Hughesnet versus Starlink: clash of the satellite internet giants in North America

In an increasingly connected world, a reliable satellite internet connection is becoming a necessity for those residing in remote or rural areas where traditional terrestrial broadband options are often limited. North America (NAM) has been at the forefront of satellite internet adoption, with Hughesnet and Viasat driving revenue growth in this sector for years. However, the satellite landscape is changing rapidly. Starlink services revenue has accelerated in the last 2 years, which positions it as one of the major consumer broadband market shareholders in the North American market. Furthermore, the recent failure of Viasat-3’s Americas satellite has forced the company to rethink its positioning in the consumer broadband market, at least in the near term. Does this mean that Hughesnet and Starlink will dominate the North American satellite internet market?

The competitive landscape in the satellite internet industry is transforming rapidly

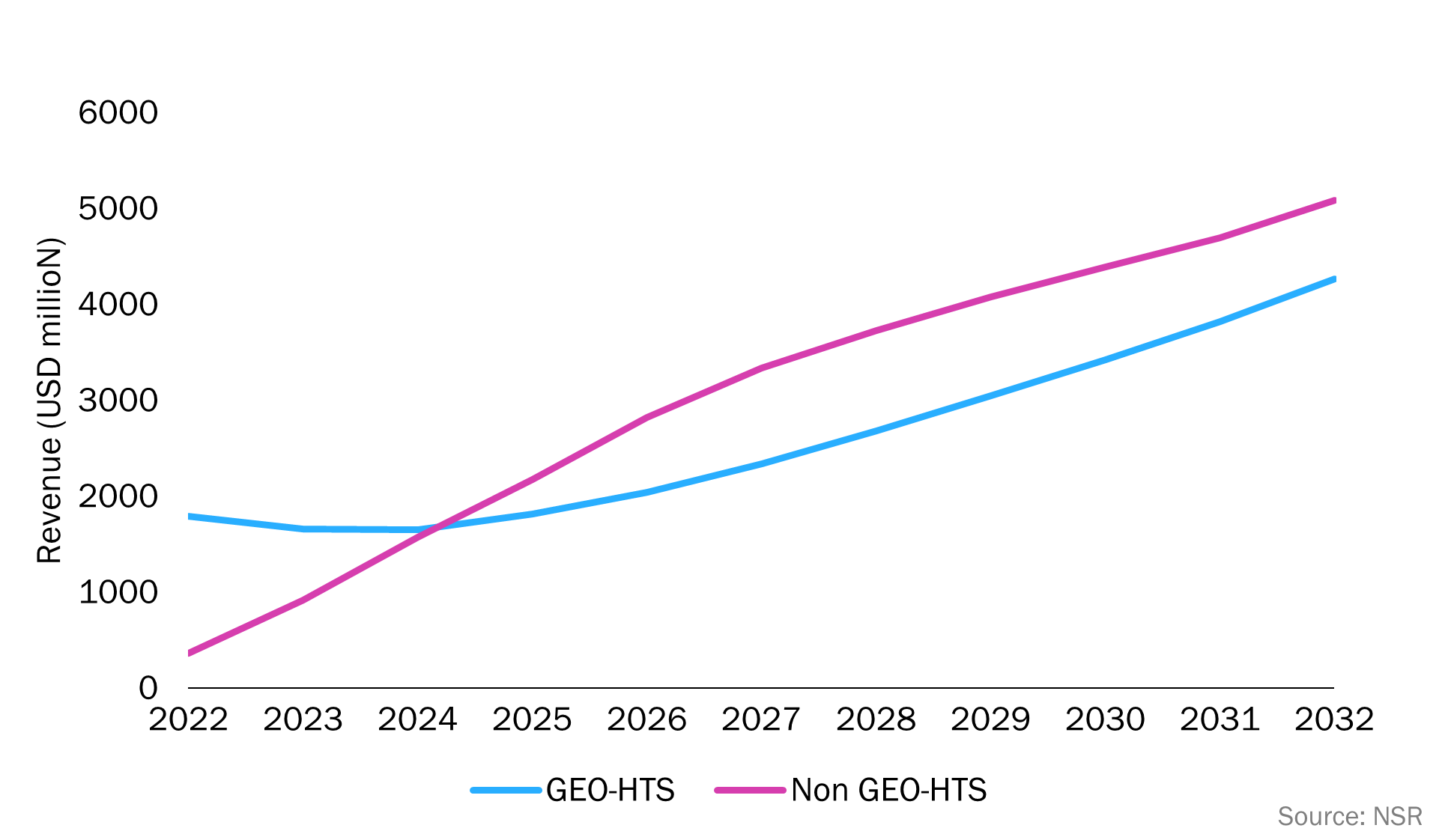

NSR’s report Consumer and enterprise broadband via satellite, 22nd edition critically analyses the changing market dynamics in the NAM region. It forecasts that the non-geostationary orbit (non-GEO) HTS will surpass GEO-HTS service revenue by 2025. This is being driven primarily by Starlink’s rapid market expansion and revenue growth and the changes that Viasat has made to its market positioning.

- By December 2023, Starlink had acquired more than 2 million subscribers, and NSR estimates that around 50% of these are in the NAM region.

- According to Viasat’s 2023 annual report, the company will purposefully and systematically derive lower revenue from the US residential broadband market so that it can increase its focus on the mobile services market.

Figure 1: Consumer broadband service revenue, North America, 2022–2032

Undoubtedly, traditional GEO-HTS satellite internet providers have been facing challenges with capacity constraints, which in turn have led to growing customer migration to Starlink. The recent setback involving the Viasat-3 satellite failure has only compounded these challenges. However, the launch of Hughes’s Jupiter-3 demonstrates the GEO player's strategic response to the relentless competition posed by Starlink. The non-GEO HTS market is projected to exceed USD5.0 billion in annual revenue by 2032, exhibiting an impressive CAGR of 30.2%.

Meanwhile, the GEO-HTS market is anticipated to remain relatively stagnant between 2023 and 2025, largely due to the continuous decline in Viasat's subscriber base. In addition, Hughes disclosed in its 2022 annual report, that its service revenue has declined by approximately USD100 million. A significant portion of this decline can be attributed to their NAM consumer broadband services. Nevertheless, this landscape is expected to undergo transformation as the capacity of Jupiter-3 is deployed to meet the increasing demands in various regions.

Players are competing on price and bandwidth speeds

NSR envisions a competitive clash in the NAM region between Hughes and Starlink in the near and medium term as Viasat repositions itself and Hughes deploys its Jupiter-3 services. Pricing and bandwidth will determine the pace of service penetration in the region. Starlink’s typical service pricing ranges from USD50 to USD120 worldwide (USD100-USD120 in NAM region) per month for a ~100 Mbit/s connection whereas typical GEO service pricing is ~USD50 or higher for a 15–25 Mbit/s connection and >USD150 for 50–100 Mbit/s connection. The pricing for Starlink equipment (USD500) is on the higher side but better bandwidth and service pricing is driving revenue growth. As indicated by trends seen in other regions, Starlink will use aggressive pricing as a customer acquisition strategy or to compete with existing players. In some regions it has lowered the starter kit pricing to around USD99–USD199. However, Hughes is preparing to counter the competition by offering new broadband plans. For example, it recently introduced Hughesnet Fusion service plans, which combine GEO services with the fixed–wireless service to offer low-latency satellite internet. The company has also announced internet plans for small businesses so that it can compete with Starlink’s premium plan. The plan will include Hughesnet Fusion and business-grade support, faster issue resolution and free installation. For improved probability of success, the company must utilise Jupiter-3 capabilities to offer competitive bandwidth and pricing.

The bottom line

The prevailing market dynamics are driving heightened competition between Hughes and Starlink, leading to enhanced satellite internet service offerings and an accelerated overall market growth trajectory. Who will win this clash, Hughes or Starlink? Both players have the potential to remain as the top two market leaders in the NAM consumer broadband market. Starlink is winning currently due to its growth momentum and Hughes’s subscriber churn. However, with the roll-out of Jupiter-3 services, a certain and stronger fightback can be expected from Hughes in the coming years.

Ultimately, consumers in North America will be the clear winners as better cost structures and higher bandwidth provisioning will be part of the benefits borne out of these evolving competitive dynamics.

Article (PDF)

DownloadAuthor