The UK leads the way in fixed broadband ASPU growth, while Spain and Portugal suffer declines

30 January 2026 | Research and Insights

Article | PDF (3 pages) | European Quarterly Metrics

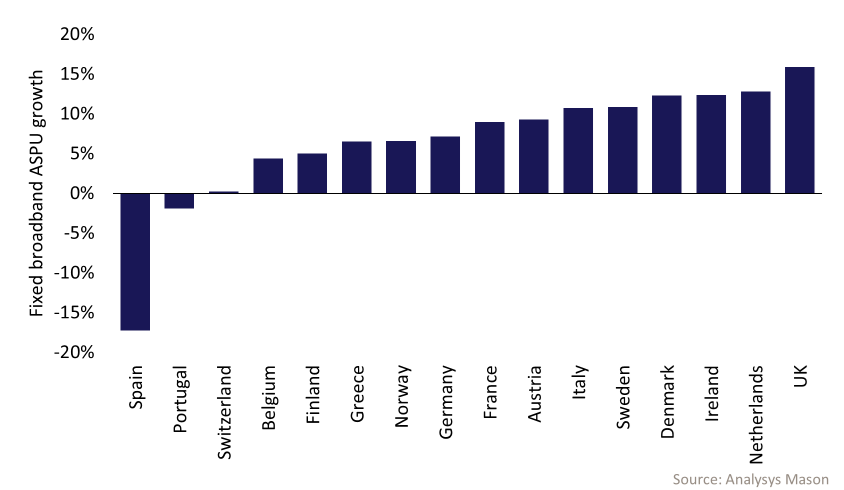

Fixed broadband ASPU in Western Europe is growing. It increased by an average of 6% between 3Q 2023 and 3Q 2025, with most countries in the region experiencing growth of 5–12%. There are three notable outliers. Spain and Portugal are the only markets in which fixed broadband ASPU is declining. Conversely, fixed broadband ASPU in the UK is rising significantly faster than other countries in the region (Figure 1).

This article is based on data from Analysys Mason’s European Quarterly Metrics, which can be found in the Analysys Mason DataHub.

Figure 1: Fixed broadband ASPU growth in Western Europe between 3Q 2023 and 3Q 2025

Fixed broadband ASPU is falling rapidly in Spain

Fixed broadband ASPU in Spain dropped by 17% between 3Q 2023 and 3Q 2025. The presence of DIGI, which offers low-cost fibre, has been driving down ASPU, for two main reasons.

- Many customers have migrated to DIGI. The operator doubled its number of fibre connections between 3Q 2023 and 3Q 2025, reaching a 13% market share of connections.

- Other operators have been lowering their prices to compete with DIGI. Customers who are not churning are benefiting from cheaper prices. Figure 2 shows the movement of some fibre prices between 2019 (soon after DIGI launched) and 2025.

Figure 2: Prices for selected fibre plans from DIGI, Movistar and Vodafone

| 2019 | 2025 | |||

| Operator | Speed (Mbit/s) | Price (EUR) | Speed (Mbit/s) | Price (EUR) |

| DIGI1 | 500 | 30 | 600 | 15 |

| Movistar | 600 | 71 | 600 | 38 |

| Vodafone | 600 | 43 | 600 | 30 |

Source: Analysys Mason

The Spanish market shows that, even in an almost fully fibre market, a low-cost challenger such as DIGI can trigger price erosion by offering cheap tariffs without compromising on service quality.

Analysys Mason’s latest Spain: consumer survey shows DIGI has the highest Net Promoter Score for fixed broadband services in the country. Its combination of strong performance and low prices undermines traditional quality-based differentiation. DIGI also demonstrates that fixed–mobile convergence (FMC) does not guarantee customer loyalty and ASPU protection. Spanish consumers have shown that they are willing to unbundle and switch if the price gap is large enough, even in one of Europe’s most mature fibre markets.

Fixed broadband ASPU is dropping slowly in Portugal

Portugal is the only other country in Western Europe in which fixed broadband ASPU is falling, albeit at a lower rate than in Spain. It declined by 2% between 3Q 2023 and 3Q 2025.

The Portuguese broadband market is very mature, with high percentages of customers on fibre and FMC plans (71% and 53%, respectively, in 3Q 2025).2 The market is competitive, with the three leaders – MEO, NOS and Vodafone – close in terms of their market share of connections. All three offer a premium main brand and a lower-cost sub-brand. These sub-brands will increase in importance following the launch of DIGI, which acquired NOWO in 4Q 2024.

The structure and maturity of the Portuguese market is similar to Spain. ASPU is already declining and DIGI has entered the market, which means operators will need to develop a strategy to avoid significant ASPU erosion. Operators in Portugal should use their already established low-cost sub-brands to compete with DIGI, while offering clearly differentiated, premium offers through their main brands to retain their high-value customers. This will limit the loss of customers to DIGI and avoid intense price competition.

Fixed broadband ASPU is growing faster in the UK than in any other Western European country

Fixed broadband ASPU grew by 16% in the UK between 3Q 2023 and 3Q 2025. This is 3% higher than any other country in Western Europe. Two factors are driving ASPU growth in the UK.

Copper-to-fibre migration is ongoing in the UK. Customers in the country are paying more for fibre: fibre ASPU was 19% higher than DSL ASPU in 3Q 2025. Many altnets are offering fibre in the UK, and they have been starting to increase their market share of connections as customers migrate away from legacy DSL plans offered by operators such as TalkTalk.

Another driver of ASPU growth has been price increases, which operators in the UK continue to implement annually. Price increases were previously inflation-linked (most commonly CPI plus 3.9 percentage points), but Ofcom banned this practice from the start of 2025. Price rises are still built into contracts, but operators now take a pounds-and-pence approach to these rises (with annual price increases typically ranging from GBP3–4 per year). This pricing strategy is used by almost all operators in the UK.

The UK shows that significant fixed broadband ASPU growth is achievable when operators all implement annual price rises. This makes increases feel like the industry norm rather than the action of an individual operator. It also makes customers disinclined to switch provider because all providers are raising prices. Consumers have proved to be more tolerant of price increases when they are positioned around essential connectivity, particularly when getting an improved service by switching from DSL to fibre. However, this strategy may be challenged in the mid-to-long term when most customers are on fibre and have a speed that easily meets their needs. Operators might then see more price competition.

Ongoing consolidation among fibre players in the UK may further change market dynamics; it is not impossible that an operator following a DIGI-like strategy will emerge. Indeed, there are already some similarities between DIGI’s approach and that of Community Fibre. See our presentation What to give the consumer who has everything for additional information on operator strategies surrounding market challengers.

The markets in Spain, Portugal and the UK provide three very different outlooks for fixed broadband services. Operators across Europe can take the lessons from these markets to help them achieve optimal fixed broadband ASPU growth. Subscribe to Analysys Mason’s European Quarterly Metrics data module for further analysis on the latest trends in the European telecoms market.

Analysys Mason provides historical and forecast data for over 80 countries worldwide. We are experts in the key trends and revenue drivers across these markets. Please contact Stephen Day or Tom Rebbeck for a discussion of the issues raised in this article.

1 These tariffs are for services on DIGI’s own network.

2 Data on the FMC market is available as part of Analysys Mason’s Fixed–Mobile Convergence programme.

Article (PDF)

DownloadAuthor

Stephen Day

AnalystRelated items

Podcast

Analysys Mason’s research topics for 2026

Tracker

European quarterly metrics: Western Europe 3Q 2025

Tracker

European quarterly metrics: Central and Eastern Europe 3Q 2025