SMBs’ spending on marketing automation applications is increasing rapidly

Small and medium-sized businesses (SMBs) made considerable progress with their digital transformations during the COVID-19 pandemic. This has heightened their focus on new modes of doing business, such as via digital marketing. The increase in the number of SMBs that do business online means that budgets, including those previously used for travel, have been reallocated.

SMBs’ spending on digital marketing will continue to grow rapidly across all industry verticals. Indeed, SMBs’ spending on digital marketing automation software worldwide is set to increase from USD2.2 billion in 2021 to USD3.2 billion by 2026.

Spending on SMB-specific marketing automation solutions has grown rapidly in the past 2 years

This market growth is illustrated by the increase in revenue for Hubspot (+41% in the year to 1Q 2022), Salesforce (25% year-on-year growth in its marketing segment in FY2022) and Adobe (17% year-on-year growth in its Digital Experience segment in FY2022).

Hubspot, the biggest player in this market, grew its revenue faster than its competitors thanks to its freemium pricing strategy. It has used inbound marketing to appeal to SMBs; it provides information and resources via its blog, online courses, downloadables and webinars, all for free. It also partnered with Pipe to provide start-ups with access to USD100 million in funding.

Such an SMB-specific approach, including the use of a freemium strategy, was also important to Mailchimp’s success. Mailchimp has the largest share of the email marketing market and accounted for 8% of Intuit’s revenue growth during FY2022.

The revenue opportunity for digital marketing automation software will increase to USD7.2 billion worldwide by 2026

The total market for digital marketing automation will be worth USD4.1 billion in 2022 and will grow to USD7.2 billion in 2026 at a CAGR of 12.0%, according to Analysys Mason’s SMB Technology Forecaster. SMBs accounted for 53% of the total spending on marketing automation in 2022. 21% of SMBs are planning to start using or upgrade their marketing automation solutions in the next 12 months, according to Analysys Mason’s survey of SMBs.1

Factors that will continue to drive the popularity of marketing automation software among SMBs include the following.

- Multi-channel opportunities. There has been a rise in both the number of new marketing channels and the volume of content delivered via influencer marketing, content marketing and affiliate marketing. SMBs can now target consumers through online articles, videos, social media posts, paid ads, influencers, virtual events, games, augmented reality (AR) and virtual reality (VR). A multi-channel digital marketing strategy helps SMBs to harness new opportunities and enables customers to receive the same experience, regardless of the channel. Omnisend claims that customer retention rates are up to 90% higher when using omni-channel marketing automation rather than traditional marketing solutions.

- Regulation. Government authorities are beginning to introduce regulations on data accumulation, such as the European Union’s General Data Protection Regulation (May 2018) and China’s PIPL law (November 2021). SMBs are looking to improve their customers’ data security by using automation, which provides greater transparency of collected data and gives customers simpler and more-direct control of their own data, thereby reducing the need to contact the SMB directly.

- AI and deep learning opportunities. Marketing automation solutions that use AI and deep learning to analyse live intent signals can improve contextual targeting. Marketing automation will become even more attractive to SMBs as product improvements, including AI, make marketing tools more effective.

Spending on marketing automation applications will grow strongly in all sectors, particularly among medium-sized businesses

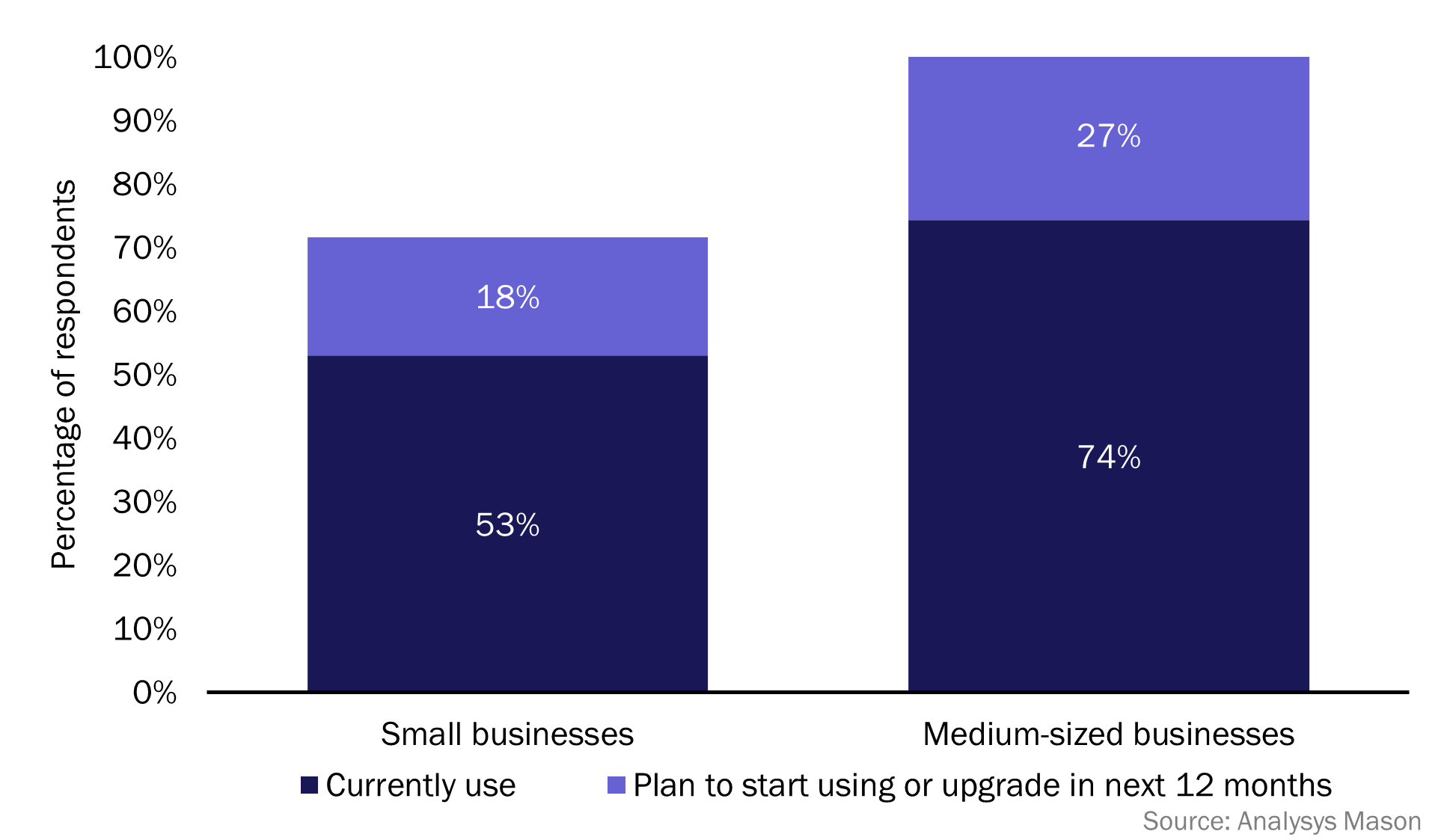

Analysys Mason’s survey indicates that SMB spending on marketing automation differs according to business size rather than industry vertical. Indeed, Figure 1 indicates that more medium-sized businesses (MBs) plan to adopt marketing automation applications than small businesses (SBs). The difference is likely to be due to MBs’ increased capacity to spend.

Figure 1: SMBs that currently use or plan to use/upgrade marketing automation applications in the next 12 months, by business size, Germany, Singapore, UK and USA, 1Q 20222

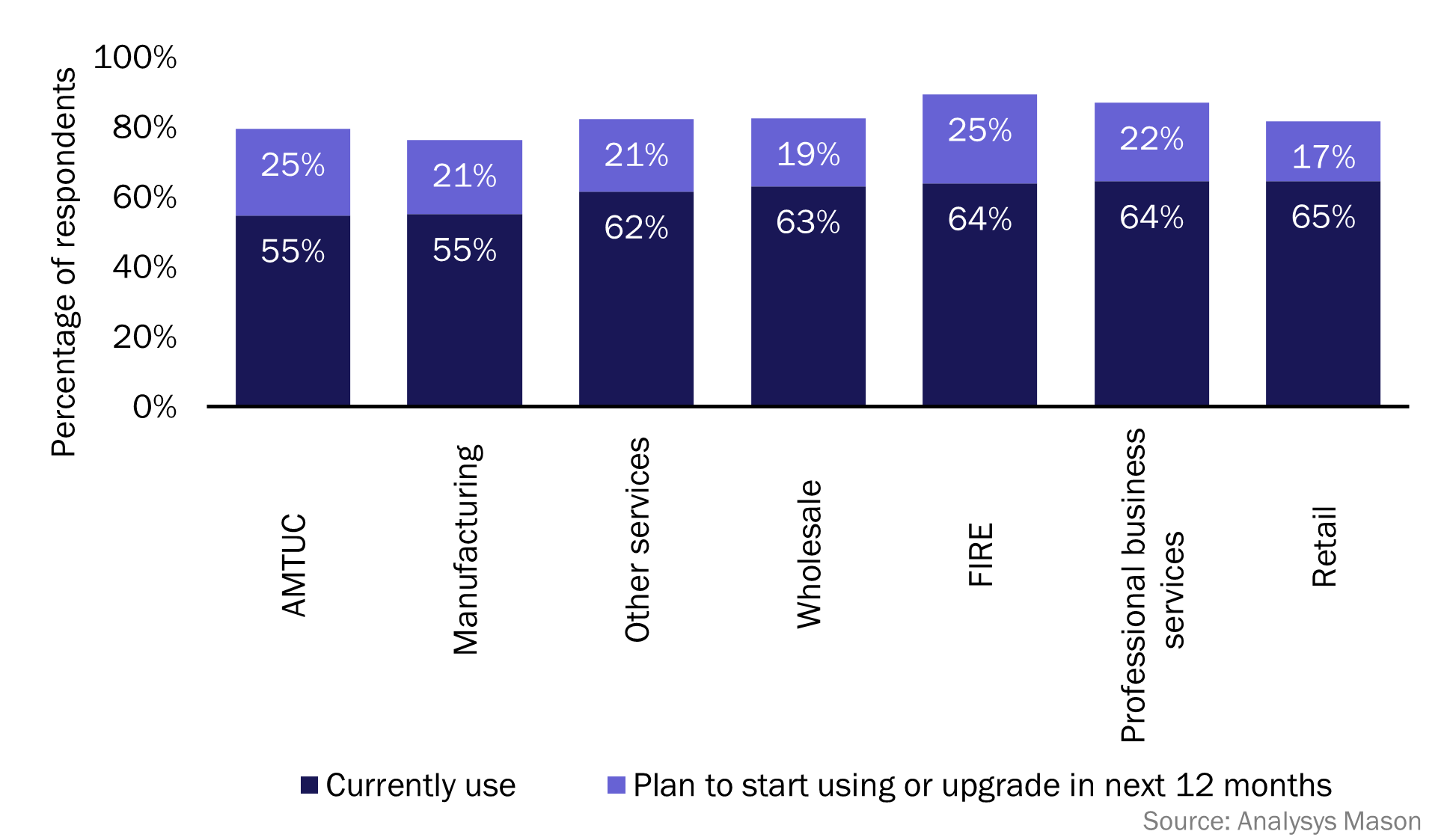

Figure 2 shows that there is little variation in the use of digital marketing automation between industry verticals. Marketing efficiency has improved as businesses have found new ways to trade and discovered new revenue streams. The pandemic has also led to significant shifts in customer behaviour. The results of the survey suggest that these factors are applicable to all verticals, despite differences in the sectors.

Figure 2: SMBs that currently use or plan to use/upgrade marketing automation applications in the next 12 months, by industry vertical, Germany, Singapore, UK and USA, 1Q 20223

SMBs in the retail sector are well-placed to use user-generated content and influencer marketing to appeal to younger generations, who represent the largest target audience for digital marketing and are also the most likely to seek independent brands and influencers who reflect their values. The AMTUC vertical is well-known for its use of offline channels such as trade shows and exhibitions, and here marketing automation has helped to speed up follow-up communication, integrate offline and online activity and upsell to existing partners. Likewise, FIRE industries have adapted to new technologies by providing services such as real estate virtual tours.

SMBs in all sectors are also planning to increase their spend on digital marketing automation solutions. We expect that 80–86% of SMBs in all verticals will use marketing automation solutions by 2023. The predicted future growth in spending is similar across sectors.

Vendors should capitalise on the high growth in spending on marketing automation software

Digital marketing automation for SMBs represents a large market opportunity for vendors, especially given the fast-growing penetration of connected devices worldwide. Marketing automation vendors should capitalise on this growth in spending by promoting the various advances in the market to SMBs.

1 Analysys Mason conducted a survey of 1149 SMBs in Germany, Singapore, the UK and the USA between December 2021 and January 2022.

2 Question: “Which of the following front office-related applications does your firm currently use or plan to use/upgrade in the next 12 months? If upgrading a product now in use, be sure to check both “use” and “upgrade” columns.” n = 1149.

3 Question: “Which of the following front office-related applications does your firm currently use or plan to use/upgrade in the next 12 months? If upgrading a product now in use, be sure to check both "use" and "upgrade" columns.” n = 1149. AMTUC stands for agriculture, mining, transportation, utilities and construction. FIRE stands for finance, insurance and real estate.

Article (PDF)

DownloadAuthor