Intuit’s purchase of Mailchimp will significantly expand its addressable market

Intuit announced its acquisition of Mailchimp, a customer engagement, marketing and e-commerce platform vendor, on 13 September 2021 in a deal worth USD12 billion. This is Intuit’s largest acquisition to date. It is indicative of Intuit’s major shift from only supporting back-office functions (such as accounting) to helping customers to generate new revenue. The integration of Intuit’s solutions with Mailchimp’s capabilities will create a broad range of end-to-end business solutions that will be of great use to small and medium-sized businesses (SMBs). However, the resulting Intuit–Mailchimp entity will face number of challenges.

The shared mission to empower SMB customers was a key driver of the acquisition

The acquisition price represents a valuation of roughly 40 times Mailchimp’s EBITDA in 2020 (reported to be around USD300 million) and around 15 times its revenue (USD800 million in 2020). It is useful to compare this with the valuation of Mailchimp’s competitor (at least for some products), HubSpot. It has a market capitalisation of over USD30 billion as of 2Q 2021, but it is both larger (its 2021 revenue is expected to be around USD1.27 billion) and faster-growing (its revenue grew by 46% year-on-year in 2Q 2021, compared to 20% for Mailchimp). It also has a broader set of products. Mailchimp would need to considerably expand its offering if it wanted to emulate HubSpot, which would probably require a number of acquisitions. The sale to Intuit was therefore a faster, less risky exit. The USD12 billion price is also similar to HubSpot’s market capitalisation in October 2020.

Ben Chestnut, the co-founder and CEO of Mailchimp, believes that Intuit is a good fit for Mailchimp. He said in the investor call on 13 September 2021, “I’ve long admired Intuit. We both share a passion for our customers, and a like-minded obsession with helping business owners solve their most pressing challenges.”

Intuit needs Mailchimp’s capabilities to achieve its goal of being an “end-to-end customer growth platform” for SMBs

Intuit has been maintaining a leading position in the back-office management systems for SMBs market for nearly four decades, but its lack of products and services to help customers to drive revenue growth was preventing it from achieving its business goal of being “the center of small business growth.”1

Mailchimp will provide Intuit with the capabilities that it has been lacking. These include e-commerce capabilities (such as website development, online transactions, social commerce and appointment scheduling), marketing automation (such as multi-channel campaign promotions, personalisation and ad optimisation) and AI-driven customer relationship management for predictive insights and customer engagements.

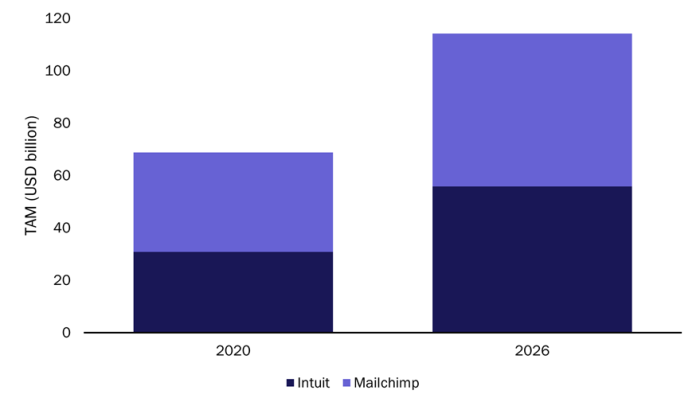

Analysys Mason’s SMB Technology Forecaster estimates that these areas will collectively add USD38 billion to Intuit’s USD31 billion total addressable market (TAM) for home-based businesses and SMBs (with 1–999 employees) in 2021 (Figure 1). This combined TAM is expected to grow to USD114 billion by 2026, at a CAGR of 11%.

Figure 1: TAM for Intuit and Mailchimp among home-based businesses and SMBs, worldwide, 2021 and 20262

Source: Analysys Mason, 2021

Mailchimp’s strong market position also influenced Intuit’s decision. Both Intuit and Mailchimp have a dominant share of their respective areas of the SMB market. The acquisition enables the combined entity to cross-sell solutions to both QuickBooks users and 13 million Mailchimp users. Most commerce solutions offer easy integration with QuickBooks, but this still requires a third-party service provider, which entails additional cost and time. The pre-integration of Mailchimp’s online store solutions into QuickBooks will therefore appeal to SMBs.

More importantly, Intuit will be able to create a competitive edge by offering more-advanced technology to SMBs. Nearly one in five SMBs are interested in AI, but these solutions are hard for them to adopt. Intuit’s existing AI-driven expert platform is centred around reducing errors in financial transactions, but the AI-driven insights and predictions based on Mailchimp’s 70 billion contacts and 2 billion data points combined with QuickBooks’s back-end financial and purchase data will help SMBs to boost their businesses.

The combined entity will face challenges when competing with existing players

The Intuit–Mailchimp entity will be a strong threat for existing players in the e-commerce space. For example, the Adobe Magento and Marketo package offer more features, customisability and scalability than Mailchimp, but Mailchimp has lower prices and so is more attractive to smaller firms. The integration with Intuit’s popular financial and back-office solutions will add value to Mailchimp, and will potentially erode Adobe’s competitive edge.

The integration of Mailchimp’s e-commerce and marketing platform with Intuit’s PoS and payroll, time tracking and employee benefit management features will result in a platform that is comparable with Shopify, Square and other major PoS vendors’ solutions. Intuit’s pricing will need to remain competitive and Mailchimp should look to add the delivery and shipping capabilities that it currently lacks.

International expansion will be the major challenge for Intuit. Intuit generates 95% of its revenue within the USA,3 and Mailchimp’s e-commerce and marketing platform is currently only available in the UK and the USA. Major competitors’ solutions are available worldwide and offer greater scalability.

Intuit is relying on Mailchimp’s international customer base, which accounts for “over a half of its revenue”, to implement its strategy to “[a]ccelerate growth globally for QuickBooks and Mailchimp with a global go-to-market approach.” Intuit–Mailchimp will need to develop a robust strategy for global expansion, and must pay particular attention to emerging Asia–Pacific, which accounts for 44% of all small businesses and self-employed staff worldwide.

Intuit’s acquisition of Mailchimp will create a strong contender to e-commerce and digital marketing platform players, especially in the historically underserved less-than-50-employees segment. Intuit announced that Mailchimp will keep its brand, but Intuit must integrate its products seamlessly and offer competitive package prices and localisations to achieve its goal of being the global platform for SMB revenue growth.

1 Intuit (13 September 2021), Acquisition of Mailchimp Conference Call Remarks. Available at: https://s23.q4cdn.com/935127502/files/doc_downloads/2021/09/Investor-Call-Script-9.13.21-PM.pdf.

2 The TAM for Intuit includes spending on accounting/financials, payroll, quotes and invoicing and POS. The TAM for Mailchimp includes cloud CRM, marketing automation and website development.

3 According to Intuit’s annual report 2020.

Article (PDF)

Download