Most telecoms operators’ business revenue declined in 2020, but those with strong IT teams performed best

The impact of the COVID-19 pandemic on mobile roaming and equipment sales means that most telecoms operators’ business revenue fell in 2020 (see Analysys Mason’s Business Revenue tracker). However, the rate of decline of operators’ business revenue varied. In general, operators whose business revenue performed poorly in 2019 experienced an exaggerated decline in the wake of the pandemic, and those whose business revenue performed well in 2019 were more resilient.

Challengers and those incumbents with large IT divisions did better than other operators

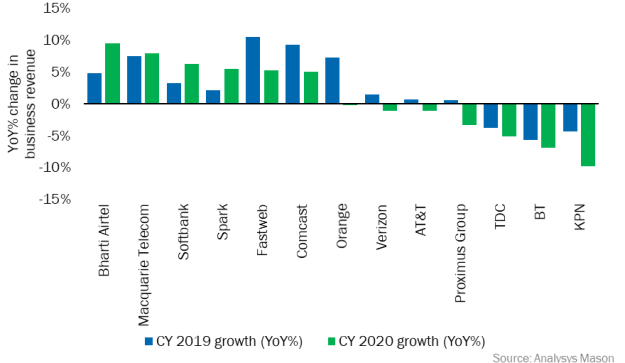

The performance of operators’ business divisions since 2019 can be broadly split into three groups (see Figure 1).

- Challenger operators (for example, Comcast, Fastweb and Macquarie Telecom) that increased their business revenue.

- Incumbent operators that have made significant investments in IT divisions (including AT&T, Orange and Spark) for which business revenue has grown or remained flat.

- Other incumbents that have suffered a continued decline in business revenue (including BT, KPN and TDC).

Exceptions to this include Proximus in Belgium, which has invested heavily in IT but saw its 2020 revenue fall (largely due to a disappointing 4Q 2020 performance after three strong quarters).

Figure 1: Year-on-year percentage change in business revenue for 13 operators, calendar years 2019 and 2020

Challenger operators’ relative success in 2020 can be explained by the consistent growth of their connectivity revenue. These operators are encroaching on incumbents’ market share of connections, largely thanks to competitive pricing. For example, Comcast in the USA attributed its business revenue growth, in part, to the net addition of 30 000 business customers in 2020. Connectivity revenue growth has offset the short-term decline in mobile revenue and the continued decline in legacy voice revenue for Comcast and other challenger operators. In addition, these smaller operators have invested in cloud, security and data services to improve their tailored services, which has helped to increase revenue.

In contrast, almost all incumbent operators have faced significant challenges in 2020. The combination of a decline in mobile revenue as result of the reduction in roaming revenue (for example, Orange’s roaming revenue decreased by 63.8% in 2020) and the continuing decline in legacy voice and fixed revenue was felt more acutely by some incumbent operators. Proximus and TDC Telecom in the UK both reported a decline in their customer bases due to competitive pricing and the competitive nature of the market. This pressure on incumbent operators’ core connectivity revenue was explored further in Analysys Mason’s Operators may be facing a two-step decline in business revenue, but they are not powerless to respond, which uses 2Q 2020 data to analyse business revenue trends worldwide.

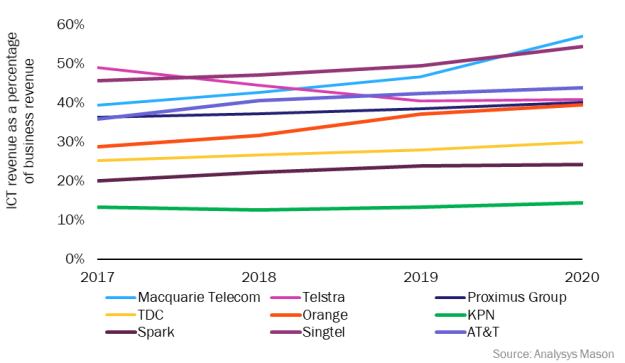

Figure 2: ICT revenue as a percentage of business revenue for 8 operators, worldwide, 2017–2020

All operators should invest in the ICT sector, but the associated lower margins will present challenges that must be addressed

Operators that are taking ambitious steps into new areas such as cloud and security performed (relatively) well. ICT services was one of the only revenue streams to perform strongly throughout 2020. For example, AT&T in the USA reported 2.3% year-on-year revenue growth from ICT services, PLDT in the Philippines achieved 2.8% and Singtel gained 6.7%. This reflects the growing importance of ICT services for businesses (see Figure 2).

ICT revenue growth did not necessarily translate into overall business revenue growth for all operators, but it helped to reduce the impact of the pandemic on overall business revenue. For example, Orange’s ICT revenue, particularly its cloud and cyber-security business revenue, grew by 6% in 2020 compared to 2019.

The increasing importance – and resilience – of ICT services for businesses during 2020 should encourage operators to invest in new areas such as cloud and security. However, although revenue in these new sectors may grow more quickly than in other areas, the margins will be lower (often much lower) than operators’ revenue from their core connectivity business. The challenge for all operators will come from trying to manage these margins.

Article (PDF)

DownloadRelated items

Article

VMware Explore Europe 2024: Broadcom’s investment in SD-WAN lines up with operators’ B2B ambitions

Tracker report

Operators’ AI solutions for enterprises: trends and analysis 1H 2024

Article

Business trends to watch in 2025: telecoms operators will explore different models to drive revenue growth