Situational Awareness with Cloud Services Matches

The surging trend of Government/Military players gravitating towards cloud-based solutions screams volumes about the recognition of cloud computing's prowess in handling massive amounts of data, enabling real-time decision-making, and boosting mission capabilities. The matchless scalability, flexibility, and real-time data processing resources make it an ideal fit for time-sensitive applications like mission-critical operations using situational awareness for defense agencies. Consequently, agencies like SDA are teaming up with players like SAIC to develop, implement, and maintain battle management, command, control, and communications (BMC3) systems. This has fueled the adoption of cloud, with Gov/Mil players embracing on-premises cloud services from CSPs to meet their security and compliance needs. What is the opportunity size of space-enabled cloud services and what are additional revenue streams that Cloud Service Providers (CSPs) can capitalize on that make Situational Awareness (SA) an enticing prospect?

Constellations Spark Demand Surge

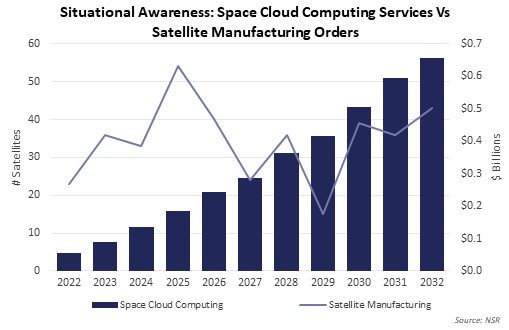

The SA space cloud computing market is witnessing exponential growth and readiness, and NSR’s Space Cloud Computing, 4th Edition forecasts a total 136 EB of data to be downlinked on cloud for SA driving $3.5 Billion Cloud service revenues. The surge in demand for SA applications is tied to increases in geopolitical conflicts, greater needs for monitoring threats for assets safety and protection of sovereign borders. In addition, the SDA Tracking Layer constellation will further the volumes of data downlinked for SA, intensifying the need for cloud computing to process data generated by these satellites. With increasing sizes of planned constellation by government players to enhance situational awareness capabilities and commercial players such as HawkEye 360 deploying their constellations, the data volumes generated is increasing by leaps and bounds and drive the need for direct to cloud delivery of this data to increase accessibility across remote locations and enable scalability in storage and processing needs. As a majority of the satellites are from the NAM region, the corresponding satellites are expected to drive 62% of the cloud data traffic. The EU is the next region that shows increases in demand, enabled by the need for establishing sovereign capabilities.

The growth of cloud service revenues is intrinsically linked to the operational status of situational awareness satellites. As the deployment of the SDA’s Tranche 1 and Tranche 2 advances, the data downlink capacity increases substantially driving proportional surge in revenues. However, despite an impressive CAGR of 28%, the cumulative revenue opportunity of cloud services for SA is only one-twelfth of the revenue generated from satellite manufacturing for SA applications. Thus, manufacturing continues to hold a larger chunk of the market but the opportunity for CSPs will grow upstream, with a strategic shift towards on-board data processing to minimize downlinking of unusable data to ground stations, enhancing the overall value proposition.

CSPs to capitalize by stacking solutions

The satellite operators’ have specific needs when it comes to situational awareness (SA) applications such as meeting compliance with DoD security standards, cross-domain data ingress and egress, faster insights from raw data, low latency, and higher data processing speeds and these are all crucial requirements for effective SA. To cater to these needs, Cloud Service Providers (CSPs) are actively addressing the gaps in their existing solutions, tailoring them to the end-users' requirements.

However, security remains a major concern, especially for government and military customers who are significant players in the SA market. Ensuring data security and protection from cyber threats is a critical aspect that CSPs are actively working on. They are developing tailored solutions to meet the additional security requirements of government customers, and commercial companies serving the government are adopting these solutions to meet their customers' needs. By providing these specialized security solutions in addition to their existing offerings, CSPs can capitalize on the growing demand in this segment.

Cloud-based data analytics holds immense potential, as it allows for processing multiple datasets from diverse sources to unveil critical insights. The US Space Force recognizes this potential and has extended contracts for data-as-a-service solutions that aggregate data from multiple sources. Moreover, the commercial sector's adoption of machine learning solutions for analytics further validates the increasing opportunities for CSPs to offer diverse cloud-based solutions for SA applications.

Lack of expertise and established operations standards without cloud architecture can hinder the adoption of these solutions. To address this, CSPs can seize the revenue opportunity by providing extensive training and personnel support to facilitate a smoother transition for satellite operators.

Ground segment virtualization is also key to increasing cloud adoption. While some operators still rely on their own ground stations, CSPs can leverage their existing ground network and partner network to address the demand for downlink and direct-to-cloud data ingestion. By offering an Infrastructure-as-a-service (IaaS) model, CSPs can meet the ground segment needs of situational awareness satellite operators.

High capital investment has been a challenge too for SA satellite operators and thus they consider a switch to cloud solutions. Hence, commercial situational awareness players prefer adopting cloud-enabled solutions due to its flexible pay-as-you-go models. These models enable operators to optimize costs based on their actual resource usage. By offering data downlink and direct-to-cloud solutions, along with downstream processing services, CSPs can tap into the growing market opportunity and attract more customers in the SA domain.

The Bottom Line

Government and military players are increasingly adopting cloud-based solutions for Space Situational Awareness (SA) applications due to their ability in handling massive data, enabling real-time decision-making, and boosting mission capabilities. The SA space cloud computing market is witnessing exponential growth, driven by increased geopolitical conflicts and the need for threat monitoring. Thus, the adoption of cloud computing by government and military players is expected to increase in the long term.

CSPs can capitalize in this market by offering a diverse range of products on the cloud to cater to the unique needs of their customers. Moreover, they can leverage cloud-based data analytics solutions to further enhance SA applications. By strategically positioning themselves and focusing on key aspects such as security, data analytics, virtualization, training, support, and flexible pricing models, CSPs can establish themselves as pivotal players in the rapidly expanding market for situational awareness solutions.

Author