Operators must address the connectivity divide between urban and rural areas

The overall demand for household broadband is increasing and the average user is consuming more data, thereby driving the need for high-speed broadband infrastructure. Indeed, fixed data traffic worldwide grew by 42% year-on-year in 2020.1 However, there is a significant divide between rural and urban areas in terms of both the availability of fixed and mobile network infrastructure and the quality of service. Achieving complete coverage is a challenge.

Rural areas are defined by the FCC as areas that are unserved (with broadband download speeds of less than 25Mbit/s) and underserved (with broadband download speeds of less than 10Mbit/s). The British government defines rural areas as those that fall outside settlements of more than 10 000 inhabitants.

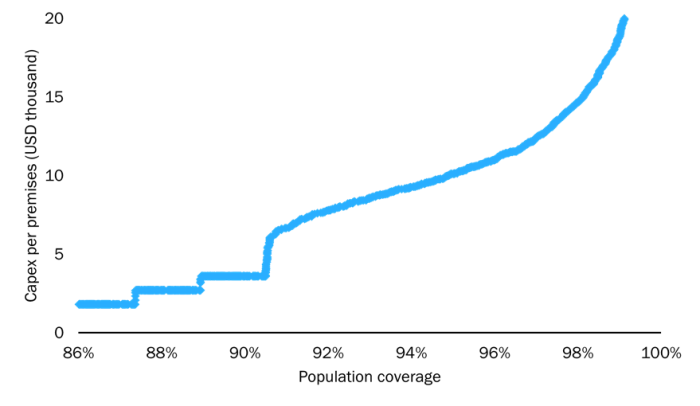

One site may cover only a few hundred inhabitants in some areas, which means that the number of users per tower is much lower than in urban areas. This means that the business case for traditional deployment approaches in rural areas is poor. Indeed, there is a risk that the total revenue generated from providing rural services is lower than the total cost of ownership of the network. Figure 1 shows how the estimated FTTP deployment capex per premises in rural Norway can be up to ten times higher for the last 10% of the population covered than the first 86%.

Figure 1: Estimated FTTP deployment capex per premises to achieve a population coverage of 86–100%, rural Norway, 2021

Source: Analysys Mason, 2022

Rural and urban connectivity require different deployment models

In our report, Strategies to address the economic challenges of rural network deployment, we propose three key recommendations for operators to help them to address issues related to the unfavourable return on investment from deploying rural networks.

- Operators should take advantage of government aid and policy measures (by co-ordinating an investment strategy or taking direct investment) to expand their deployments to rural areas. For example, the Italian government allocated EUR5 billion (USD5.45 billion) to next-generation access (NGA) projects as part of its national broadband plan.

-

Operators should consider embracing new technologies such as alternative backhaul options that can be cheaper to deploy than cellular or fibre options. For example, some operators are already using microwave backhaul that typically operates in the 5.8–8GHz frequency range in rural areas. Meta has also launched Terragraph to explore the possibility of using millimetre-wave radios mounted on street infrastructure to create a wireless distribution network for ‘last-mile’ connectivity.

The use of satellite communication has also been growing, largely due to the rise in the use of Low-Earth orbit (LEO) and geostationary (GEO) satellites. These non-terrestrial networks are being developed as alternatives for mobile backhaul in areas that are either unreachable by terrestrial networks or too expensive to cover. High-altitude platforms (in which an unmanned object such as a balloon is stationed in the Earth’s stratosphere) can also be used to provide connectivity.

Emerging technologies such as fixed-wireless access (FWA) can make use of existing infrastructure and have lower upfront costs than FTTP. However, this largely depends on the assumption that existing mobile networks are upgraded to support 5G FWA services.

-

Operators should take advantage of new business models to reduce the total cost of ownership. Infrastructure sharing is one of the measures advocated by policy makers to help lower the barriers to network deployment in rural areas. Operators can use passive and active sharing as a means to reduce the cost of expanding their networks by lowering both the scale of the investment and the operating costs. For example, Vodafone, Kyivstar and Lifecell in Ukraine agreed to share passive and active mobile network infrastructure to speed up the deployment of 4G LTE networks in rural Ukraine and on main roads in 2020.

The range of new business models is vast. For example, operators could use roaming deals, co-investment ventures and neutral host opportunities to reduce both the capex and opex associated with deploying and running mobile networks.

New ownership models such as neutral hosting could create opportunities for operators in rural areas

In the neutral host model, assets are owned and maintained by a third party and are then leased to operators who can access their network services. Neutral host models can vary in terms of what assets are included in their perimeter of operations.

The neutral host model has some advantages over operator-led initiatives because it reduces the total cost of ownership for operators and gives them the possibility to expand their coverage via a more controlled investment. Neutral hosts can also mediate disputes between operators regarding network-sharing agreements.

This model complements the widespread adoption of 5G because it can address the requirement for a high density of masts for network coverage. The virtualisation of the RAN is another opportunity that can be harnessed by neutral-host providers. Decoupling RAN software from hardware means that a range of operators can run their software on neutral-host-owned hardware.

Overall, it is vital for operators to find cost-effective solutions for rural deployment, especially because regulators are increasingly determined to reduce the digital divide and as a result, are implementing roll-out conditions associated with spectrum licences to pressurise operators to reach ubiquitous coverage.

1 For more information, see Analysys Mason’s Fixed network data traffic: worldwide trends and forecasts.

Article (PDF)

DownloadRelated items

Article

Norlys shows how smaller players can combine telecoms and energy products to remain efficient

Article

Iliad’s central telecoms strategy is similar to that of most operators, but the details have lessons for others

Article

Digital twins will transform the sustainability of digital infrastructure