business. Churn reduction is therefore vital.

Loyalty varies from business to business, with one operator commenting: “In reality we see a lot of pressure. Some are loyal but some are not” while another noted that “No one wants to change if things work.” This is a critical point for established operators. Provided they can keep up reasonably well with their peers in the things that matter to their customers, and provided they can deliver a decent level of customer satisfaction, they are unlikely to lose a significant share of the connectivity market.

Network footprint and technical solution have declined in importance but remain a vital part of fixed connectivity offerings

Network footprint and technical solution are examples of factors that are important for operators to demonstrate that they can keep pace with their peers, but where opportunities for differentiation are limited.

In some countries such as New Zealand, widespread use of wholesale services makes it especially hard to differentiate on network aspects; large overlapping fibre networks have a similar effect in countries such as Spain. For global connectivity, operators can differentiate with better connectivity on certain routes, but the most popular routes are well addressed by all the major providers. Differentiation is usually only possible when enterprises have specific demand for very high bandwidth, levels of automation or security features.

Technical solutions do vary slightly between provider, but one operator commented that businesses care “more about the reputation [of the operator to] design a solution according to their needs” rather than the nature of the solution itself. We identified very few examples of truly innovative solutions in the connectivity market although some operators hope to gain a first-mover advantage with solutions in areas such as quantum networking and identity management.2 Notably, only one operator mentioned AI as a potential network differentiator.

Challenger operators have a few opportunities to gain market share

In the past, challenger operators have used aggressive pricing to gain market share. However, the fixed enterprise connectivity market is relatively conservative and most operators report that price has diminished in importance for enterprise choice of provider. For example, one commented: “It would have been [very important] 2–3 years ago. Now it’s less important”. Prices have been falling (and are likely to continue to fall) for all providers, perhaps as a result of widespread access to wholesale networks.

One operator told us that pricing pressure from competitors means that it is winning business at a lower price than in the past. Another felt that the improved quality of service it offers could not command a price premium, merely a defence against reducing prices.

It is difficult for challenger operators to make significant gains in the fixed enterprise connectivity market, but we have identified a few areas in which they can gain at least a short-term advantage:

- quality of managed services

- range of co-managed options

- first-mover with new services

- use of customer references to build credibility with certain types of customer.

These are explored further in our report: Telecoms operator strategies for differentiating fixed connectivity for enterprises.

1 2024 survey based on responses from 11 operators and specified selection of a fixed connectivity provider. 2021 survey based on responses from 16 operators and specified selection of a communications provider. ‘Management and reporting tools’ not included in 2021 survey. Scale: 1 is ‘not at all important’ and 5 is ‘very important’.

2 Deutsche Telekom’s Premium Internet Underlay and Colt’s Green Routes are the clearest examples of innovative solutions.

Article (PDF)

DownloadAuthor