IoT revenue growth slowed down in 2020, despite a healthy increase in the number of connections

Analysys Mason’s IoT/M2M revenue and connections tracker shows that the number of IoT connections worldwide continued to grow at a healthy rate in 2020, but that IoT revenue grew much slower than in 2019. Indeed, several operators maintained growth in the number of connections of 20% or higher, but all operators who disclosed IoT revenue in 2020 reported a slower growth rate than in 2019. High levels of competition in the connectivity market and the effects of the COVID-19 pandemic have put pressure on connectivity pricing and IoT revenue.

The COVID-19 pandemic resulted in a smaller-than-expected decline in the growth of the number of IoT connections worldwide

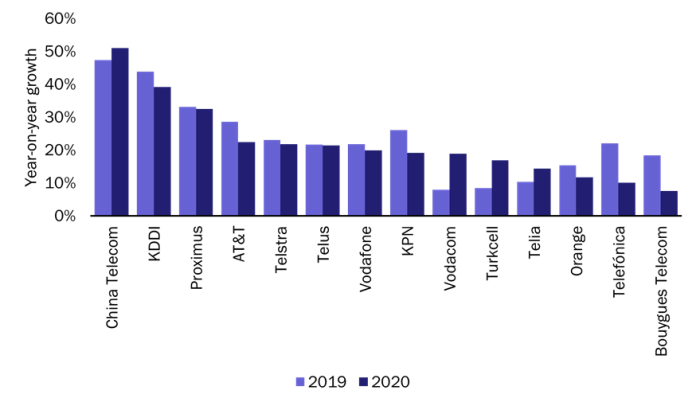

Figure 1 shows that the year-on-year growth rates for the number of IoT connections were lower in 2020 than in 2019 for 10 of the 14 operators to report numbers. This was mostly due to the negative effect of the COVID-19 pandemic in the first half of 2020, though half of the operators ended the year with at least 20% growth in the number of connections, which shows that the market recovered as strict lockdown measures were lifted.

Figure 1: Year-on-year growth in the number of IoT connections, worldwide, 2019–2020

Source: Analysys Mason, 2021

The following operators stand out in terms of the growth in their number of IoT connections.

- China Telecom increased the number of its IoT connections by over 50% in 2020, which is a slight improvement to the growth seen in 2019 (47%). This may reflect the earlier outbreak and more limited impact of the COVID-19 pandemic in China. China Telecom reported that the utilities and industrial sectors were important in driving its IoT performance in 2020.

- Vodacom, Turkcell and Telia all achieved higher growth rates in 2020 than in 2019, though all three operators had below-average growth in 2019.

- Telefónica added 4.3 million new IoT connections worldwide in 2019 (22% growth year-on-year), but only 2.4 million new connections in 2020 (10% growth year-on-year). Telefónica’s performance varied significantly by opco: growth was considerably higher in the UK (27%) and Germany (18%) than in Brazil (3%) and Spain (3%).

IoT revenue growth slowed down in 2020, and IoT still accounts for only a fraction of operators’ total telecoms revenue

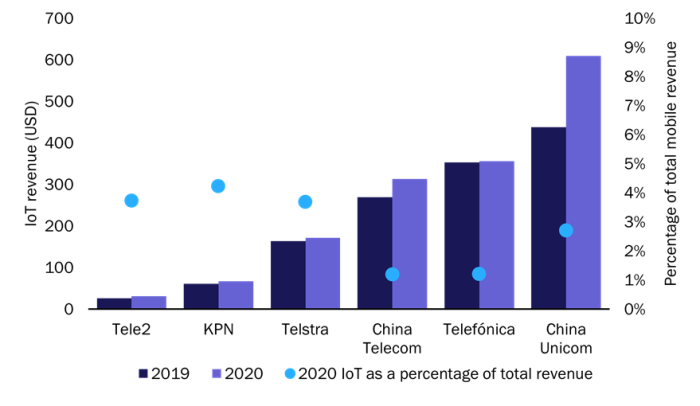

Only a few operators report IoT revenue and some, such as Vodafone and Verizon, stopped reporting in 2019. This in itself may indicate that IoT revenue is failing to grow as quickly as operators would like, despite good growth in the number of IoT connections. Nevertheless, some trends are still evident from the operators and vendors that have reported IoT revenue (Figure 2).

- IoT revenue growth slowed down in 2020. A simple average of the IoT revenue growth rates of the two Chinese operators in Figure 2 was 27.6% in 2020, compared to 33.9% in 2019. This average was just 8.2% for the four non-Chinese operators in 2020, down from 14.9% in 2019. High levels of competition in the connectivity market put downward pressure on connectivity prices, and the IoT market was significantly disrupted by the COVID-19 pandemic. Operators whose IoT revenue is dependent on the automotive and industrial sectors were particularly affected by the crisis.1

- IoT continues to account for a small part of operators’ total mobile revenue. IoT revenue accounted for around 4% of the total mobile revenue for KPN, Tele2 and Telstra. This share is even lower for Telefónica and China Telecom (both 1.2%). China Unicom has had some success in this area; its IoT share of revenue more than doubled between 2018 (1.3%) and 2020 (2.7%).

Figure 2: Telecoms operators’ IoT revenue and IoT revenue as a percentage of total mobile revenue, worldwide, 2019–20202

Source: Analysys Mason, 2021

The pressure on connectivity revenue will continue, but operators can explore other revenue growth opportunities in 2021

The COVID-19 pandemic contributed to the slow-down of IoT revenue growth in 2020, though the market did at least recover somewhat in the second half of the year. However, 2021 is likely to remain challenging. Economic conditions will improve, but will be no better than those in 2019 in most countries. The level of competition in the IoT connectivity market will remain high, and the pandemic will continue to have an influence (for example, a shortage of chips will affect production in the automotive sector). All of these will affect IoT operators’ performance in 2021, which means that their work in new areas (such as private networks) and new opportunities in healthcare and smart buildings resulting from the pandemic will be even more critical.

1 For more information, see Analysys Mason’s IoT market growth will slow down due to the COVID-19 pandemic and the limited take-up of LPWA solutions.

2 Telefónica reports ‘IoT’ and ‘Big data’ together as one revenue segment. Telefónica does not report the split of mobile and fixed revenue for all opcos. We assume that mobile revenue accounts for 60% of its total telecoms revenue based on the mobile/fixed split of those opcos that do report data (Brazil, Germany and the UK).

Article (PDF)

DownloadAuthor

Ibraheem Kasujee

Senior AnalystRelated items

Forecast report

Cellular data traffic from connected cars: worldwide forecast 2023–2029

Article

Other operators could follow AT&T in shutting down NB-IoT, but the technology is not obsolete yet

Article

Business trends to watch in 2025: telecoms operators will explore different models to drive revenue growth