Operators in emerging markets must prioritise Wi-Fi as a key part of their broadband tiering strategies

In-home connectivity (that is, connectivity in which everything happens on the ‘end user’ side of the optical network terminal (ONT) or modem) has become a critical enabler of digital experience. Today’s households rely on a growing ecosystem of connected devices, such as smart TV sets, games consoles and smart-home IoT sensors, whose bandwidth and reliability requirements continue to rise.

Yet operators in many low- and middle-income markets primarily provide only the ONT or a basic modem as a standard part of their broadband service. This leaves Wi-Fi equipment and in-home networking to the consumer. As a result, many households depend on outdated, cheap Wi-Fi hardware or unmanaged third-party Wi-Fi extenders. This limits operators’ ability to keep up with changes to the home device and application ecosystem. Additionally, operators still get the blame when the user experience falters, even if they have not sold the in-home networking equipment.

A Wi-Fi network that might just about ‘keep up’ with existing usage could fail as households add a second TV set in the bedroom, make video calls in the study or add an IoT device to the front door. This would have a negative effect on customer experience and loyalty. Reclaiming control of in-home connectivity by making high-quality, operator-supplied Wi-Fi equipment a standard part of the broadband proposition, could help operators to deliver a superior service and retain customers while also unlocking new revenue streams.

Operators should reclaim ownership of in-home networking equipment from third parties

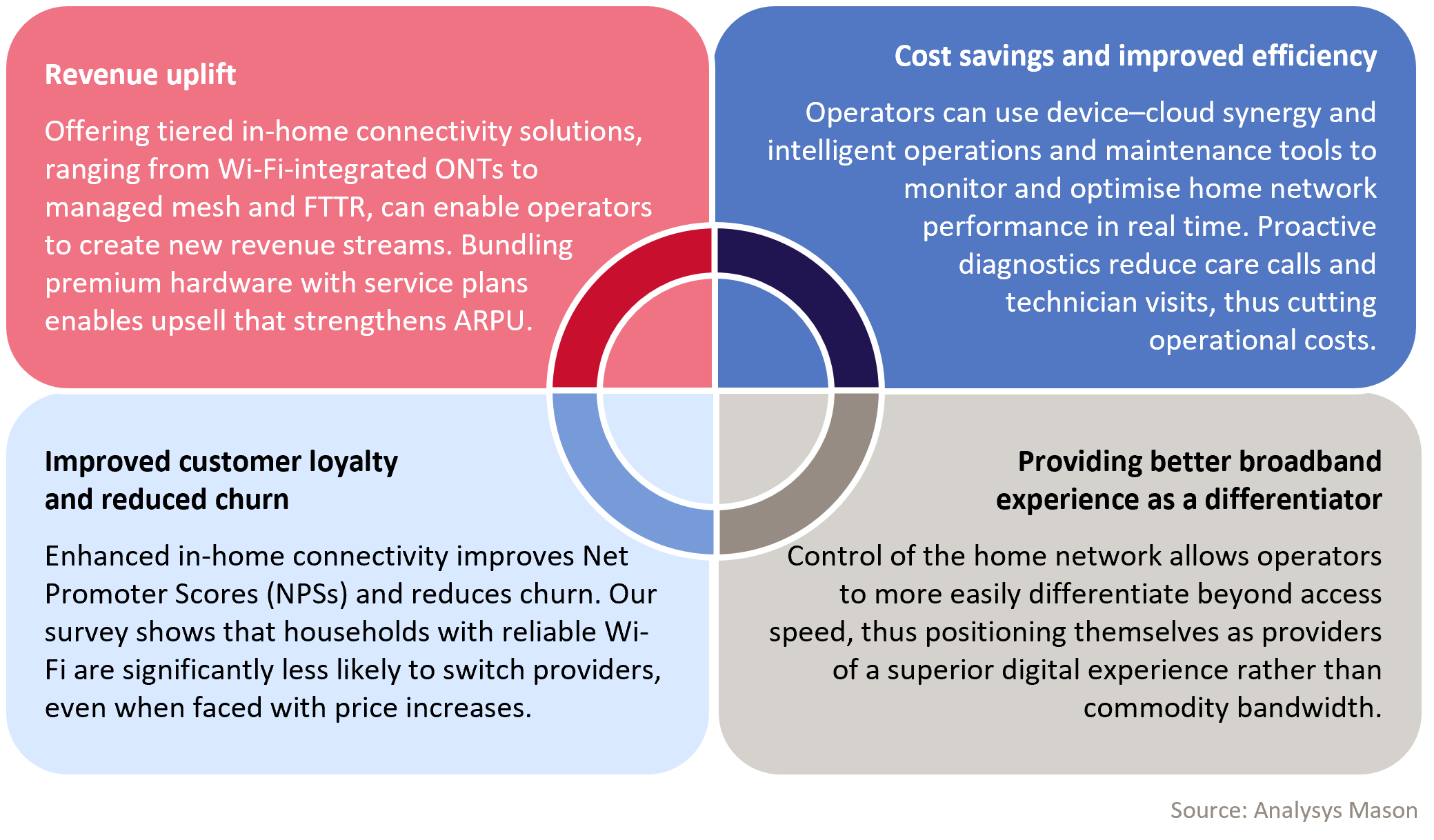

Taking ownership of the in-home network unlocks multiple strategic advantages for operators, as outlined in Figure 1.

Figure 1: The strategic advantages of operators taking ownership of the in-home network

Consumers want better Wi-Fi

The results of Analysys Mason’s latest consumer survey of 19 500 adults show that only 28% of respondents are ‘very satisfied’ with their in-home Wi-Fi. However, almost two thirds of respondents also said that they would be prepared to pay more for better-performing Wi-Fi. This suggests that there is an opportunity to monetise customers while also improving their experience.

The modern household is a bandwidth-hungry environment. Most home Wi-Fi set-ups are already under strain from supporting a mix of TV sets, laptops, tablets and games consoles. New generations of these devices, and higher resolution media, will push this demand further. The average home now hosts 15–20 connected devices, and this number will rise as smart-home adoption grows.

Gamers are a good bellwether for the importance of in-home connectivity. Some ‘serious’ gamers will rely on wired Ethernet connections to ensure maximal reliability, but the majority of gaming, in terms of both the number of users and minutes of play, takes place over Wi-Fi. This is because a lot of gaming occurs on mobile handsets or portable consoles.

Gamers know that their Wi-Fi is not always adequate for their needs. A regression analysis of our consumer survey results shows that improving Wi-Fi coverage in the home improves gamers’ overall satisfaction with the broadband experience more than improving jitter, ping or speeds.

Optimising Wi-Fi for gamers is particularly important because heavier gamers spend almost 25% more per month on broadband services than non-gamers, on average. Gamers’ sensitivity to network performance is also likely to be mirrored by non-gamers.

Introducing a three-tier model can help operators transition from an ONT‑only approach to one of integrated in‑home connectivity

Many operators have historically used a three-tier approach (‘good’, ‘better’, ‘best’) for speed-tiering their services. However, we have seen that this approach starts to break down in some developed markets. For example, consumers in Italy now tend to be presented with only one speed option (the maximum fibre speed available in their area) due to the strong open access fibre market in the country.

Yet, consumers desire choice. Tiering models work, but access speeds are no longer as useful for differentiating as they once were. In-home network connectivity is a particularly effective way for operators that still default to just a basic ONT or modem to evolve their proposition. It could be deployed in three tiers as outlined in Figure 2.

Figure 2: A three-tier approach to in-home networking solutions for operators in emerging markets that are transitioning from a basic ONT-only proposition

| Tier | Solution | Target segment(s) | Value proposition |

|---|---|---|---|

| Good (e.g. 100Mbit/s) |

Enhanced ONT, either with integrated Wi-Fi or with a Wi-Fi access point (AP) as a second box |

Small households with basic connectivity needs |

Affordable upgrade for improved coverage and stability |

| Better (e.g. 200–500Mbit/s) |

Managed mesh Wi-Fi system (enhanced ONT, either with integrated Wi-Fi or with a Wi-Fi AP as a second box + mesh nodes) |

Families with multiple devices and rooms |

Whole-home coverage with proactive management and app-based controls |

| Best (e.g. >500Mbit/s) |

Fibre to the room (FTTR) |

Premium users such as gamers, remote workers and smart-home enthusiasts that demand ultra-reliable gigabit connectivity |

Full-fibre coverage, seamless roaming and ultra-low latency for next-generation applications |

Source: Analysys Mason

Tiering in-home networking in this way would help operators to enhance their broadband tiers. The benefits of such an approach, particularly in regions where ONT-only deployments are common, such as Africa, emerging Asia–Pacific and parts of Latin America, are numerous. By taking end-to-end control of the home network, operators in these regions can:

- unlock new revenue streams via tiered offerings

- provide better broadband experience as a differentiator

- improve customer satisfaction and loyalty

- reduce operational costs via proactive management.

Operators that continue to ship ONT‑only or basic gateways should act now to make Wi-Fi a standard component of their broadband plans. Those that fail to address this opportunity miss out on the above benefits and, in doing so, risk losing relevance and revenue compared to retail competitors that do sell such solutions.

Disclaimer: This article was commissioned by Huawei. Analysys Mason does not endorse any vendor’s products or services.

Article (PDF)

DownloadAuthor