A new era of abundant satellite capacity is forcing satellite operators to rethink their selling strategy

The satellite industry has historically been constrained by capacity supply, which limits growth potential and price reductions in most market segments. However, with new LEO capacity and next-generation high-throughput MEO/GEO satellites, the industry is entering a phase unlike anything it has experienced before; a period of ‘abundance’.

For an industry that has been defined by niche markets and scarcity economics, the shift to abundance is a new paradigm; with its own challenges and opportunities. A broadening industry scope could fuel revenue growth for years, which could benefit several satellite players. In addition, some players may be required to make risky strategy decisions and not all will succeed.

SpaceX Starlink and Amazon Kuiper are the main reasons for this industry transformation, so a careful examination of their strategies is necessary to understand how to respond.

Abundance has created convergence opportunities and challenges for satellite operators

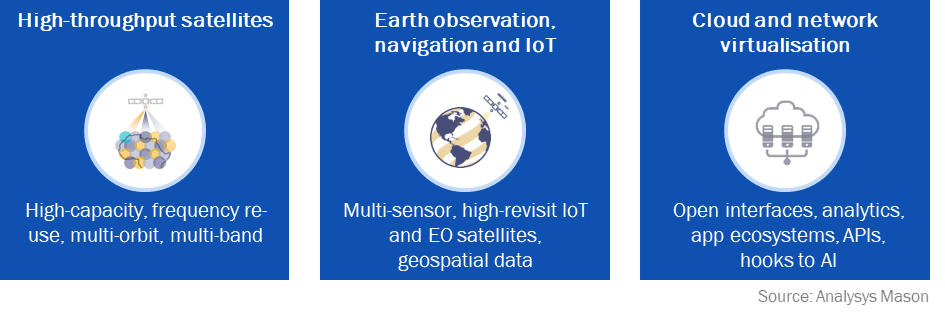

The sheer size of so-called satellite ‘mega-constellations’ and their accelerating launch cadence can foster growth-reinforcing convergence opportunities across space sectors (for example, satcom, Earth observation (EO), navigation/timing, IoT and cloud) that have been operating under different principles (Figure 1). In-orbit capacity and resources continue to outpace demand take-up on the ground, so new addressable markets must now be considered. This is especially true for GEO satellite operators that are struggling to redefine their business because of increasing competition from LEO satellites. Satellite operators in many sectors, such as pure communications and EO, are therefore being forced to change their strategies as they seek to diversify and access new revenue sources.

Figure 1: Examples of cross-platform convergence in the satellite industry

However, convergence is not necessarily a straight path to revenue growth. Up-front investment in new payloads and platforms increases the risk profile for operators, especially as they adapt their legacy connectivity business to new, potentially unproven markets. The EO industry, for example, is known for low barriers to market entrance but uncertain demand outside of large government/military entities. In a period of EO data commoditisation, downstream analytics and productisation are the end goal, but few can articulate what the final end product will be. In addition, the commercial EO market will not necessarily provide a clear, consistent revenue stream. However, satellite operator incumbents may not have a choice but to target these markets.

Outside of new applications and market segments, the de facto positioning for most GEO operators is ‘multi-orbit’ via either direct investment or partnership with MEO and/or LEO operators. The abundance of LEO satellite capacity forces the hand of GEO operators where latency is higher and capacity is much, much lower. This multi-orbit trend is a necessary overlay to any satellite operator strategy now and in the future.

SpaceX and Amazon are approaching the market with unique strategies

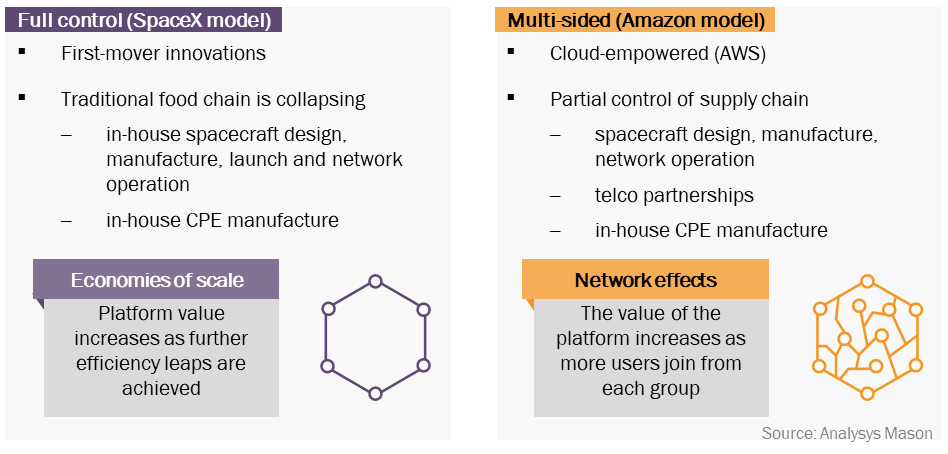

In the context of this changing market, operators could learn from two outliers in the business: SpaceX (Starlink) and Amazon (Kuiper). These companies are approaching the market quite differently (Figure 2). SpaceX provides a full vertically-integrated model of ‘owning everything’, while Amazon intends to focus on fully digitising the infrastructure that points at multiple touch points with its leading cloud play (AWS).

Figure 2: Emerging non-GEO ‘innovation scaling’ models

By controlling all elements of the value chain, Starlink’s value increases as it launches ever more capacity and diverse services such as direct-to-device communication. Kuiper’s value increases as more users from each user group join its network and provide another touch point within its global cloud architecture.

SpaceX and Amazon will surely compete, but are not yet on a clear collision path given these divergent strategies. Amazon’s scaling model could be a game changer, but SpaceX will probably advance its cloud strategy given that Google/Alphabet is a significant SpaceX stakeholder.

Abundance is changing the satellite operator business forever. Satellite operators must carefully adapt their diversification strategies, take on risk and learn lessons from SpaceX and Amazon to build a defensible growth plan for the future.

Article (PDF)

DownloadAuthor