20% of fixed broadband accounts in the USA will be part of an FMC package by 2026

Fixed–mobile convergence (FMC) offers are available from almost every major operator in the USA, but FMC penetration remains low because very few operators have a large market share of both the fixed and mobile markets. We expect that the penetration of FMC in the USA will continue to grow over the next 5 years as predominantly fixed operators, especially cable operators, offer mobile services and as predominantly mobile operators offer fixed services.

Indeed, 20% of fixed broadband connections will be part of an FMC account by 2026, up from just 7% in 2021. Fixed–mobile consolidation remains a distinct possibility and would accelerate FMC penetration growth if it were to take place.

The data used in this article comes from Analysys Mason’s Fixed–mobile convergence in the USA: trends and forecasts 2021–2026.

FMC penetration has increased in the USA in recent years, despite the low level of fixed–mobile infrastructure ownership

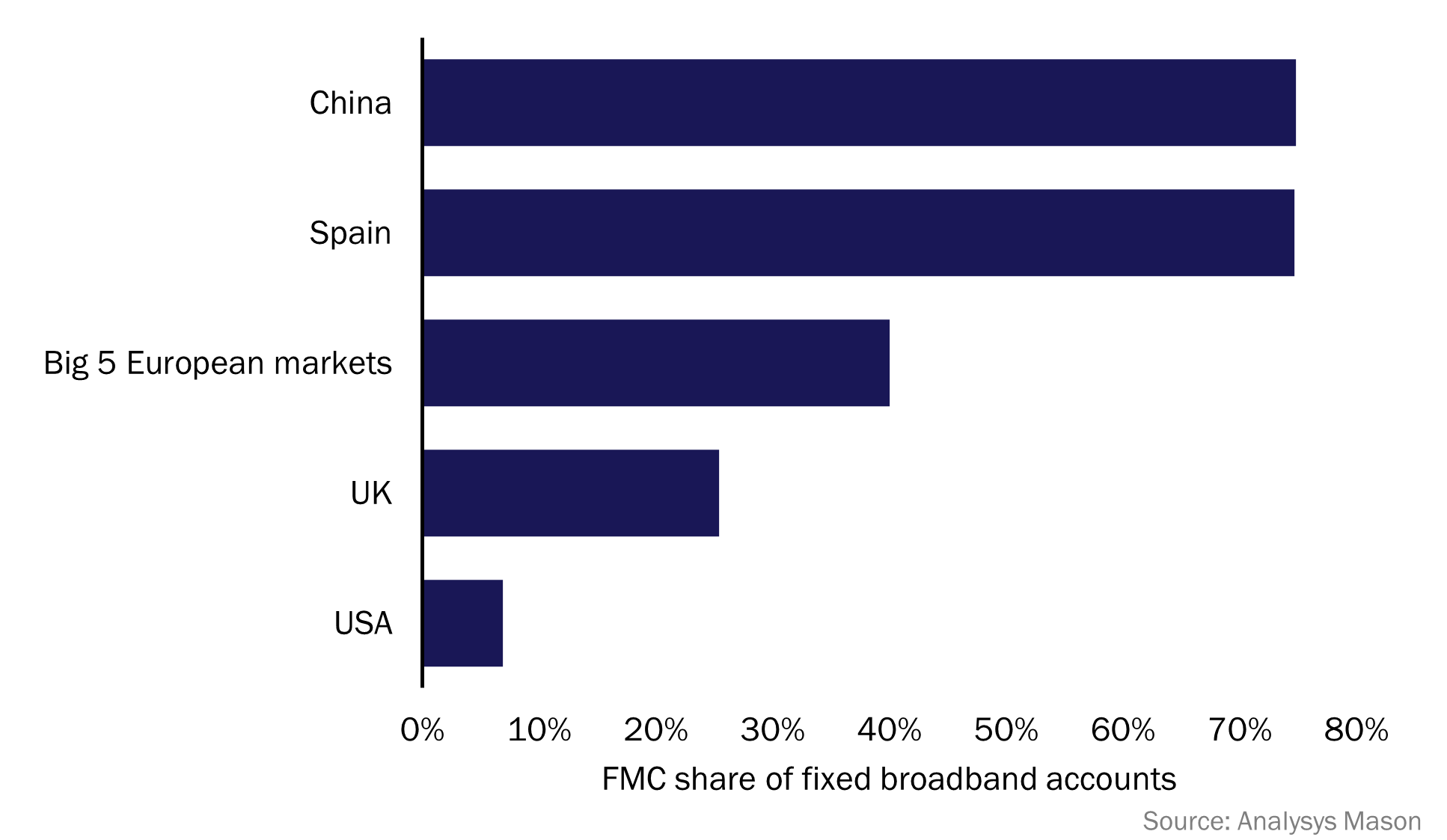

The FMC share of fixed broadband connections is very low in the USA compared to that in Europe (Figure 1). This is largely because of the limited competition in the US fixed market and the low level of fixed–mobile network overlap. Nonetheless, this share increased from a base of virtually nothing in 2017 to almost 7% in 1Q 2022.

Figure 1: Comparison between FMC share of fixed broadband accounts, USA and selected other countries, 2017–20211

This increase has mainly been driven by the following two factors.

- Fixed broadband competition. Cablecos need a way to insulate their bases and increase revenue. Pay-TV revenue is under pressure due to the rising popularity of streaming services, which threatens cablecos’ ability to bundle pay TV with fixed broadband services. Mobile offers a way to boost revenue from the existing base. Established cable providers can also use fixed–mobile bundling (largely via MVNOs) to manage churn and defend against other fixed players, including new fibre network providers.

- Mobile operators adding fixed services. The large MNOs want to pivot into the fixed broadband market and 5G fixed-wireless access (FWA) is a suitable replacement for cable broadband for some customers. Verizon and T-Mobile hope to organically increase their revenue by cross-selling FWA to their existing mobile bases. AT&T is cross-selling FTTP to its mobile users and offers discounts on FMC packages.

FMC offers in the USA are aggressive. The cablecos that offer MVNO connectivity (primarily Comcast and Charter) are undercutting the MNOs on price (unlimited tariffs are up to 50% cheaper than the tariffs offered by the MNOs), and their offers are only available to fixed broadband customers. However, similarly large discounts are available to MNO customers that take emerging fixed broadband services (for example, T-Mobile mobile subscribers can get a 5G FWA package from as little as USD30 per month instead of USD50). All of the operators that offer both fixed and mobile connectivity now provide FMC packages.

FMC will account for 20% of all broadband connections in the USA by 2026

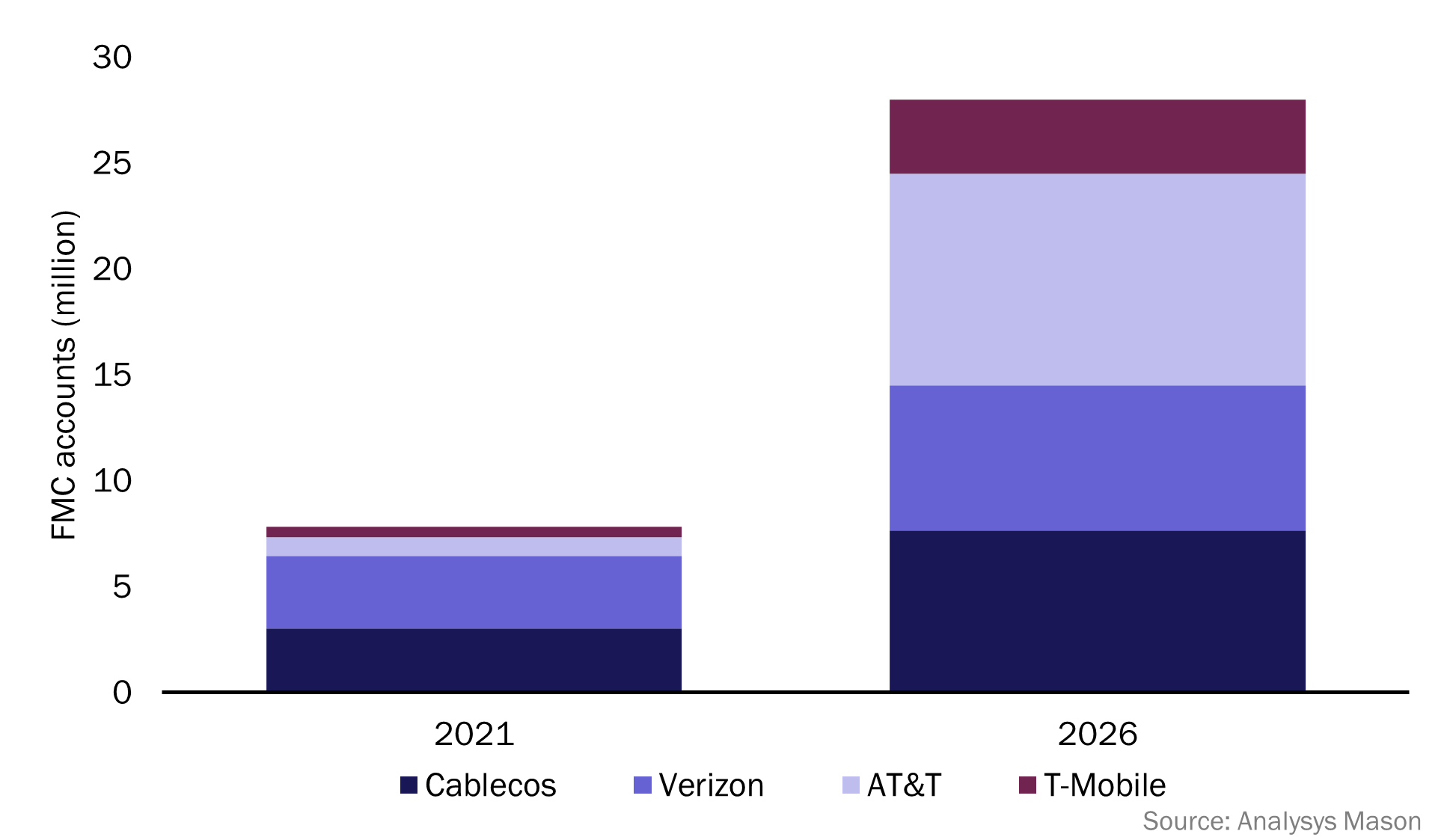

The take-up of FMC offers will continue to increase over the next 5 years, and the rate of growth will accelerate as services such as 5G FWA gain further traction and as the operator with the largest overlap of fixed and mobile customers (AT&T) consolidates its fixed and mobile bases using discounts and bonuses (Figure 2).

Figure 2: Number of FMC accounts by operator, USA, 2021 and 2026

The FMC plans from Verizon and T-Mobile will be key drivers of this growth. Both operators are aiming to build their presence in the fixed broadband market by offering competitive 5G FWA convergence offers. This means that most 5G FWA coverage in the USA will be part of a convergence account by 2026. We forecast that 5G FWA will account for approximately 5% of all fixed broadband connections in the USA by 2026; T-Mobile is targeting 7 million–8 million premises with its 5G FWA offer, up from 1 million today.

We expect that the cablecos will continue to increase their mobile market shares via MVNOs. Overall, these subscriptions are expected to account for 5% of all mobile subscribers in the USA by 2026.

However, the penetration of FMC accounts will still not reach that in many countries in Europe due to the low level of fixed–mobile coverage that most US operators have. In our forecasts, we have assumed there will be no infrastructure consolidation within the market over the next 5 years.

Operators must consider how convergence will affect their performance in the future

FMC bundles can reduce churn among both fixed broadband user bases and mobile user bases. Indeed, this has been a major factor in converged operators’ improving revenue performance in many European countries. However, overly aggressive discounting can destroy value in a market, and operators must ensure that their strategies are competitive without depleting revenue. This may involve implementing a bonus-focused strategy that provides broadband speed boosts or improved Wi-Fi connectivity for converged subscribers. The potential to use mobile services to differentiate is also decreasing because unlimited tariffs are now standard across the market.

The launch of FMC has led to an increase in M&A activity between predominantly fixed and predominantly mobile operators in many countries in Europe. However, the large size and complexity of telecoms operators in the USA may limit such activity. Nonetheless, US operators must assess the possibility of these deals and formulate a plan of action should a deal take place. Any consolidated operator would have an advantage over its peers in terms of its ability to provide FMC offers.

1 The “Big 5 European markets” are defined as France, Germany, Italy, Spain and the UK.

Article (PDF)

DownloadRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Forecast report

USA: fixed–mobile convergence forecast 2025–2030