SMBs in manufacturing and professional service industries are making big investments in CRM solutions

Customer relationship management (CRM) solutions are becoming increasingly important to the operations of small and medium-sized businesses (SMBs); SMBs’ total spending on CRM applications worldwide is expected to increase at a CAGR of 9.2% from USD28.4 billion in 2022 to USD44.0 billion in 2027, according to Analysys Mason.

SMBs will account for 52.6% of spending on CRM solutions in 2027, as smaller businesses grapple with more complex customer journeys due to omnichannel marketing. Vendors can optimise their strategies for attracting SMB customers by targeting specific industries, such as manufacturing (discrete and process) and professional services.1

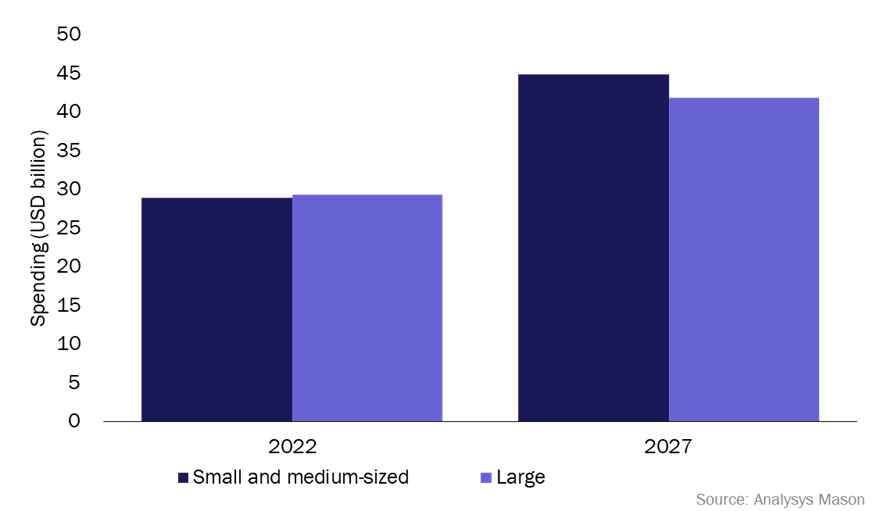

SMBs’ spending on CRM software will overtake that of large businesses by 2027

SMBs’ spending on CRM software is increasing SMBs will spend more on these solutions that large businesses by 2027 (Figure 1). SMBs are keen to use CRM software because it can:

- improve the customer experience

- increase the visibility of important processes and information

- be scalable

- reduce time and costs.

In addition, CRM solutions can improve the accuracy of business forecasts and enable businesses to adapt operational resources to particular customer segments. This benefit is particularly relevant in uncertain economic times, during which SMBs will want to monitor and react to changing customer behaviours.

Figure 1: Spending on CRM solutions, by business size, worldwide, 2022 and 2027

SMBs’ spending on CRM solutions will increase from USD28.4 billion in 2022 to USD44.0 billion in 2027 at a CAGR of 9.2%, while large businesses will increase spending from USD29.3 billion in 2022 to USD41.9 billion in 2027 at a CAGR of 7.4%. Medium-sized businesses will account for most of the spending on CRM solutions in the SMB segment; 70% in 2022 and 71% in 2027.

SMBs in some industries will be particularly heavy investors in CRM solutions

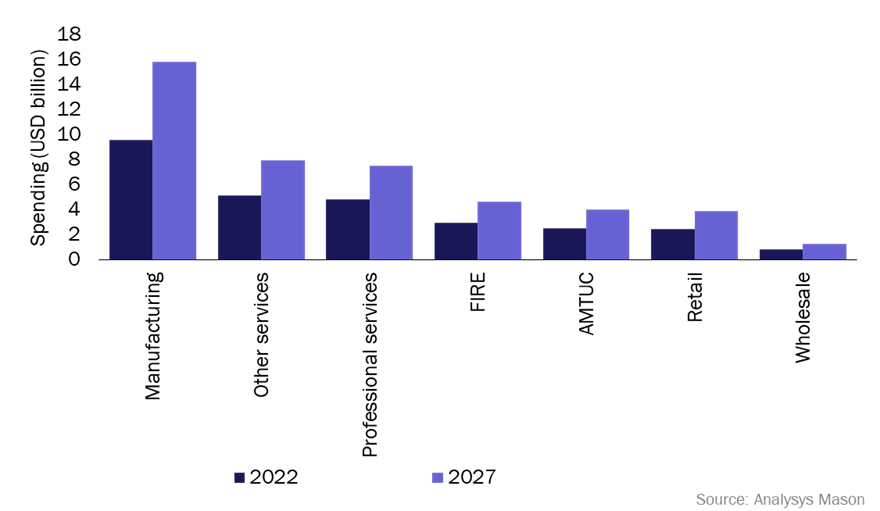

CRM solutions can automate repetitive tasks according to a range of SMB needs. CRM vendors might note that SMBs’ spending on CRM solutions will vary by region, but also according to vertical industry preferences (Figure 2).

Figure 2: SMB spending on CRM solutions, by industry vertical, worldwide, 2022 and 2027

Industries with the highest proportion of SMB spending on CRM solutions in 2027 will be manufacturing at USD15.6 billion (35%), other services at USD8.0 billion (18%), and professional services at USD7.5 billion (17%). Industries with the fastest growth rate of SMB spending on CRM will include pharmaceuticals, agriculture/mining and process manufacturing at 13.0%, 10.8% and 10.7% CAGR respectively between 2022 and 2027.

Industry-specific CRM solutions are more popular in industries that have unique needs and requirements, such as healthcare, financial services, and manufacturing. These industries require CRM solutions that can handle specific workflows, compliance regulations and data management requirements that are specific to their industries.

Multiple trends are involved in the increase of spending on CRM solutions in particular sectors.

- Within manufacturing, trends including labour shortages, the increased importance of sustainability and the digitalisation of the industry make the improved sales management and production planning of CRM ever more appealing. These companies want AI and predictive analytics to analyse product development data with faster feedback processes and forecast accuracy in order to make informed decisions more rapidly.

- Professional services companies want to have access to client analytics and portals to provide a more consistent service. Centralised customer data enables companies to access relevant information quickly, thereby fostering customer loyalty. Professional services companies also need tools that can identify optimal times to connect with clients based on historical buying cycles or their new fiscal years. CRM software can help to track and automate these processes.

In most industry verticals, medium-sized businesses account for most of the SMB spending on CRM solutions, at 66%–78%. However, spending in the retail vertical is more equally distributed between small and medium-sized businesses, at 46% and 54% respectively. Small retail businesses may be particularly keen to have CRM software because it helps to navigate online customer interactions, repeat customers and targeted campaigns. The retail industry has increasingly adopted digital channels; e-commerce, online marketplaces and omnichannel strategies are prevalent. Smaller businesses in this industry are especially likely to benefit from being able to cater to a variety of customers in different channels and vendors should be aware of how the size of the business and the segment that it is in will affect its requirements.

CRM vendors should take a targeted approach to capture the SMB market

CRM vendors have an opportunity to target the growth in spending by SMBs between 2022 and 2027. Top vendors such as HubSpot and Pipedrive are promoting CRM for smaller businesses by emphasising how easy it is to implement and manage their software. Salesforce, which is more traditionally known for servicing larger businesses, has recently launched Salesforce Starter Suite for small businesses.

Most CRM providers have also taken steps to target specific verticals. For instance, Microsoft Dynamics, Oracle CX and Salesforce all offer industry-specific solutions. Some organisations may prefer to offer hybrid solutions, such as ZohoCRM, which use a general CRM as a foundation and then customise it with industry-specific features and functions. Vendors can do more to target specific SMB industries, such as discrete manufacturing, professional services and process manufacturing, by using targeted advertising in their communications and advertising of products.

1 Discrete manufacturing is the production of individual finished products that can be counted and assembled. Process manufacturing produces goods in which ingredients of constituents are mixed together with a predetermined formula or recipe. Professional services are those that require expert knowledge in a given field.

Article (PDF)

DownloadAuthor