Infrastructure sharing could help operators in Egypt to improve network performance

29 April 2021 | Research

Article | PDF (3 pages) | Mobile Services| Middle East and Africa Metrics and Forecasts

Mobile operators in Egypt received relatively low scores for customer satisfaction metrics compared to those in other countries in Africa according to our Connected Consumer Survey 2020. Price continues to play an important role when customers are choosing their plans and in how willing they are to recommend an operator. Our results also showed that network coverage and data speeds are becoming increasingly important differentiating factors.

The results of our survey suggest that operators in Egypt should improve network performance to increase customer satisfaction. This will require investment, but operators could use network sharing and tower leasing to keep costs at manageable levels.

Compared to operators in other countries in Africa, operators in Egypt have poor NPSs and customers are more likely to want to churn

We conducted a survey of smartphone users in Egypt, Kenya, Nigeria and South Africa between August and September 2020. Each country had 1000 participants, and we asked questions about their mobile-internet-related behaviour, preferences and plans.

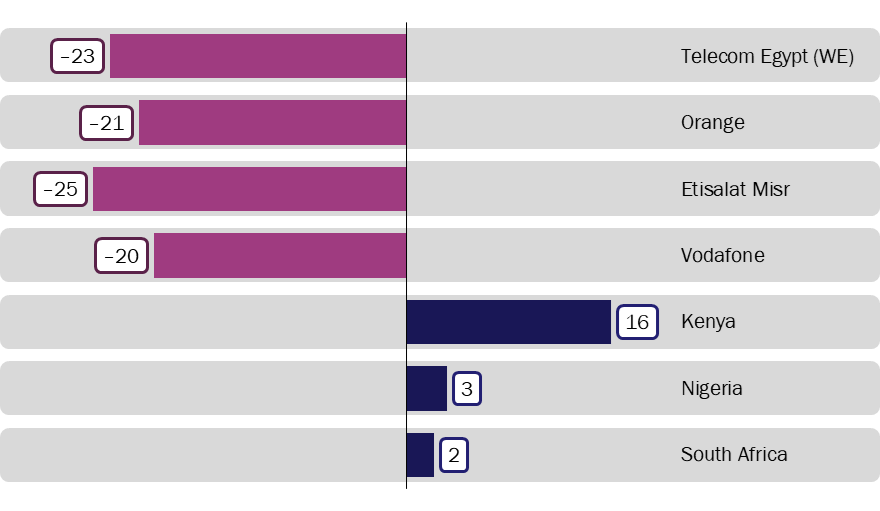

We asked participants to rate how likely they were to recommend their mobile operator on a scale of 0 (not at all likely) to 10 (definitely); this data was then aggregated to derive the Net Promoter Score (NPS).1 The results show that operators in Egypt have the lowest NPSs in the region (Figure 1). Their scores were also very close to each other, suggesting that none of the operators stands out.

Figure 1: Net Promoter Scores by operator, Egypt, and averages for Kenya, Nigeria and South Africa, 2020

Source: Analysys Mason

Network performance is an important factor in whether customers in Egypt will recommend an operator and how likely they are to want to churn

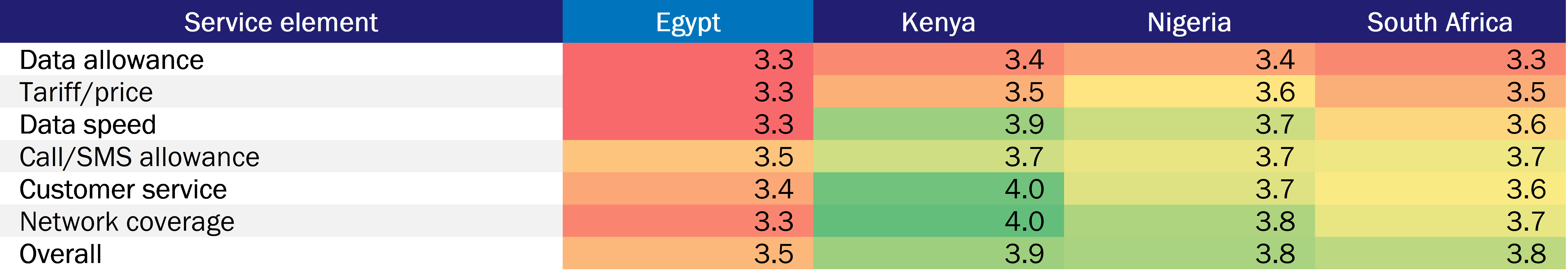

Smartphone users in Egypt are less satisfied with their mobile services than their peers in Africa, especially with network-related aspects. Participants were asked to rate how satisfied they were with various aspects of their mobile services on a scale of 1 to 5 (see Figure 2).

Figure 2: Average customer satisfaction scores for elements of a mobile service, by country, 2020

We carried out a regression analysis to assess the effect of one-point improvement in an individual’s satisfaction rating (for example, from 2 to 3 for data speed) on willingness to recommend (and, therefore, NPS) for each service element. The results revealed that price and network coverage have the strongest influence on customers’ willingness to recommend an operator in Egypt. Price is an important lever for most operators to drive satisfaction, but Egyptian MNOs have little room to decrease their tariffs given that they already offer some of the lowest in Africa.2 It will be possible for most operators to improve network coverage, but they should do it without increasing prices.

Data speeds and network coverage are also important factors that influence customers’ decision to keep or change their operator. Respondents in Egypt have expressed the highest intention-to-churn rate (16.5% compared to an average of 8.6% across Sub-Saharan African countries). Data speeds and network coverage were among the top three reasons for considering changing operator, and the two most frequently cited factors that influence respondents when choosing their next plan. These results confirm the importance of network performance in the selection of a mobile plan and provider.

Operators should improve network coverage and data speeds as a priority to improve customer satisfaction metrics

Nearly 80% of survey respondents in Egypt reported using 4G services. We estimate that Etisalat, Orange and Vodafone’s 4G network coverage exceeded 85% of the population by the end of 2020, while Egypt Telecom (WE) has deployed its 4G network in major urban centres. However, when Opensignal, the mobile analytics company, measured network coverage in various locations that matter most to everyday users on a scale of 0–10, it was as low as 4.2 for Telecom Egypt (WE) and 6.4 for Orange; Etisalat and Vodafone had better scores: 7.7 and 8.7, respectively.3 Opensignal’s findings supports our survey’s conclusion that end users are not getting good 4G experience in Egypt.

Operators might decide to increase the proportion of towers that they share with other operators or lease from towercos. This will enable them to reduce costs and expand the coverage of their 4G networks more rapidly than if they relied on their own towers only. The regulator NITRA is expected in 2021 to issue new towerco licences that include a roll-out obligation of up to 6000 new sites over the next 3 years. In addition, Vodafone acquired a 40MHz block of spectrum in the 2600MHz frequency band in 2H 2020, and Telecom Egypt and Etisalat Misr each received a 20MHz block. This should help to improve 4G network capacity in the short term. Orange is the only operator that did not secure additional 4G spectrum.

If operators can cost-effectively improve network performance, then they could boost customers’ willingness to recommend them and reduce the rate at which customers churn. Operators need to select a sharing model and partners (with operators and non-operators) that help them to achieve their strategic goals (that is, improve data speeds and network coverage). They also need to ensure that they maintain a degree of control over the shared infrastructure to offer some differentiation (which they currently lack, according to our survey) in terms of services and network performance.

1 The Net Promoter Score (NPS) is calculated by subtracting the percentage of subscribers that rated the operator 6 or below from the percentage that rated it 9 or 10.

2 For more information, see The Most Expensive Data Prices in Africa.

3 The coverage experience metric reflects the proportion of locations where customers of a network operator received a 4G signal relative to the locations visited by users of all network operators. The higher the value, the more locations an operator can provide 4G services to its subscribers. Opensignal automatically collects these measurements using software installed in its app or that of its partners.

Article (PDF)

DownloadRelated items

Tracker

5G coverage tracker 1H 2025

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers