Operators are scaling back ambitions in consumer IoT and are focusing on specific sub-sectors

Listen to or download the associated podcast

Operators have struggled to make inroads into the consumer IoT market. Many of the products that were profiled in Analysys Mason’s Consumer IoT: case studies and analysis report in 2019 have since been discontinued due to a lack of demand.

Operators have since scaled back their ambitions in consumer IoT, as detailed in Analysys Mason’s Consumer IoT: case studies and analysis 2023 report. Most operators that remain in this market now focus on one or two specific segments, but the level of investment in the market varies by operator. Some, such as TELUS and Telefónica, have used acquisitions or joint ventures to bolster their propositions. Others have one core product (such as AT&T and Verizon in the automotive segment) and simply resell devices in other segments.

Operators were initially active in multiple consumer IoT segments

We separate the consumer IoT market into four main segments (Figure 1). Several operators initially attempted to provide consumer IoT products across all or in most of these segments, but this strategy provided unsuccessful.

Figure 1: Consumer IoT segments and descriptions

| Segment | Description |

| Automotive | Covers vehicle tracking, diagnostics and providing in-car Wi-Fi to passengers. OBDII ports are important in this segment. |

| Surveillance | Home security solutions that connect devices, such as cameras, alarms and motion sensors. Operators may simply sell their devices or offer a professionally monitored solution. |

| Home automation | Connecting devices in the home, such as smart speakers, thermostats and doorbells. Some solutions involve integrating these devices with voice-activated AI assistants (such as Amazon’s Alexa). |

| Tracking | The tracking of people (usually children, or elderly and vulnerable individuals) via watches and wristbands, or devices that can be placed on bags or other objects to track their location. |

Source: Analysys Mason

The lack of take-up of operators’ consumer IoT solutions can be explained by the following factors.

- Lack of demand. Many products were new for operators (that is, devices that had not previously been connected via cellular). Consumer awareness and understanding of these products was low and demand did not materialise for some products.

- Pricing. Operators found it difficult to persuade customers to pay a monthly subscription for cellular connectivity. Consumers have alternatives, based on technologies such as Wi-Fi and Bluetooth, which do not require the consumer to pay for connectivity. Operators have struggled to come up the right pricing structure for devices and connectivity.

- Competition. The emergence of alternative LPWA solutions such as LoRaWAN, Sigfox, Helium and Amazon SideWalk, some of which are cheaper than cellular connectivity.

- Coverage. Operators have been slow to build out NB-IoT and LTE-M networks to provide the coverage needed for consumer tracking use cases.

Operators have streamlined their consumer IoT portfolios but are taking different approaches in their target segments

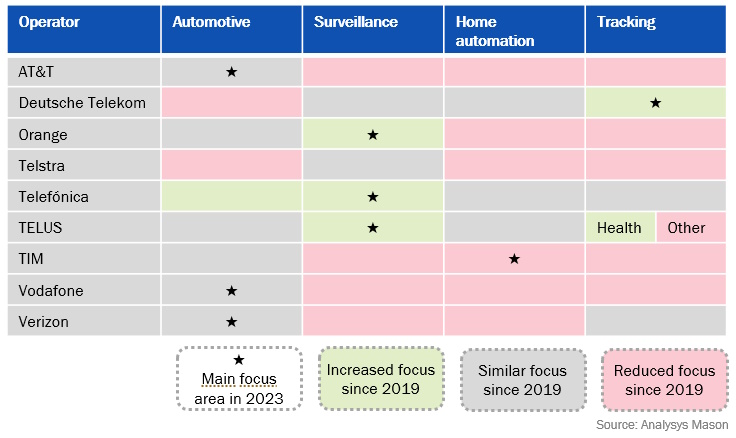

Most operators have stepped back from trying to cover multiple consumer IoT segments and now focus on one main segment (Figure 2). Telefónica is an exception as the only operator that has not discontinued at least one consumer IoT product offered in 2019. It arrived later to the consumer IoT market (2019) than most operators. This may have helped it to learn from the failures of earlier consumer IoT initiatives; it focused on two main segments (automotive and surveillance) rather than covering all four.

Figure 2: Overview of operators’ areas of focus in consumer IoT

Operators are taking different approaches to targeting their segments of choice.

- AT&T, Verizon and Vodafone have developed their own aftermarket automotive solutions, capitalising on their existing expertise in the sector.

- TELUS (healthcare tracking) and Telefónica (surveillance) have used acquisitions or joint ventures to develop vertical expertise.

- Orange has forged partnerships with specialists such as Groupama to target the home automation and surveillance segments.

Consumer IoT may not have reached the scale that operators had previously expected, but it will continue to present opportunities

It is too early to judge the success of the new, streamlined approach to consumer IoT. Operators will continue to face competition from non-cellular technologies, including emerging protocols such as Thread/Matter for smart home, which have the backing of large tech companies such as Amazon, Apple and Google.

However, operators that still have ambitions in consumer IoT have some positives in their favour. It is unlikely to become a significant area of revenue growth, but it could help to reduce churn if operators were to offer a smart home product as part of a wider mobile or broadband package, for example. Consumer awareness of IoT has improved and operators with NB-IoT and LTE-M are better placed than they were in 2019 because coverage has improved and device costs and performance (for instance, battery life) have improved.

Some players have stepped back from, or left, the market completely, making the market less crowded for those that remain. Those that have stuck with it will have learned lessons and improved their understanding of the pricing and go-to-market strategies that are needed to make consumer IoT work.

Article (PDF)

DownloadAuthor