Satellite is an increasingly cost-effective means for MNOs to reach remote mobile customers

Satellite technology has advantages over cellular backhaul in terms of range and ease of deployment, but its historically high operational costs have prevented it from being widely used for mobile cells. This is now changing. Improved performance, falling capacity pricing, the prevalence of mobile small cells and the emergence of managed service models have made satellite technology more useful to mobile network operators (MNOs) worldwide that are trying to provide coverage to unserved populations in order to bolster revenue. Indeed, satellite has become the most cost-effective technology for many rural deployments, and MNOs in every continent are partnering with satellite operators to provide backhaul services to mobile cells in remote areas that would be challenging to connect to the internet backbone by terrestrial means.

Analysys Mason forecasts that satellite capacity revenue for satellite backhaul and trunking worldwide will grow at a CAGR of 9.8% between 2023 and 2033, and will exceed USD5.5 billion by 2032. Our Satellite backhaul and direct-to-device financial viability report assesses the business case for satellite backhaul and direct-to-device (D2D) connectivity and compares it to that of terrestrial solutions.

Falling HTS capacity prices are making satellite backhaul increasingly more cost-effective than microwave links

Government funding for digital inclusion programmes was previously often required to close the business case for satellite backhaul to the most remote locations. This is changing due to the influx of high-throughput satellite (HTS) capacity in the past 5 years. This caused the worldwide average HTS capacity price for satellite backhaul to fall from over USD320 per Mbit/s per month in 2018 to less than USD190 per Mbit/s per month in 2023. As such, the sites for which unsubsidised satellite backhaul has become more cost-effective than microwave links are closer to the backbone and serve more traffic than before.

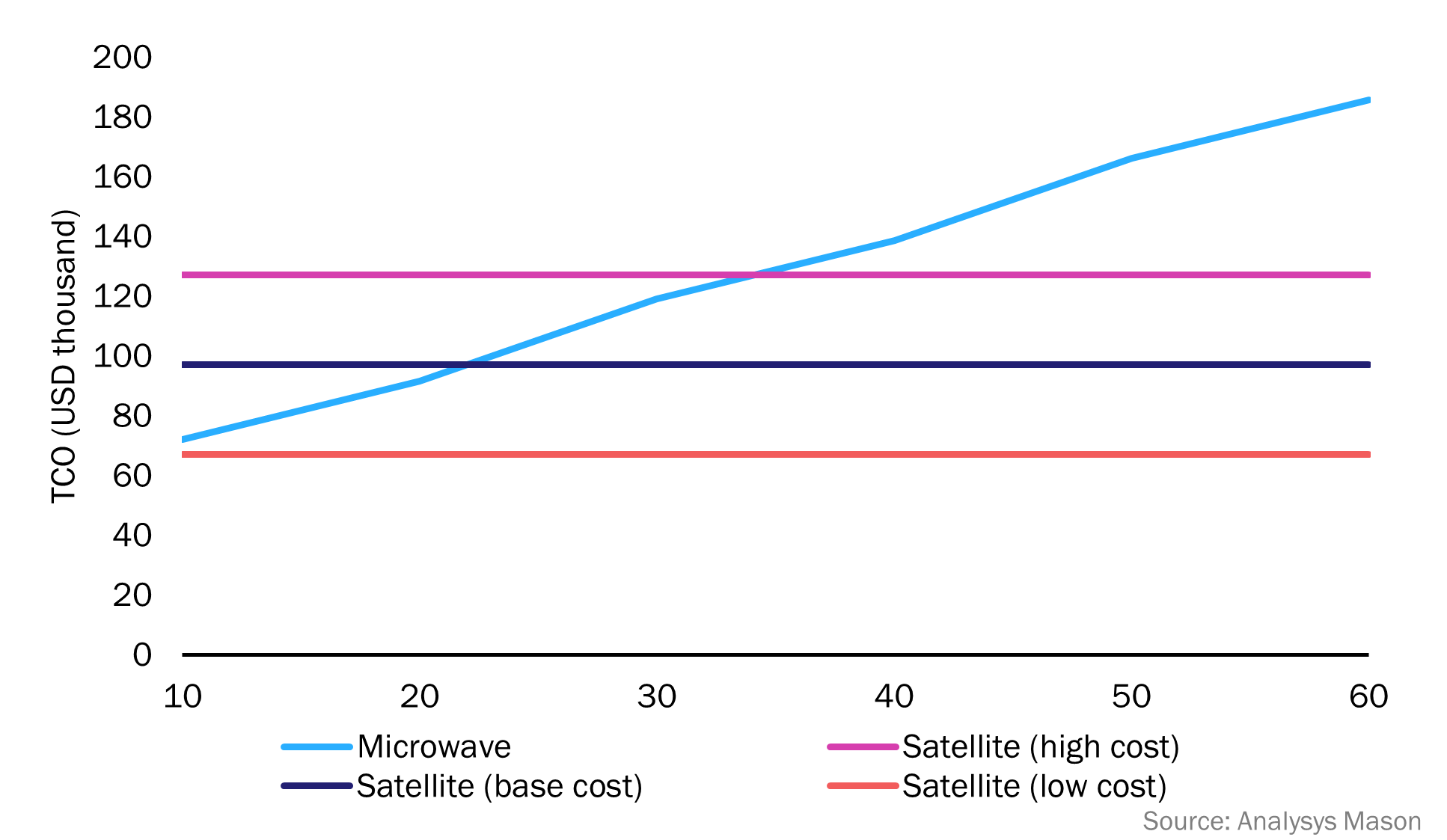

The total cost of ownership (TCO) for satellite is now generally lower than that for microwave link deployments for a 4G small cell situated 20–25km from the internet backbone (Figure 1). Satellite would be cheaper than microwave at a distance of 10km if capacity were to reach an aspirational price point of USD50 per Mbit/s per month. Nonetheless, the marginal cost of monthly traffic is very high for satellite mobile sites due to the need to lease more capacity to serve the above-average traffic levels associated with such sites. MNOs should be wary of the traffic demands for each site because macrocells that serve large population agglomerations demand a high average bandwidth and thus incur high capacity costs.

Figure 1: 5-year total cost of ownership (TCO) versus the distance to the backbone for microwave and satellite 4G small cell backhaul, 20241

MNOs are increasingly partnering with satellite players for mobile connectivity

The provision of mobile backhaul via satellite is becoming increasingly popular, and a number of MNOs worldwide are signing large long-term deals with satellite service providers (SSPs). These partnerships help to cover remote populations with high-bandwidth VSAT sites in order to provide 4G speeds to end users. MNOs are also increasingly electing to take managed end-to-end services from satellite players. These so-called ‘network-as-a-service’ (NaaS) models remove the need for MNOs to acquire satellite-specific knowledge.

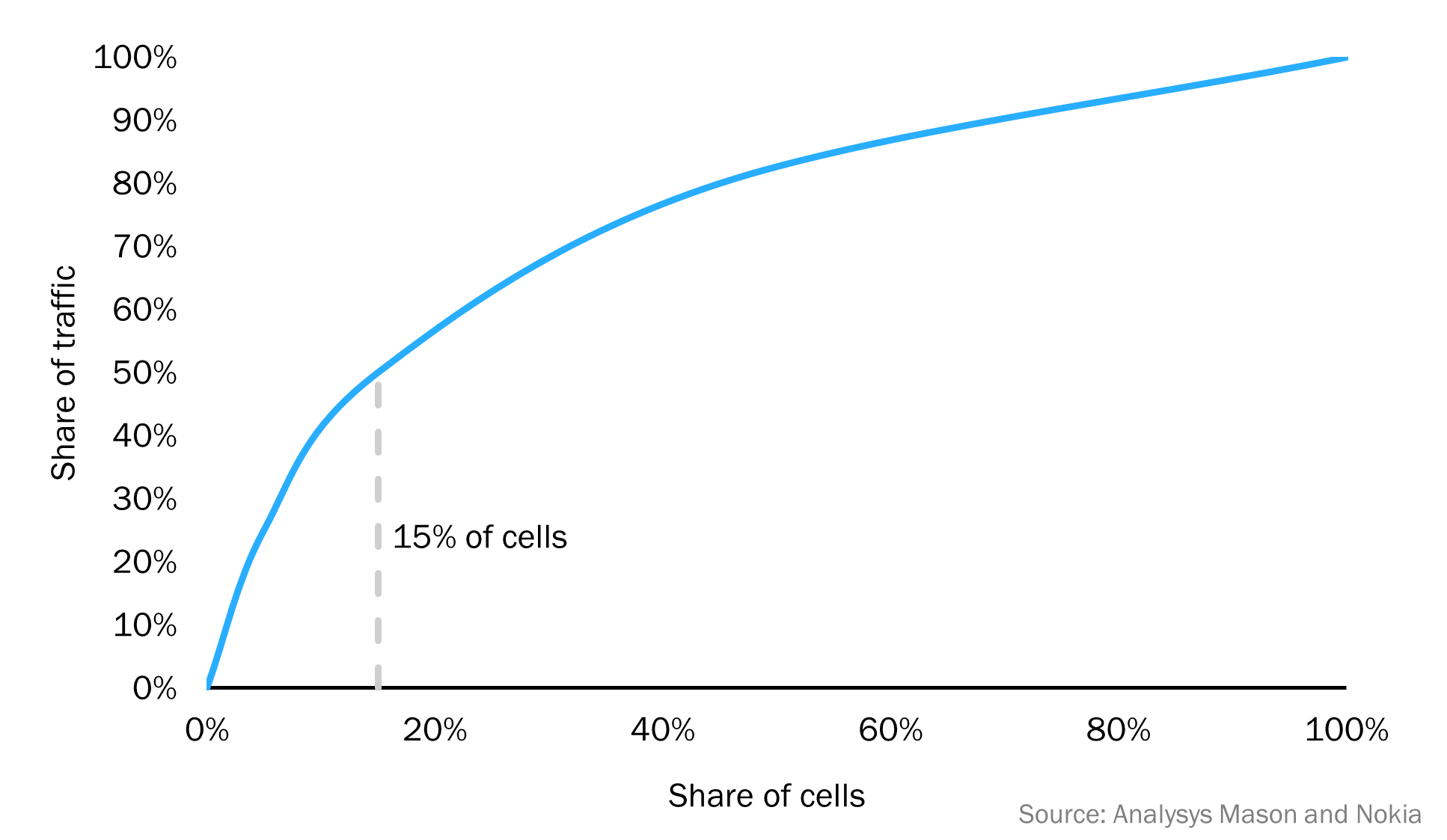

A high proportion of all mobile traffic is shared across a small number of sites, so there is a long-tail of low-bandwidth sites as depicted in Figure 2. An increase in the amount of traffic that can be most cost-effectively addressed by satellite will therefore translate into a rapid elasticity effect in the demand for satellite backhaul.

Figure 2: Share of mobile traffic against share of mobile cells

Hughes Network Systems announced, in July 2023, that it was selected by Africa Mobile Networks (AMN) to backhaul 2G, 3G and 4G sites in Madagascar and Nigeria. AMN has also used low-Earth orbit (LEO) capacity from SpaceX Starlink to help its expansion plans, and is aiming to reach 2000 sites in Nigeria alone by midway through 2024. This sudden growth in the use of satellite backhaul demonstrates the responsiveness of the backhaul landscape to the availability of competitively priced capacity. The growing competition between satellite operators in various orbits will ensure a cost-effective and reliable service for MNOs.

The D2D market remains nascent, but some MNOs have also proactively partnered with satellite operators in this sector. For example, T-Mobile USA has solicited Starlink’s future D2D services to reach the 13% of the USA that currently has no mobile coverage. AST SpaceMobile’s D2D LEO constellation reaches 2 billion customers via partnerships with 40 MNOs worldwide, and has funding from AT&T, Vodafone and Google. Nevertheless, D2D services will be constrained by the very low availability of spectrum in mobile bands, thereby restricting end-user bandwidth to SMS capabilities, at least initially. D2D will therefore only be economical for MNOs when their target users are too dispersed for mobile cell deployments to be efficient. D2D will be adopted more widely as the price of data falls for D2D relative to that of mobile backhaul.

MNOs will eventually deploy hybrid solutions using terrestrial links, satellite backhaul and D2D for their rural mobile networks

Satellite technology will not supplant terrestrial mobile networks; it will instead complement them by addressing the growing share of rural locations that push the limits of terrestrial feasibility. Leading MNOs will select the technology with the most appropriate cost profile for various end users and will therefore deploy a blend of satellite and terrestrial technologies. For the time being, satellite backhaul will prove a fruitful way forward for MNOs that wish to expand their reach. Capacity prices will fall worldwide as HTS capacity supply increases across multiple orbits. Moreover, consumers’ growing data demands will be mirrored in MNOs’ need for bandwidth, which in turn will apply pressure on satellite operators to offer ever cheaper capacity.

MNOs will assess D2D technology’s merits against satellite and terrestrial backhaul as its capabilities evolve from basic SMS to data services. D2D is the mobile technology with the lowest capex and highest opex so will be particularly useful at the edge of mobile networks. Indeed, D2D will help MNOs to provide basic connectivity to any customer, anywhere.

1 ‘Satellite (high cost)’ refers to satellite capacity that costs USD250 per Mbit/s per month. ‘Satellite (base cost)’ refers to satellite capacity that costs USD150 per Mbit/s per month. ‘Satellite (low cost)’ refers to satellite capacity that costs USD50 per Mbit/s per month.

Article (PDF)

DownloadAuthor

Luke Wyles

AnalystRelated items

Forecast report

Consumer and enterprise broadband via satellite: trends and forecasts 2023–2033

Article

Predictions for the space industry in 2025

Article

Direct-to-device satellites are being deployed in LEO and VLEO but scale is required for mainstream services