Discussions at Space Tech Expo Europe underscored the need for a European satellite market strategy

12 December 2025 | Research and Insights

Article | PDF (3 pages) | Earth Observation| Emerging Space Applications| Government and Military Space| Satellite Broadband| Satellite Capacity| Satellite D2D| Satellite Manufacturing and Launch| Satellite Mobility| Satellite–Telecoms Integration| Space Ground Segment| Space Infrastructure

Analysys Mason attended Space Tech Expo Europe in Bremen, Germany in November 2025. Over 800 exhibitors and 10 000 participants gathered for the continent’s largest space conference, and we were repeatedly asked the same two questions: “Is the European satellite market opportunity getting bigger? Is it big enough for European and international players?” The answer to both is ‘yes’, though players with a local presence, an innovative value proposition and strong partners in Europe will benefit the most.

The geopolitical changes in the last few years have disrupted the status quo of the satellite sector. The USA has historically led and directed space activities worldwide, but Europe is now taking on a stronger and more independent role. European governments, venture capital firms and large enterprises have invested billions of euros in new sovereign launch vehicles and satellite constellations, and the European Space Agency’s (ESA’s) recent ministerial council meeting demonstrated stronger budgetary commitment from European nations towards the satellite and space sectors. As a result, international players are starting to see their European peers as leaders of satellite initiatives rather than just partners.

Momentum is building in the satellite manufacturing and launch market in Europe

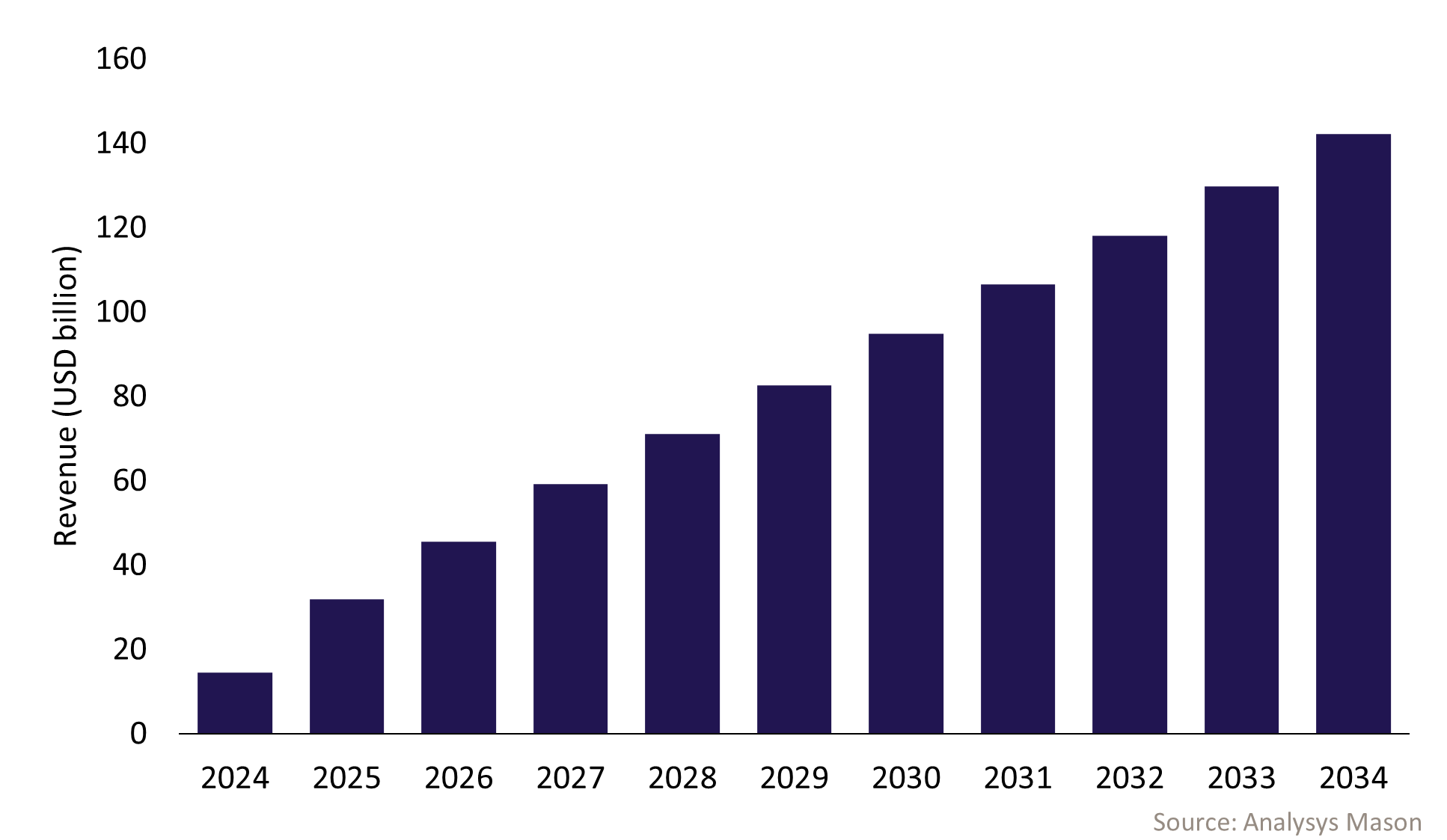

Analysys Mason’s Satellite manufacturing and launch services: trends and forecasts shows that the cumulative revenue from building and launching satellites worldwide will reach over USD900 billion between 2024 and 2034 (Figure 1). Revenue from non-geostationary-orbit (non-GEO) satellites, especially constellations, will account for 93% of the total, and government and military customers account for 67% of the market opportunity. European customers will account for 16% of the total (USD 142 billion), but European vendors are able to sell to customers outside of the region, so the opportunity is larger. However, it may be challenging to broach other markets due to geopolitical, regulatory and cultural challenges.

Figure 1: Cumulative satellite manufacturing and launch revenue, Europe

The European satellite market has traditionally competed with Asia for second place, after North America. Europe’s strong industrial base and institutional budgets support satellite activity, but overly prescriptive requirements and a lack of funding on top of strict industrial policy rules have held the market back. Commercial players have often left Europe to seek funding elsewhere. Such was the case for Finland-based ICEYE.

However, things are now starting to change. Starlink’s behaviour during the Russia/Ukraine crisis in 2022 demonstrated the risk of over-relying on a single operator. The USA’s new tariffs in 2024 pushed players in other regions to start developing satellite and space activity independently. Suddenly, the status quo, where much of the world relied on the efforts of the USA, was shaken, and EU government budgets and programmes for new space infrastructure were announced and moved forwards. For example, the European Commission announced an investment of EUR10.6 billion in the IRIS2 constellation.

European commercial players will benefit from this shift in two important ways.

- They will benefit from the growing number of new contracts and investments directly from government and military customers. For example, the ESA’s 2025 ministerial council meeting resulted in a32% increase in funding compared with 2022 (17% when adjusted for inflation), and the French government has invested EUR 700 million towards Eutelsat.

- Commercial players will build on this increasing government support to mature and raise the competitiveness of their offerings, thus enticing customers and support from outside of Europe.

European satellite vendors must demonstrate a local presence, unique value and strong partnerships to succeed in the long term

European satellite players will benefit from the above trends in the short term, and will see a growing addressable market and investment opportunity. However, they will not survive in the long term without a well-defined strategy built on three pillars: a local presence, a unique value proposition and strong partnerships.

- Local presence. Growing concerns for sovereign capabilities for many new programmes will push vendors to establish a local presence. European customers will prefer to work with European players. Those outside of Europe are therefore likely to need to consider acquiring a local firm to expand their portfolio and potential customer base, as exemplified by USA-based Redwire, which acquired Belgium-based QinetiQ to gain a foothold in Europe.

- Unique value proposition. Expanding competitive landscapes mean that vendors must stand out to get ahead. Novel technologies and approaches that fulfil market demand while offering new alternatives will draw more interest. For example, SpaceX’s reusable rocket allowed the company to stand out and build traction in Europe, and HyImpulse’s unique paraffin-based hybrid rocket helped the company to secure EUR45 million in funding.

- Strong partnerships. Partnerships are key to reaching certain customers and covering competency gaps. AST SpaceMobile’s partnership with Vodafone is a strategic move to make in-roads into Europe, as demonstrated by its selection of Germany as the prime operations centre. ICEYE’s partnerships with major German and Portuguese government organisations have opened the door to new satellite-as-a-service opportunities and funding. Finally, the SpaceRISE consortium brought together some of Europe’s leading satellite service providers and manufacturers to secure developmental contracts for the EU’s IRIS2 programme.

European players’ ambitions are growing, as is the market potential, driven by internal and external factors, and expanding value and supply chains. However, the opportunity will be hard to address unless players develop a strategy that is built on the tried and tested pillars of local presence, unique value propositions and strong partnerships.

Analysys Mason’s Space Infrastructure research programme covers investments, contracts and new developments related to satellite manufacturing and launch, in-orbit services and the optical and lunar markets. See our quarterly deals tracker and yearly investment analysis or contact Dallas Kasaboski to discuss the issues raised in the article further.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Forecast

Defence satellite mobility addressable market: worldwide trends and forecasts 2024–2034

Forecast report

Connected vehicles via satellite: worldwide trends and forecasts 2024–2034

Tracker

Space infrastructure news and deals tracker 4Q 2025