SMBs’ digital transformation needs remain unaddressed

Small and medium-sized business (SMB) spending in certain categories of the SaaS market has grown quickly during the COVID-19 pandemic. These categories include point of sale (PoS)/e-commerce, customer relationship management (CRM) tools and project management solutions. However, SMBs may still not be investing enough in new software tools to achieve their digital transformation ambitions. Indeed, half of all SMBs believe that the pandemic has resulted in a permanent change to their business model, but less than one third of businesses are making investments to adapt to this change.1 This gap creates an opportunity for vendors, and in this article, we consider how vendors can help SMBs to respond to the new market conditions.

SMBs are initiating digital transformations in the areas that have a direct impact on sales and remote management

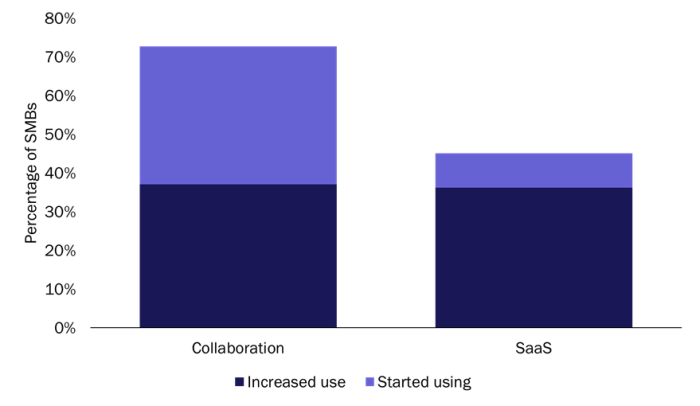

The COVID-19 pandemic has changed the way in which SMBs operate. This in turn has resulted in an acceleration of digital transformation strategies, supported by investment in SaaS. Many SMBs have increased their use of collaboration solutions, and the results of our recent survey show that 45% of SMBs have either started using or increased their use of SaaS solutions as a result of the pandemic (Figure 1).

Figure 1: Percentage of SMBs that have started to use or increased their use of collaboration and SaaS solutions due to the COVID-19 pandemic, worldwide, 20211

Source: Analysys Mason, 2021

Key high growth areas within the SaaS space include the following.

- PoS/e-commerce. Brick-and-mortar business has been significantly affected by COVID-19-related restrictions, so SMBs have developed omni-channel sales strategies and have adopted software solutions to help with these plans. Shopify’s overall revenue grew by 86% year-on-year in 2020, and the sales of its merchant solutions (including online payment processing and shipping services) that enable e-commerce grew by 116% year-on-year. Similarly, Toast, a supplier of SaaS-based PoS solutions for restaurants, achieved 70% year-on-year growth in recurring revenue in 2020. Its customer base also surpassed 40 000, partly as a result of adding extra features to support online ordering and delivery services.

- CRM/marketing automation. The increase in the number of online interactions has inevitably boosted the importance of omni-channel customer engagement. SMBs that were using traditional CRM tools for contact management have upgraded to solutions with greater functionality including marketing and sales engagement. Salesforce’s subscription and support revenue increased by 25% year-on-year in 2020 and the sales of its marketing and commerce products grew by 27% year-on-year. The subscription sales of Hubspot, a Salesforce competitor, grew by 32% year-on-year in 2020, and its customer base surpassed 100 000 (up 42% from 2019).

- Project management. Increasing levels of remote working have resulted in growing needs for project management tools that have features beyond simple collaboration services to track progress and manage projects. All of the leading project management vendors (Monday.com, Smartsheet and Asana) grew their revenue by more than 40% year-on-year in 2020. Citrix expects that the revenue of its recent acquisition Wrike will grow by roughly 30% year-on-year in 2021.

There is a significant gap between the investment required to achieve SMBs’ ambitions and their actual spending

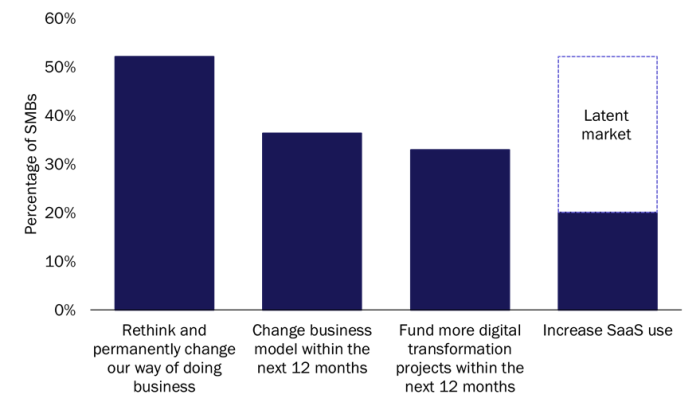

There remains a gap between the investment needed for SMBs to achieve their ambitions and their actual spending, despite their increased use of e-commerce, CRM and project management tools. Around half of SMBs expect that the COVID-19 pandemic will permanently change the way in which they do business, but only around one third of SMBs are investing in digital transformation. Just 20% plan to increase their use of SaaS solutions in the longer term (Figure 2). If we assume that most SMBs cannot transform their business without increasing their use of SaaS tools then there is a large gap between SMBs’ expectations and their investment plans.

Figure 2: SMBs’ plans as a result of the COVID-19 pandemic, worldwide, 20211

Source: Analysys Mason, 2021

One of the reasons for this gap is the limited access to business and technology advice. Successful digital transformation requires in-depth knowledge, which many SMBs lack; their existing knowledge and experience does not extend to new business models.

Over 70% of SMBs are looking for assistance to develop a business continuity plan and to select technology solutions. Only half of all SMBs that plan to fund more digital transformation projects started to use or increased their use of SaaS-based tools in 2020, and 24% plan to increase their use in 2021. A significant number of SMBs therefore need support if they are to invest in digital transformation.

Vendors should pay close attention to specific business sizes and verticals in order to target under-addressed market segments

SaaS-based tools and solutions are indispensable elements in digital transformations. The gap between the needs and actual actions of SMBs provides a key opportunity for SaaS vendors. Many vendors have increased their online marketing efforts during the pandemic, but some opportunities still remain.

To address the unmet demand, vendors should do the following.

- Increase market education. Webinars are an effective method of reaching a large audience, but focusing on simply explaining products is not sufficient. Vendors should address SMBs’ business pain points to demonstrate their understanding of SMBs’ activities. It is also critical that they use language that SMBs can understand. Indeed, many SMBs are not familiar with technical jargon and tend to fail to understand the relevance of vendors’ solutions to their businesses. Case studies distributed through independent analysts can be also useful.

- Provide focused guidance through channel partners. Vendors should also provide more-focused guidance to smaller groups or individual SMBs, preferably through conversations with channel partners. Channel partners often have rich experience in specific market segments. It is important to understand and segment channel partners by both their market expertise and their technology expertise in order to cultivate the SMB space and maximise SaaS sales.

1 For more information, see Analysys Mason’s Rethinking your 2021 SMB strategy: COVID-19 survey insights for IT vendors.

Article (PDF)

Download