COVID-19: the pandemic will accelerate the digitalisation of SMBs’ HR management solutions

The 2Q 2020 results from human resource (HR) management solution providers were mixed. Workday’s revenue grew strongly year-on-year (+19.6%), despite the impact of the COVID-19 pandemic, as did Paycom’s (+7%), Ceridian’s (+12.6%), Paylocity’s (+8%) and Paycor’s (+12%). The other major players in the market, ADP and Paychex, reported revenue declines of 3% and 7%, respectively.

We remain positive about the long-term prospects for the HR solutions market. The changing working environment means that flexible, cloud-based HR solutions are more useful than ever before. The take-up of such solutions in the smallest companies (those with fewer than 50 employees) is still low, and this is expected to be both a driver of revenue growth and an opportunity for HR vendors.

The reduction in employment among SMBs is the main cause of the difference in HR players’ results

The major factors causing the difference in revenue growth figures for the major HR vendors are as follows.

- The product mix. Workday’s and Ceridian’s core businesses are based on HR and payroll software. The demand for cloud-based versions of such solutions has increased dramatically as a result of the COVID-19 pandemic, as many enterprises have had to adapt to the changes in working environments. ADP and Paychex have a greater reliance on payroll processing services, and these have been directly affected by the reduction in employee numbers caused by the pandemic.

- The customer mix. Workday and Ceridian primarily serve the large enterprise segment, while ADP and Paychex work more with the small and medium-sized business (SMB) segment. Paychex, in particular, works a lot with the smallest companies in the market. Its customers have an average of 17 employees, and as a result, Paychex’s revenue fell more than that of its main competitor ADP, which is less exposed to the smallest firms. Martin Mucci, Paychex’s President and Chief Executive Officer, stated that, “COVID-19 caused worldwide business shutdowns directly affecting small and medium-sized businesses, which impacted our business sales and financial performance.” Kathleen Winters, ADP’s Chief Financial Officer, said, “…we felt the full force of a double-digit decline in employment among our clients.”

Employment levels are gradually recovering, albeit at a slower pace than expected. Only half of the 20 million jobs that had been lost due to the pandemic in the USA were recovered by August 2020.1 Slow organic recovery for vendors such as ADP and Paychex will be unavoidable in the short term, but long-term revenue growth remains promising, especially for vendors that are focused on HR software for SMBs.

SMBs are the key drivers of future revenue growth for cloud-based HR software providers

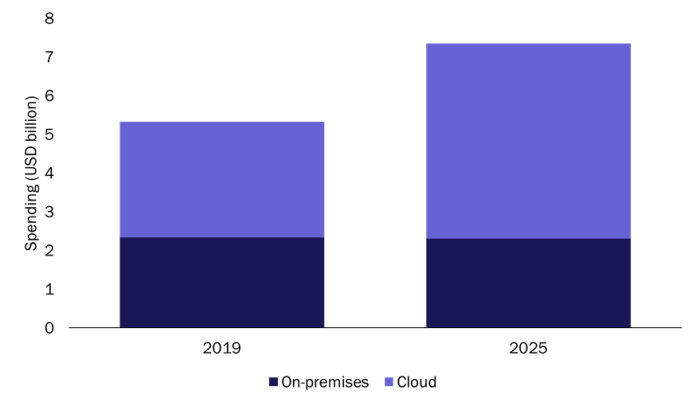

SMB spending on HR and payroll software is forecast to reach USD7.3 billion by 2025; this is a 69% increase from today’s figure (Figure 1). Spending on cloud HR solutions will increase at a CAGR of 9.2%, but spending on on-premises solutions will decline. The migration to the cloud will be driven by companies wanting to have a more flexible solution; this is especially important in uncertain economic conditions. Such companies will add over USD2 billion to the SMB HR software market worldwide in the next 5 years.

Figure 1: Spending on HR and payroll software by SMBs, by solution type, worldwide 2019 and 2025

Source: Analysys Mason, 2020

Source: Analysys Mason, 2020

HR management software handles employee data, so it has historically been kept on-premises due to privacy and security concerns. However, SMBs that have limited internal technological expertise and resources have struggled with on-premises deployments in terms of cost, management and maintenance. Cloud solutions that can demonstrate their privacy and security capabilities and that can reduce these burdens will appeal strongly to SMBs.

The increasing complexity of HR management will push SMBs towards digitalisation

SMBs were keen to digitalise their business management processes, even before the COVID-19 pandemic. We conducted a survey of 3000 SMBs worldwide in 2019 and asked respondents to indicate their priority areas for digital transformation. HR management-related topics were a top priority for SMBs that selected at least three different areas for transformation (Figure 2).

Figure 2: SMBs priority business areas for digitalisation (HR management-related topics are marked in bold), worldwide

| Number of areas selected | Areas for digital transformation (in order of priority) |

|---|---|

| 1–2 (33% of respondents) | Marketing, financial analysis/planning/forecasting and advertising |

| 3–4 (42% of respondents) | Financial analysis/planning/forecasting, marketing, talent/performance management and talent recruiting/hiring |

| 5 or more (25% of respondents) | Talent/performance management, financial analysis/planning/forecasting, marketing, customer insight, talent recruiting/hiring, procurement and expense control, production quality control and customer experience |

Source: Analysys Mason, 2020

The COVID-19 pandemic is likely to accelerate the digitisation of SMBs’ HR solutions because business owners and managers will need to support flexible work shifts, adapt payroll schedules, support complex health management and apply for government stimulus programmes/funds. Indeed, our recent survey found that a third of small businesses (firms with under 100 employees) started to use or increased their usage of cloud-based software as a result of the pandemic.

Vendors should understand how the opportunities vary by business size

The SMB market is challenging for vendors for a number of reasons. Customers can be hard to reach due to their diversity and fragmentation. They also need more pre- and post-sales support than larger enterprises because their technical skill level is typically lower. This can increase costs for vendors. However, the SMB market accounts for 98% of private companies in commercial sector, hires 78% of the labour force and generates over a half of the total spending on HR/payroll software worldwide.

Segmentation based on business size is the key to a successful marketing strategy for HR solution vendors. Payroll solutions are relevant to all businesses regardless of size, but vendors of other HR solutions have historically focused predominately on businesses with 50 or more employees. For example, Paycom and Paylocity have achieved revenue growth of more than 20% year-on-year in the past few years by strategically targeting firms with 50 employees or more.

Businesses with 50 or more employees will remain the main target market for HR vendors. However, companies with fewer than 50 employees will drive new demand as they start to adopt cloud-based HR solutions.

Most vendors do not have direct access to these smaller companies. Such companies are highly reliant on social media, reviews and a vendor’s online reputation when selecting a brand and product; vendors hoping to address this market should therefore use these tools to target customers and promote the ease of use of their solutions, the flexibility of their add-ons and their high-quality customer service.

1 Trading Economics (2020), United States ADP Employment Change. Available at: https://tradingeconomics.com/united-states/adp-employment-change.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Receive the latest news and research on SMB IT buying behaviour and forecasts