Monetisation platforms: slow growth in 2021 masks transformation of the underlying systems

Monetisation platforms continue to be mission-critical systems for communications service providers (CSPs), accounting for more than USD16.8 billion in annual spend in 2021. According to Analysys Mason’s Monetisation platforms: worldwide market shares 2021, CSP spending on monetisation platforms was flat in 2021 when compared to 2020. However, this masks a significant transformation that is underway in this segment, as newer and cheaper systems replace older and more expensive legacy technology.

CSPs are continuing to invest in monetisation platforms for three main reasons

- The significant cost of maintaining legacy systems and their lack of agility are the main concerns that are driving CSPs to transform their monetisation platforms. This is particularly true in the case of the billing and charging sub-segment, which accounts for 70% of CSP spend on monetisation platforms. Legacy billing and charging systems are mostly on-premises, and CSPs are prioritising the adoption of cloud-native-compliant, microservices-based architecture to transform these systems. Multi-vendor environments are another challenge, especially because the introduction of new capabilities will require additional customisation and integration. This is one reason why professional services account for a significant proportion of the overall spend in this segment. Complex architecture frameworks with legacy systems that are interconnected via highly customised interfaces continue to support critical operations within large CSPs. This has driven many CSPs to retain managed services contracts, although the average duration of such contracts has fallen from 5–7 years to 2–4 years.

- The wider roll-out of 5G standalone networks is an important driver of new spending as CSPs invest in upgrading their billing and charging systems. 5G-readiness is considered to be an effective way to futureproof monetisation systems, even for CSPs that do not have any immediate plans to roll out 5G standalone. This is because 5G enforces an extensive overhaul of the monetisation process flow, especially when it comes to charging. 5G monetisation no longer depends on call data records (CDRs); instead, it uses APIs. Charging systems that are designed to support CDRs will therefore need to be updated or replaced. This also has implications for other functions, such as billing. CSPs will need to take a hybrid approach in the next 2–3 years by using online charging systems (OCSs) alongside converged charging systems (CCSs) to manage 3G/4G and 5G traffic, respectively. A small number of CSPs are investing in charging function (CHF) bridging capabilities to support 5G standalone networks in the next year or two, even as they develop their monetisation systems strategies for the longer term.

- Another driver, to a lesser degree, is the growing emphasis on B2B2X ecosystems and value chains. This is leading to new CSP investments into ecosystems and marketplaces. The following two key trends are leading to a new wave of investments in partner management capabilities to support digital marketplaces and multi-dimensional, multi-step value chains.

- The shift from a producer–consumer framework to an ecosystem model. Traditional CSP business and operating models and associated systems were designed to exist within a producer–consumer framework. Business environments today are increasingly embracing a model that is more open, collaborative, software-driven and centered around ecosystems and marketplaces.

- The shift from connectivity provider to service enabler. CSPs need to shift from being service providers to becoming service enablers in order to establish their role in emerging value chains.

Leading vendors in telco monetisation platforms

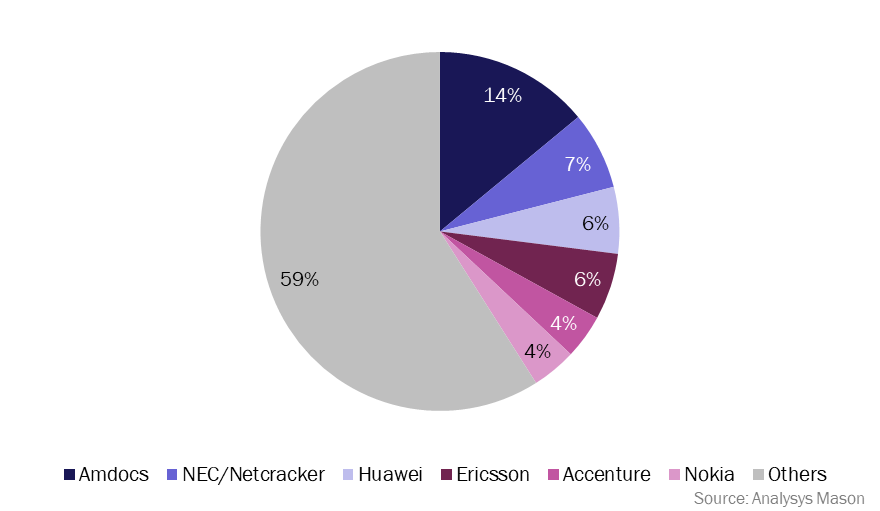

Amdocs remains the dominant vendor in the monetisation platform segment by a wide margin. The company is well-entrenched within multiple Tier-1 CSPs and is making gains with Tier-2 CSPs as well. NEC/Netcracker is in second position in terms of revenue, and its extensive portfolio and the support it gets from NEC in some Asian countries continue to make it a strong player. Huawei, Ericsson and Nokia are the three NEPs in the top six, and they continue to be influential particularly because of their strong connection to CTO groups, which play an increasingly important role in technology procurement for telcos. Accenture is the only professional services provider in the top six by revenue, thanks to its extensive presence as a transformation partner of multiple Tier-1 CSPs worldwide.

Figure 1: Monetisation platforms total revenue by vendor, worldwide, 2021

Although there are headwinds in the short to medium term in terms of uncertain economic conditions and slower-than-expected deployments of 5G standalone networks, the monetisation platform market will remain resilient in that it will continue to attract significant CSP investment thanks to its mission-critical nature and the important role it plays in unlocking emerging opportunities.

Article (PDF)

DownloadRelated items

Article

GenAI can help cut the cost of software creation, boosting the potential of free applications to transform the market

Article

Low-code and no-code platforms are a powerful tool for telecoms operators and application vendors

Strategy report

Monetising 5G and next-generation services: operational impact and implications for telecoms networks