Operators should look beyond cloud and security services to sustain long-term enterprise revenue growth

Listen to or download the associated podcast

Enterprise connectivity revenue is flat or declining for most operators, and many are diversifying their portfolios to find new revenue opportunities. Partnerships will play an increasingly important role in this. Operators will need to adapt to new models of working and find ways to differentiate their enterprise portfolios in an increasingly crowded market.

This article draws on insights from a survey of more than 200 large enterprises, as well as interviews with 16 different operators, conducted in early 2021 on behalf of CSG. Detailed findings from this research are presented in our report, Large enterprises’ demand for communications and IT services: survey results 2021.

Most operators already rely on cloud and security services to sustain their enterprise revenue

We interviewed 16 operators between March and May 2021 about their current enterprise portfolios and strategies for growth. Each has a significant enterprise unit; they operate in a wide range of geographies and are at different stages of market development.

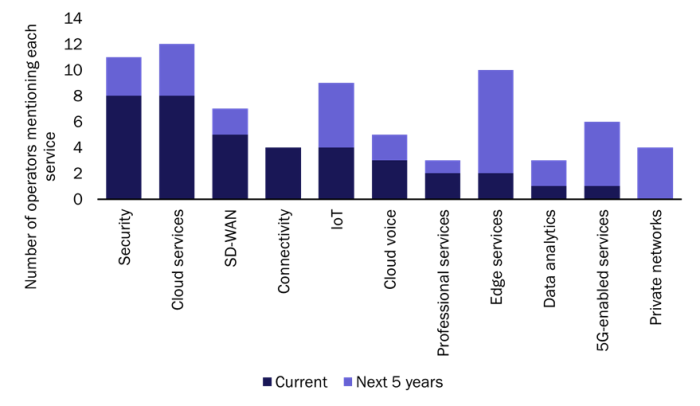

Figure 1 shows the services that operators identified as driving current and future revenue growth. Services on the left are those most often reported as supporting current revenue growth. Fewer operators mentioned that the services on the right are already delivering revenue growth, but many identified these services as likely to be responsible for revenue growth within the next 5 years.

Figure 1: Services identified by operators as driving current and future (in the next 5 years) revenue growth from large enterprises1

Source: Analysys Mason, 2021

Security and cloud services were each mentioned by half of the operators as already driving revenue growth. Several operators have broad portfolios in these areas based on both internal capabilities and expertise and partnerships with security vendors and public cloud platforms. SD-WAN, connectivity, IoT and cloud voice services were also each highlighted by several operators as being contributors to current revenue growth.

Operators should broaden their range of services to support long-term revenue growth

Most of the operators that we spoke to are focusing their sales efforts on up-selling additional services to existing customers rather than on attracting new connectivity customers. For many, this is an ongoing process; the majority of their customers just buy connectivity services at the moment. Only a quarter of operators reported providing additional, non-connectivity services to more than half of their enterprise customers.

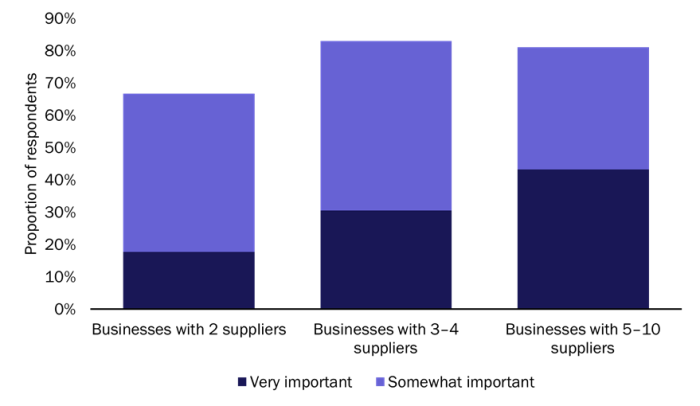

Promisingly for operators, our parallel survey of 200 large enterprises identified significant appetite for buying more services from their main communications service provider. It also indicated that many enterprises were keen to reduce their number of suppliers. Indeed, almost 90% of enterprises reported using at least two suppliers for their core communications services and 78% of these would like to reduce this number (see Figure 2).

Figure 2: Enterprise responses to the question, “How important to you is reducing the number of suppliers?”

Source: Analysys Mason, 2021

The most common reason given for using multiple suppliers was the need to support additional services. This suggests that operators with a broad portfolio are well-positioned to sell additional services to enterprises. Only 16% of enterprises reported that they do not want to rely on a single supplier.

Some of the most advanced operators reported moving away from selling new services simply as an add-on to connectivity. Instead, they are positioning themselves as solutions providers that are able to deliver digital transformations on behalf of enterprises. These operators typically also stressed the importance of providing enterprises with a broad portfolio of services supported by multiple technology vendors and brought together as a single package by the operator.

More generally, many operators recognised the importance of developing new service propositions including edge, 5G-enabled services, private networks and data analytics. Our enterprise survey also identified that over 80% of enterprises would consider buying edge, 5G slicing and private network services within the next 5 years. Operators recognise that they will be increasingly reliant on partners to deliver these propositions. Indeed, one interviewee commented, “Partners will be absolutely key… There’s only going to be more [co-development].”

Product differentiation is likely to become more challenging

Many operators are already adopting a partnership model for service provision in order to meet business demand for new services, and this is seen as inevitable by most others. This model has a number of important advantages including lower investment costs, a reduction in the time to market for new services, the ability to keep pace with the latest technological developments and an increase in the overall customer value.

However, the adoption of a partnership model also has implications for the processes, sales approaches and margins associated with new services. It limits the control that operators have over product development and may weaken their role in the value chain. Perhaps most importantly, many operators may struggle to find ways to effectively differentiate their offerings as they develop partnerships with the same set of technology providers as one another.

Some operators are differentiating by providing a professional and managed services wrap, and a small number of operators have already identified professional services as a contributor to their current revenue growth. Other operators are experimenting with differentiating by providing access to multi-vendor services via an integrated platform, by offering services that support local data sovereignty rules or by developing a vertical focus.

Operators will need to not only continue to extend their portfolio, but also identify ways to make their propositions stand out in an increasingly crowded market in order to successfully sustain their enterprise revenue in the long term.

1 Only services mentioned by at least three operators are included.

Article (PDF)

DownloadAuthor