Operators will still lead the mobile voice space, but RCS will have a limited effect on the messaging market

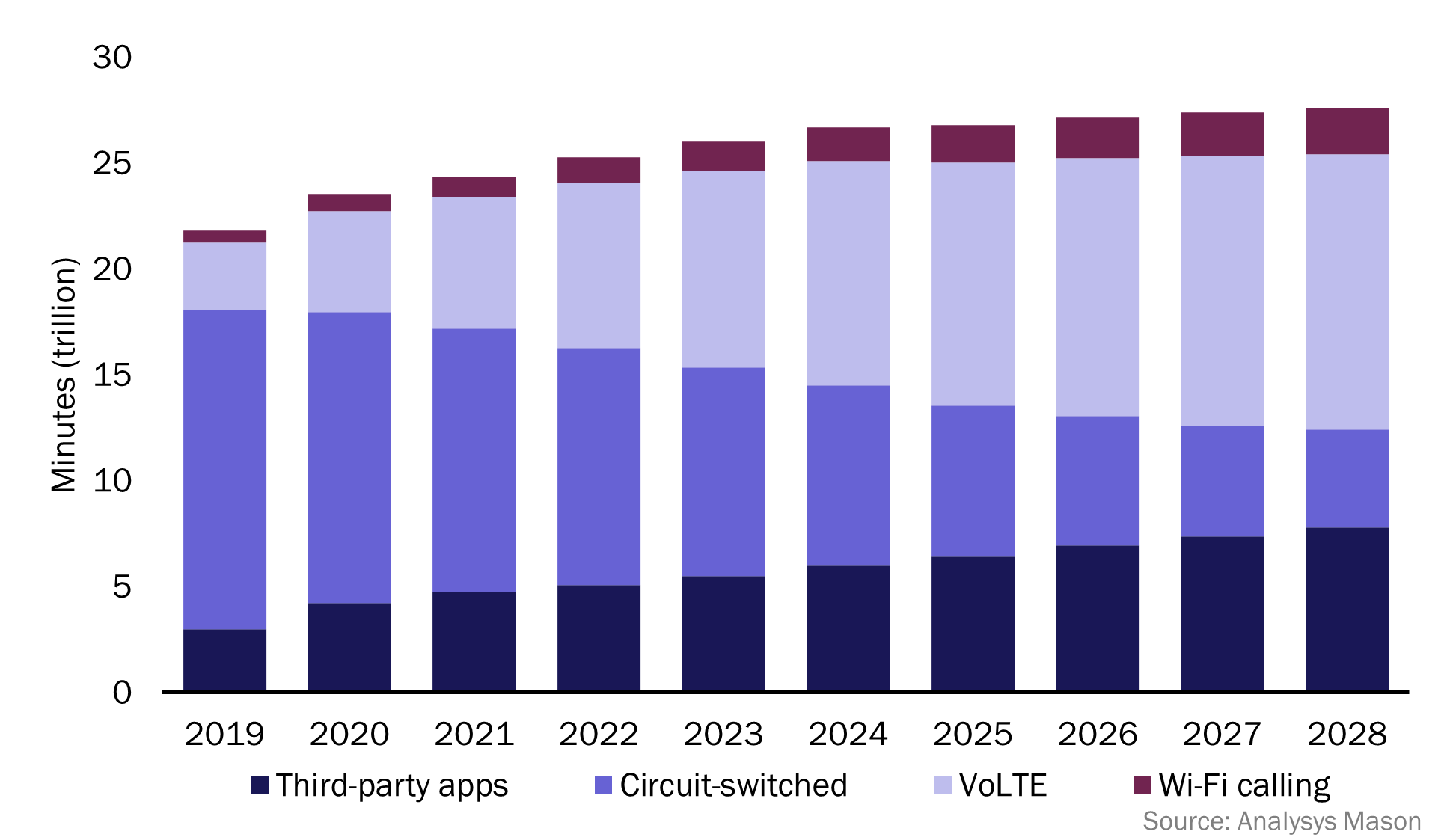

Mobile voice traffic worldwide will grow from 26.0 trillion minutes in 2023 to 27.6 trillion minutes in 2028. Operators’ share of the market will fall slightly from 79% to 72% during this period because third-party apps will continue to grow in popularity. Operators’ mobile voice traffic will gradually migrate to voice-over-LTE (VoLTE) and Wi-Fi calling, thereby leading to a decline in the use of circuit-switched technology (Figure 1).

Figure 1: Mobile voice traffic, by channel, worldwide, 2019–2028

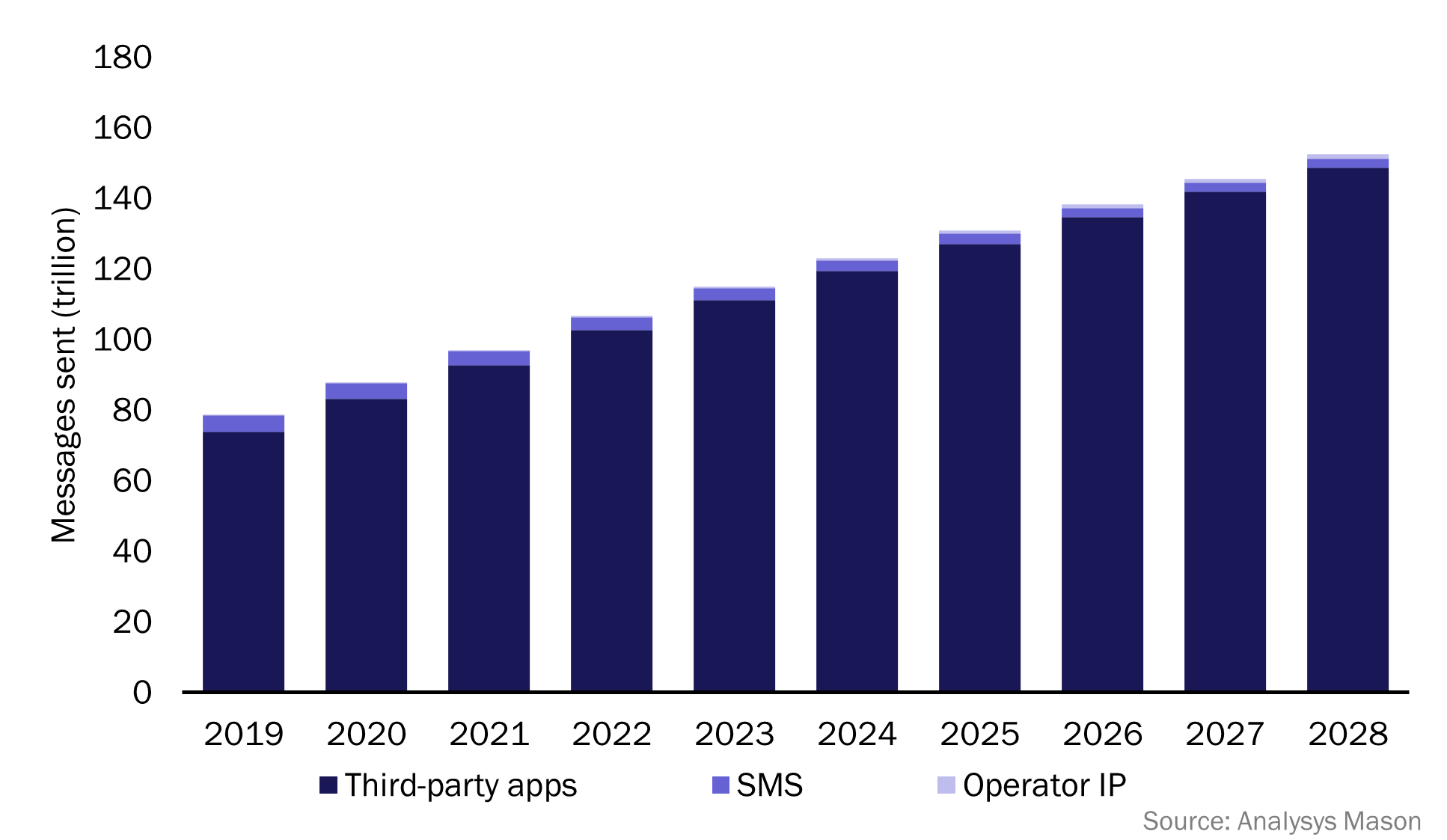

Third-party apps (such as WhatsApp) dominate the peer-to-peer (P2P) mobile messaging market. They accounted for 97% of the total traffic worldwide in 2023; this figure will rise to 98% by 2028. Apple’s adoption of Rich Communication Services (RCS) in 2024 will enable operators to better compete with third-party apps such as WhatsApp and Telegram, especially in countries with no well-established third-party app. However, this will have little impact on the overall market. Operator IP traffic worldwide (which includes RCS and operator messaging apps such as Turkcell’s BiP) will increase at a CAGR of 26% between 2023 and 2028 due to increased RCS usage.

The data in this article comes from Analysys Mason’s Mobile voice and messaging: worldwide trends and forecasts 2023–2028.

VoLTE is replacing circuit-switched voice calling as operators upgrade their infrastructure

Mobile voice services include third-party apps and operator voice services (circuit-switched, VoLTE and Wi-Fi calling). Operator voice services will dominate in all regions throughout the forecast period. Operators are upgrading their traditional circuit-switched infrastructure to support VoLTE and Wi-Fi calling and most modern smartphones support these services. Customers will typically automatically connect to VoLTE if their operator provides it and will benefit from the improved calling experience (compared to that of circuit-switched technology). Conversely, consumers generally need to actively switch on Wi-Fi calling on their smartphone to be able to use the technology, and they must have an active fixed broadband connection.

Operators should continue to invest in VoLTE and Wi-Fi calling services to increase call quality and prevent consumers from migrating to third-party apps for mobile voice services. Partnering with services such as Microsoft Teams (via Operator Connect) to enable consumers to use these unified communication services via their mobile or landline numbers will produce marginal revenue growth for operators. Apple’s commitment to the GSMA’s Universal Profile RCS standard implies that iPhones will also support video-over-LTE (ViLTE) from 2024, thereby increasing the potential revenue opportunity for operators that offer this service.

RCS will drive operator IP messaging traffic growth, but third-party apps will retain their dominant market position

Mobile messaging traffic is split across third-party apps and operator messaging services (SMS/MMS and operator IP). Operator IP messaging consists of RCS messaging delivered by an operator1 and messages sent on an app such as Turkcell’s BiP. Most operator IP traffic comes from RCS, and the number of RCS messages will increase substantially when RCS is made available on iOS from 2024.2 However, the number of users will grow more rapidly than traffic because most users will continue to predominately use third-party apps.

Figure 2: Messages sent, by message type, worldwide, 2019–2028

The future of P2P operator messaging relies on the success of RCS. Apple’s move to support RCS on iOS is a positive for the industry. However, consumer demand for, and awareness of, RCS is low, and many operators do not yet support the technology. Furthermore, consumers in most countries are happy using third-party apps such as LINE, WeChat and WhatsApp.

Operators must not get complacent about their position in the voice market

Mobile network operators dominated the mobile messaging market until the early 2010s when they were rapidly overtaken by third-party apps. Operators will not be able to re-establish their dominance over this market. Operators that do not continually invest in upgrading their voice services may also risk losing their dominant position in the mobile voice market.

1 RCS messages that bypass operators by using infrastructure such as Google Jibe do not count as operator IP; these messages are included as third-party app traffic. If a message bypasses the operator to reach the RCS Interconnect Hub but is then delivered by the operator, the message is included as operator IP traffic.

2 For more information, see Analysys Mason’s Apple’s introduction of RCS in 2024 will have a limited effect in the near term on the SMS A2P market.

Article (PDF)

Download