OneWeb and Starlink are adopting different strategies to enter the in-flight connectivity market

OneWeb and Starlink are currently the only two low-Earth orbit (LEO) satellite providers in the satellite communications (satcom) industry. These players are now branching out into the in-flight connectivity (IFC) market and will use innovative technologies such as phased array antennas and beamforming systems to gain a competitive edge. However, there are many barriers to success, such as regulatory hurdles and technical complexities, and the IFC landscape is characterised by high switching costs and complex, sophisticated ecosystems.

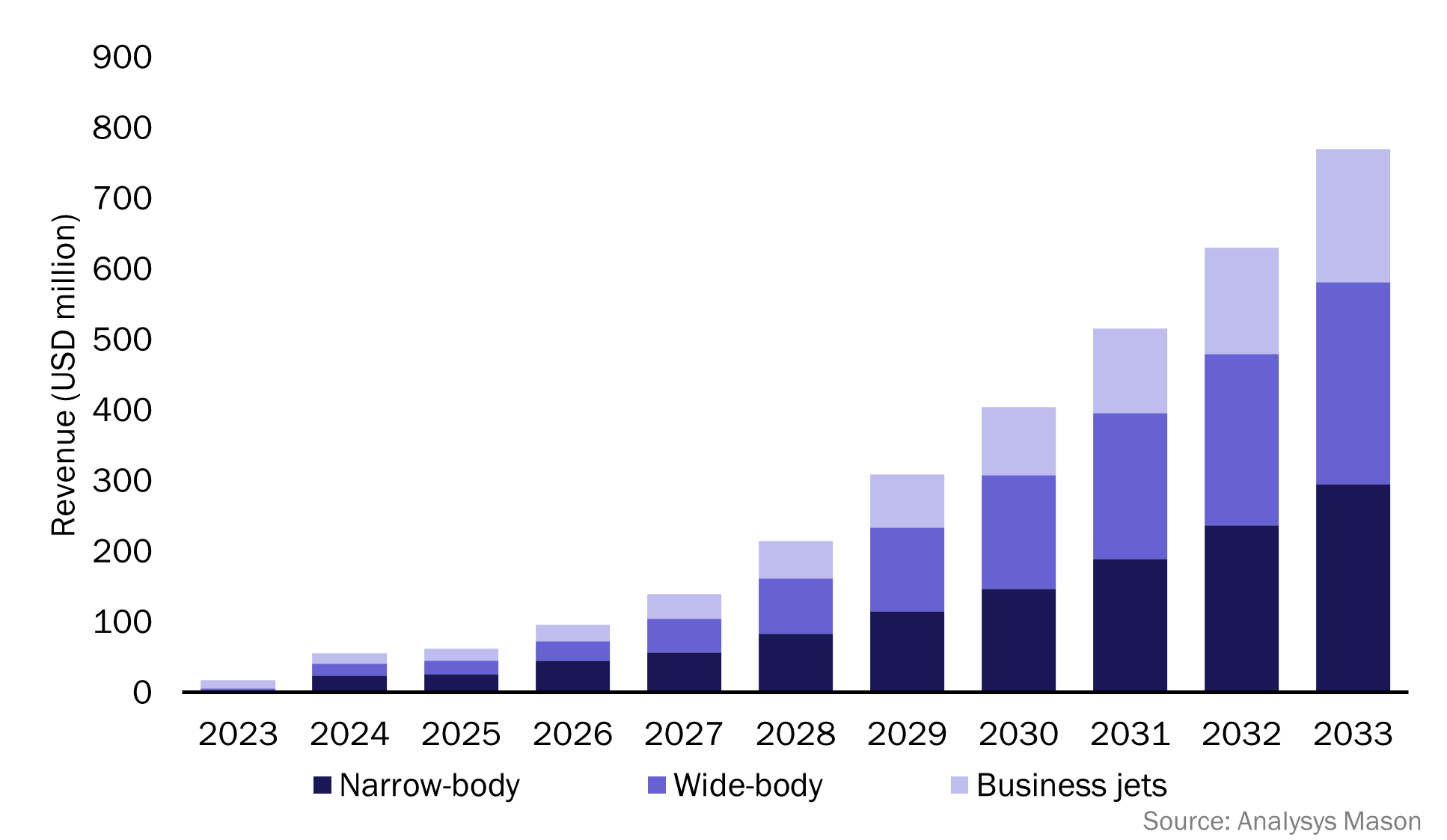

Analysys Mason’s Aeronautical satcom markets, 12th edition report shows that the total cumulative retail revenue between 2023 and 2033 for non-geostationary orbit (non-GEO) high-throughput satellite (HTS) players will exceed USD3 billion (Figure 1). OneWeb and Starlink are expected to be major players in this space in the coming years, but challenges remain.

Figure 1: Non-GEO HTS aeronautical retail revenue, by airframe, worldwide

OneWeb and Starlink players are adopting two different strategies to enter the IFC market. Starlink plans to work directly with airlines, while OneWeb has chosen to use a wholesale business model and has established a strategic alliance with legacy satellite service providers such as Intelsat and Panasonic. In this article, we will assess these strategies to see which business model will be the most successful.

Non-GEO HTS players will have a slow start in the IFC market

Starlink dominates headlines, but some airlines have been hesitant to work with the provider due to its use of unproven non-GEO technology for IFC. Indeed, non-GEO technology for IFC is relatively new, and its reliability and performance in real-world scenarios has not been fully established. Airlines prioritise passenger experience and therefore cannot afford disruptions in connectivity, which makes them hesitant to adopt unproven technology.

Integrating non-GEO HTS systems into existing fleets will incur significant retrofitting costs, which is another reason why Starlink has struggled to win IFC customers from other providers. Installing new antennas, modifying aircraft infrastructure and ensuring compatibility with existing systems requires high upfront costs, which can be a deterrent for airlines, particularly when GEO systems already provide adequate coverage and reliability.

The lengthy process of obtaining confirmation of airworthiness for non-GEO HTS terminals is also a significant barrier to their widespread adoption in the IFC space. Service providers must navigate complex regulatory frameworks and rigorous testing procedures to ensure the safety and compliance of these new technologies. The slow pace of approvals creates a bottleneck, thereby hindering the seamless integration of non-GEO capacity into IFC systems.

OneWeb has a simple but effective strategy

OneWeb’s IFC service will not be available until September 2024, but the potential for LEO and GEO providers to work together to provide IFC remains strong. Indeed, there are two implications of OneWeb’s strategy beyond expanding the availability of LEO connectivity for existing airlines.

- IFC service providers can harness multi-orbit capabilities to improve the passenger experience and expand their range of service offerings.

- Airlines can have a single point of contact; either Intelsat or Panasonic can manage their IFC needs across both LEO and GEO networks, which potentially simplifies service management.

OneWeb’s emphasis on seamless integration with existing IFC systems and strategic partnerships with current industry players will give it a head start over Starlink. Starlink’s extensive satellite network and innovative culture could give the provider a strong position in the IFC market in the long term, but its approach to integrating offerings with existing IFC systems has not been clear, which will limit adoption.

OneWeb’s integration strategy for IFC is likely to be more successful than Starlink’s

OneWeb is approaching the IFC opportunity strategically by partnering with established service integrators early on to build trust and potentially mitigate some of the technological hurdles. For example, OneWeb will be able to use the extensive experience in communications and ground infrastructure of partners such as Hughes, Intelsat and Panasonic and will not need to develop new capabilities in areas such as maintenance. OneWeb will also be well-placed to integrate its LEO network with existing avionics systems to ensure compatibility and reliability for airlines. This will ease the transition for airlines because new terminals will get installed as upgrades and renewals of existing services. This approach will give OneWeb a smooth entry into the lucrative IFC market.

Conversely, Starlink has encountered significant challenges in penetrating the IFC market, despite its rapid expansion into various satcom markets. These challenges include strong competition due to the presence of established players, such as Intelsat and Viasat, and competitors, such as OneWeb.

Starlink’s rapid deployment and competitive strategy focuses on raw capacity, but Starlink will struggle to recreate its success from verticals such as consumer broadband and maritime connectivity in the IFC market. OneWeb’s strategic edge lies in its ability to use the existing capabilities, sales channels and operations of established service integrators in an otherwise very complex market.

Article (PDF)

DownloadAuthor

Shagun Sachdeva

Senior Analyst, expert in space mobilityRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Tracker

ESG standards and goals: space organisations 2025

Forecast report

Aeronautical satellite communications: trends and forecasts 2024–2034