South Korean operators’ enterprise revenue grew strongly in 2021 and they have ambitious plans for future growth

Listen to or download the associated podcast

Operators in South Korea reported strong enterprise revenue growth in 2021 and they have ambitious targets for future growth. South Korea Telecom (SK Telecom) aims to grow its enterprise revenue from KRW1.4 trillion (USD1.14 billion) in 2021 to KRW4.5 trillion (USD3.66 billion) in 2025, and Korea Telecom (KT) plans to generate half of its revenue from B2B and digital services by 2025 (up from 40% in 2021).

To reach these goals, operators in South Korea are strengthening partnerships with public cloud providers and collaborating with IT specialists to increase ICT market share and to develop new services for domestic businesses, as well as to expand their businesses internationally. Operators in other countries are pursuing similar strategies but typically at a slower pace.

Operators in South Korea are looking to enterprise and digital services to deliver revenue growth

Fibre broadband is almost ubiquitous in South Korea, mobile penetration is high, and many businesses have already adopted 5G services. This limits the opportunity for operators to drive revenue growth from core communications services, despite growing business demand for high-bandwidth services to support cloud migration. The adoption of public cloud services is expected to accelerate in South Korea (we forecast a CAGR of 17.9% for SaaS and IaaS/PaaS revenue in South Korea between 2021 and 2025). AWS and Azure both operate multiple availability zones in South Korea and Google Cloud Platform (GCP) launched a South Korea region in 2020.

Given this context, it is unsurprising that both KT and SK Telecom have explicit strategies to drive revenue growth from enterprise ICT and other digital services.

- For KT, 2021 was the “year of transforming into Digico (Digital Platform Company) from Telco”, and the company aims to generate half of its revenue from B2B and digital services by 2025 (up from 40% in 2021).

- Following the spin-off of several ICT businesses, SK Telecom aims to accelerate the revenue growth of its remaining enterprise business from KRW1.4 trillion (USD1.14 billion) in 2021 to KRW4.5 trillion (USD3.66 billion) in 2025 at a CAGR of 34%. This will be driven by an increase in revenue from data centre services (79% CAGR), cloud, 5G multi-access edge computing (MEC) and AI-supported IoT services and an expanded global presence through equity investments.

Both operators’ approaches have already delivered significant enterprise revenue growth in 2021 as highlighted in Analysys Mason’s 4Q 2021 Business revenue tracker. KT reported that Telco B2B services grew by 5.1% in 2021, while its Digico B2B services grew by 2.5%, driven by a 16.6% increase in revenue from cloud and data centre services. SK Telecom’s enterprise revenue grew by 13.3% in 2021. The other major player in the market, LG Uplus, reported 9.8% growth in enterprise revenue, driven by strong revenue growth from data centre services and ICT solutions.

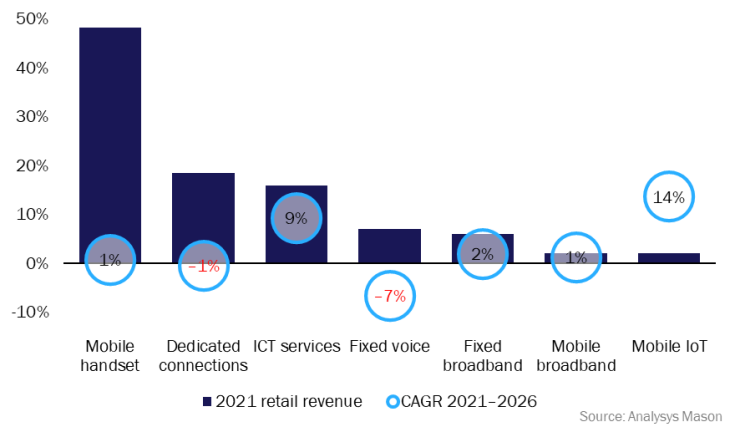

Nevertheless, the targets look ambitious compared with the more modest 9% CAGR that we forecast for operator retail revenue from businesses for ICT services in South Korea (see Figure 1).

Figure 1: Percentage of telecoms operator retail revenue from businesses in 2021 and CAGR for 2021–2026 by service type, South Korea

Operators in South Korea have undertaken several initiatives to support revenue growth from enterprise services

Operators in South Korea are pursuing multiple initiatives to achieve enterprise revenue growth including the following.

- Collaboration with IT specialists to develop and commercialise new technology. Operators in South Korea have developed several partnerships with IT specialists, including KT’s collaboration on AI with Hyundai Heavy Industries & Construction, LG Electronics and various academic institutions. In addition, SK Telecom has invested in – a partnership with – Bespin Global (a large MSP based in South Korea) on 5G and MEC services.

- Operator partnerships with public cloud providers. These include offering standard businesses services from hyperscale players as well as more-collaborative partnerships. For example, in June 2021 KT announced a strategic partnership with AWS to pursue joint research on AI solutions, cloud and media technologies. SK Telecom had already established an agreement with Microsoft in 2019 to jointly develop 5G, AI and cloud solutions for its customers. Our Edge cloud tracker highlights SK Telecom’s partnerships with AWS and Azure, and LG Uplus’s partnership with Google.

- Expansion of overseas capabilities. In September 2021, KT acquired Epsilon Telecommunications, a global networking provider that also operates a network-as-a-service platform, Infiny. The acquisition is expected to help KT to expand its global data infrastructure coverage and gain new multi-national corporate (MNC) customers including those headquartered outside of South Korea. SK Telecom’s investment in Bespin Global is also expected to help SK Telecom expand globally.

Operators are also separating out their successful ICT businesses. In November 2021, SK Telecom spun off several of its ICT and semiconductor businesses into a newly formed investment company, SK Square (like SK Telcom itself, SK Square is minority-owned by SK Inc.). In February 2022, KT announced that it will establish KT Cloud (its cloud and data centre business) as a separate, fully owned entity. It is unclear whether these changes will benefit the remaining telecoms businesses but we expect continued collaboration to serve end customers. For example, in January 2022 SK Telecom, SK Square and SK Hynix (a subsidiary of SK Square) announced the launch of the SK ICT Alliance to jointly develop and invest in ICT convergence technologies, and to create global market opportunities.

Operators in other countries can learn from the scale and pace of change in South Korea

None of the initiatives being pursued by operators in South Korea are unique. Operators in many countries in Europe have also restructured to better realise the value of existing investments, many operators are partnering with cloud providers, IT specialists and new channel partners; and operators such as StarHub in Singapore also have ambitions to expand further within Asia.

However, the scale of investment and pace of transformation and growth demonstrated by operators in South Korea is impressive, as is the way in which they have sought to maintain a leading position as developers of, and enablers for, advanced technology. Operators in other countries should consider how they too can best realise the value of existing investments while also investing in future technology and strategic partnerships.

1 For more detailed analysis, see Analysys Mason’s Operator business services: South Korea forecast 2021–2026.

2 KT (9 February 2021), KT 2020 Earnings Release.

3 KT’s B2B and digital services category consists of B2B communications and digital services as well as media and mobile platform services. The B2B communications and digital services element (including some wholesale services) accounted for two thirds of revenue for the category in 2021.

Article (PDF)

DownloadAuthors