Most SMEs consider 5G services to be a low priority as COVID-19 restrictions begin to ease

Small and medium-sized enterprises’ (SMEs’) usage of, and spending on, mobile communications is expected to remain high following the easing of COVID-19 restrictions in many parts of the world, especially because remote working is expected to continue. However, operators need to promote traditional features such as coverage and quality if they are to win a share of this spend. SMEs are not interested in 5G for its own sake. If operators want to market 5G as a benefit for SMEs, they need to show how it improves coverage and quality.

This article uses data from Analysys Mason’s recent survey report Differentiating mobile services for micro, small and medium-sized enterprises: business survey 2021 results to highlight the growing use of mobile communications among SMEs and to discuss what operators need to understand about SMEs’ changing mobile needs.

The continuing trend for remote working means that SMEs’ demand for mobile communications will remain elevated in the wake of the pandemic

Analysys Mason surveyed 1435 enterprises1 in Australia, Canada, the UK and the USA between December 2020 and February 2021 about their mobile connectivity requirements. Two-thirds of the surveyed businesses reported that they provided mobile connectivity (including mobile contracts, data plans, mobile devices and broadband) for their employees. SMEs’ deployment of mobile communications grew during COVID-19 and the majority of this increased usage will remain as pandemic restrictions ease worldwide.

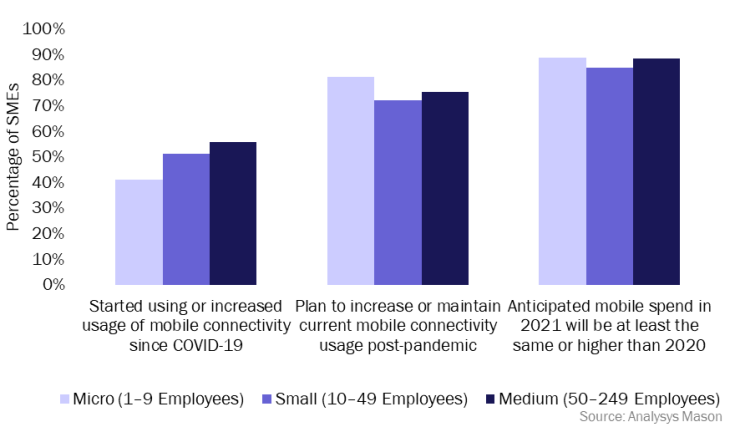

Figure 1: SMEs’ mobile communications usage and plans, Australia, Canada, UK and the USA, 1Q 20212,3,4

Most operators’ business mobile services spend fell in 2020, primarily due to a reduction in business travel, which triggered a collapse in roaming spending. However, while SMEs’ overall spending on mobile services fell, their adoption and use of such services (usage that was almost entirely domestic) increased in 2020. This indicates that the outlook for SMEs’ mobile services spend post pandemic is positive; this new, greater-level of usage is likely to continue, and spend on roaming will return (although perhaps not to previous levels).

Mobile communications provisioning rose across all business size segments as SMEs scrambled to remain operational and to support remote working practices (see Figure 1). An increasing number of SMEs anticipate that a larger proportion of their staff will work remotely in future than did so prior to the pandemic. Many are planning to prioritise support for their remote and hybrid workers, including improving their mobile connectivity. While some SMEs’ future mobile communications usage may decrease as workers return to the office, we anticipate that most SMEs will maintain their increased mobile connectivity deployments to facilitate ongoing hybrid (remote/in-office) work scenarios. This increased remote working will sustain higher levels of spend on mobile.

The majority of SMEs that provision mobile connectivity for employees (89% of micro, 85% of small and 89% of medium businesses) expect to spend as much or more on mobile communications in 2021 compared to 2020.

When ranking mobile contract features, SMEs rated network coverage and quality highest; 5G, handsets and bundled content ranked lowest

SMEs main priorities in the wake of the COVID-19 crisis include supporting their remote workers and safeguarding their communications. SMEs consider network coverage and service quality to be the most-important features of mobile services, whereas adoption of 5G services ranks low on their list of priorities.

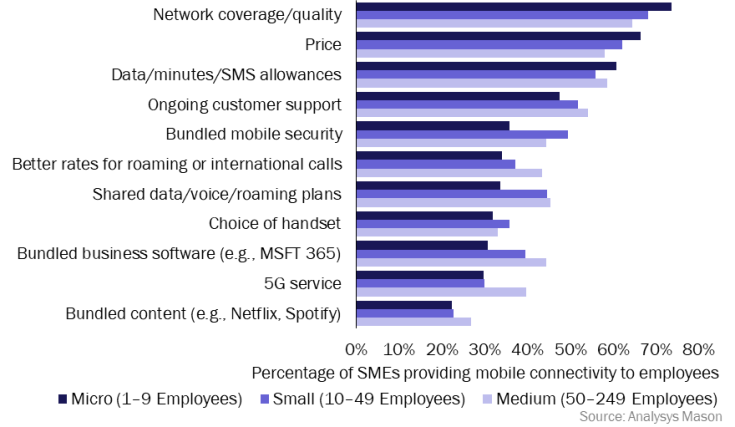

Figure 2: Mobile telephony services ranked by SMEs as ‘very important’, Australia, Canada, UK, USA, 1Q 20215

Among the SMEs that we surveyed, 74% of micro, 68% of small and 64% of medium-sized businesses ranked network coverage/quality as the most-important aspects of mobile telephony services. SMEs are very price-sensitive when it comes to mobile services, and therefore ranked price a close second in importance to network coverage (66% of micro, 62% of small and 58% of medium businesses rated price as ‘very important’ to them).

Businesses with fewer than 50 employees were harder hit by the economic effects of the pandemic than medium-sized businesses, with more within this segment reporting a decline in revenue in 2020. A higher proportion of micro and small businesses also indicated that the crisis would cause them to rethink and permanently change the way that they conduct business.

It is notable how low 5G service ranks in importance for SMEs. All other features, except for bundled content, were rated as more important. Operators should not hope to sell services to SMEs by simply saying that they are 5G – operators need to demonstrate how 5G can support the areas that do matter to SMEs, such as improved coverage or quality.

SMEs want to engage with operators and IT vendors that can help them facilitate remote working

SMEs want to work with operators and IT vendors that can help them to support remote staff using high-quality, secure and cost-effective communications and solutions. Operators have existing relationships with SMEs, which creates a smooth transition for adding business service offerings from IT vendor partners to existing contracts. The addition of business-level support for IT services will make them more attractive to SMEs.

Operators’ value propositions must address SMEs’ post-crisis priorities to support employees that are working from home, including improving mobile connectivity. Adoption of 5G services is low on SMEs’ list of priorities. Operators have the best opportunity to gain SME market share by creating value propositions that highlight benefits such as the fact that their broad network coverage comes with reliable service, maximum data allowances, enhanced security and business-quality service and support. Operators that are solely promoting 5G services to SMEs may face obstacles winning their business.

1 This survey focused on those enterprises with fewer than 250 employees (termed micro, small and medium-sized enterprises (SMEs)).

2 Question: “Please tell us about your company’s current mobile connectivity (cellular contracts, data plans and mobile devices, broadband) usage and if it has changed since the COVID-19 situation started.”; n=1435.

3 Question: “Please tell us about your company’s planned mobile connectivity usage after vaccines are available and lock down guidance is relaxed.”; n=1435.

4 Question: “Please tell us about your company’s anticipated 2021 mobile connectivity spending compared to your actual spending in 2020.”; n=1428.

5 Question: “How important are the following aspects of a mobile telephony service to your company?” Scale of 1 to 4, where 4 = very important and 1 = not at all important. n=946.

Article (PDF)

Download