Operators have the potential to offer more innovation in their FMC bundles

The penetration of fixed–mobile convergence (FMC) is growing in most countries around the world, and the number of converged operators continues to increase due to mergers and acquisitions and improving wholesale broadband access options. Operators can maximise the effectiveness of their FMC propositions by innovating in order to differentiate from their competitors. Examples of such innovation include using service advantages to maximise value, addressing the digital-native segment with dual-play offers and cross-selling value-added services to a converged base. In this article, we examine how operators in six countries in Europe and Asia–Pacific have offered innovation in their propositions and evaluate their successes.

Operators must differentiate their FMC propositions to maximise their fixed and mobile market shares

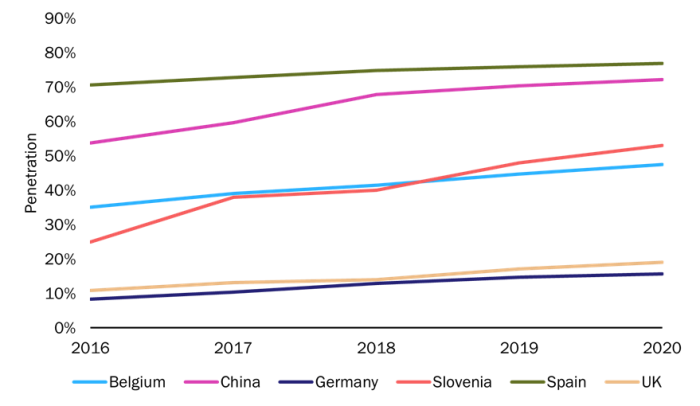

FMC retail bundle penetration continues to grow in almost every telecoms market in Europe and Asia–Pacific, though market maturity varies (see Figure 1). The pressure exerted by FMC offers on standalone operators is driving a number of mergers and acquisitions. The result is that all major operators in many countries are able to offer benefits to customers that take both fixed and mobile services. Operators in these FMC-centric markets must offer innovation in their FMC bundles to avoid competing purely on price. For example, they may target a new customer segment or maximise the value within their current user base.

Figure 1: FMC penetration of broadband connections, selected countries in emerging Asia–Pacific and Europe, 2016–2020

Source: Analysys Mason, 2021

Operators are generally using one of three strategies to differentiate their FMC propositions

We have identified the following three main strategies that operators can consider when differentiating their propositions and building value using FMC.

- Using service advantages to maximise value in FMC offers. These advantages include extensive coverage of superior fixed broadband speeds and exclusive pay-TV content. Operators can incorporate these service advantages into their FMC bundles by:

- reserving exclusive features (such as exclusive pay-TV content) for hard bundles1

- increasing the comparative discounts for premium bundles.

- Offering dual-play offers to target users that are interested solely in connectivity. Our Connected Consumer Survey shows that 18–35 year olds spend around 40% less time watching traditional live pay TV than over-35s. Bundling multiple services (such as fixed voice and pay TV) may increase the perceived value of a bundle, but established operators run the risk of losing market share to challengers if they do not cater to each demographic group’s specific demands. For example, operators should consider offering FMC bundles without traditional pay TV to appeal to younger consumers. The value of such offers could be increased by adding large mobile data allowances (or zero-rated applications), broadband speed guarantees and discounts on emerging value-added services such as cloud gaming.

- Using their converged base to support a move into value-added services. Operators are increasingly turning to non-core services such as those linked to the smart home and financial services. Not only would increasing access to these services provide direct revenue growth, but this also offers a churn reduction benefit.

Most of the operators profiled in our report have had success by employing unique FMC strategies

Figure 2 summarises the case studies in our report, Innovation in FMC bundles: case studies and analysis. We judge the relative success of each operator using various metrics, including how the mobile and fixed subscriber market shares, subscriber net additions and revenue have been affected by innovative FMC offers.

Figure 2: Assessment of selected operators’ innovative FMC offers, emerging Asia–Pacific and Europe, 2021

| Operator (location) | Notable features | Level of FMC penetration in the market | Success |

|---|---|---|---|

| China Mobile (China) |

|

●●●●● |

●●●●● China Mobile leads the FMC market in terms of penetration. It has used its large FMC base to effectively market pay TV and smart-home solutions. |

| Proximus (Belgium) |

|

●●●●○ |

●●●○○ Proximus’s new offers have diluted its ARPA, but its net additions have increased. |

| Telefónica (Spain) |

|

●●●●● |

●●●●○ Telefónica has used TV content to differentiate its offer and preserve its premium user base. Sub-brand O2 provides insulation at the lower-value end of the market. |

| Telekom Deutschland (Germany) |

|

●●○○○ |

●●○○○ The ambitious Magenta Eins Plus bundle has been overhauled less than a year after its launch. However, Telekom Deutschland has preserved its multi-SIM bundling incentive. |

| Telekom Slovenije (Slovenia) |

|

●●●●○ |

●●●○○ Telekom Slovenije has maintained its fixed and mobile revenue market shares despite significant competition and declining subscriber shares. It has grown its value-added service revenue by adding bundling incentives. |

| Virgin Media (UK) |

|

●●○○○ |

●●●○○ Virgin Media has halted the decline of its retail revenue, and was one of the only operators in the retail market to increase its fixed broadband+mobile retail revenue in 2020. Our survey results show that 16% of its subscribers take its premium Ultimate Oomph bundles. |

Source: Analysys Mason, 2021

For more information, see Analysys Mason’s Innovation in FMC bundles: case studies and analysis.

1 We define hard bundles as FMC bundles that cannot be customised in terms of mobile data allowances and fixed broadband speeds.

Article (PDF)

DownloadRelated items

Article

M&As such as the recent XL–smartfren merger are reshaping Indonesia’s telecoms market

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers