Telecoms software forecast: cloud and 5G will be the dominant drivers of CSP spending growth

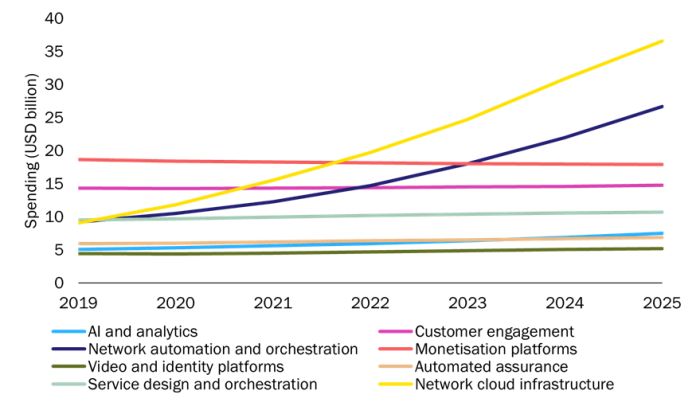

Communications service providers’ (CSPs’) spending on software and related services will grow at a CAGR of 8.8% between 2020 and 2025, from USD80 billion to USD126 billion. Cloud and 5G will be the biggest drivers of this growth. Spending in the network cloud infrastructure and network automation and orchestration segments will growth the most during the forecast period (Figure 1). This is reported in detail in our report, Telecoms software and services: consolidated worldwide forecast 2020–2025.

Figure 1: Telecoms software and services total revenue, by segment, worldwide, 2019–2025

Source: Analysys Mason, 2021

Cloud will become an indispensable part of new software deployments

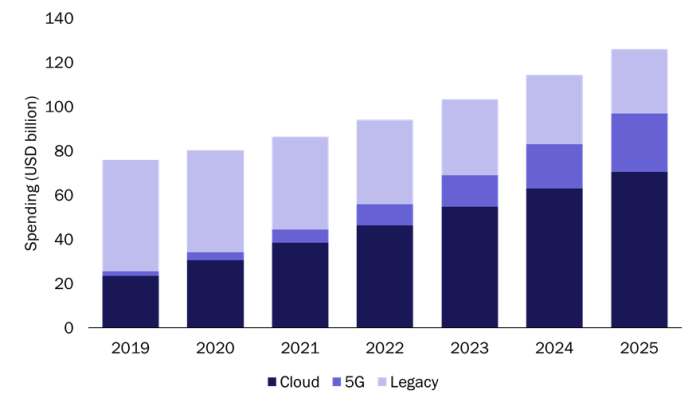

More than 50% of telecoms software spending by 2025 will be directly tied to cloud (Figure 2). Cloud enables new services, thereby creating opportunities for CSPs and requiring systems changes. Cloud technology is rapidly invading and transforming the network. Spending is shifting from traditional network equipment to virtual networks and orchestration. Normal IT payloads such as billing systems are moving to the cloud and are sometimes rearchitected as cloud-native. No other single factor is as important as cloud in our software forecast.

Figure 2: Forecast for CSP spending on the key drivers across telecoms software and services, worldwide, 2019–2025

Source: Analysys Mason, 2021

SaaS is closely linked with cloud and will steadily grow in importance during the forecast period. SaaS will have the biggest impact on spending on customer-facing systems, particularly in the customer engagement segment. Indeed, SaaS deployment will become a critical requirement in this segment. CSPs are looking for SaaS options in most areas other than network software. However, there is a big gap between the number of requests for SaaS and the number of decisions to actually use a SaaS deployment. This is an important factor that is limiting the total amount of SaaS spending.

Digital transformation has arrived and has resulted in a lot of automation: some to provide a digital customer experience and some to enable CSPs to behave like digital businesses. All of this transformation has resulted in a broader scope for automated processes, meaning that CSPs require more data and fewer manual processes. Both human job functions and business processes can now be automated. Vendors should be making a strong pivot to support cloud services, deploy in public and hybrid clouds and exploit cloud-native technology. Cloud technology and methods are at the heart of digital transformations in all industries. When implemented correctly, cloud makes a CSP more responsive to customer needs and more efficient in serving those customers.

5G will have an impact on almost all CSP spending over the forecast period

About 20% of telecoms software spending by 2025 will be directly tied to 5G (Figure 2). All software segments are influenced by CSPs’ focus on 5G network roll-outs. Virtual networks are a fundamental part of 5G roll-out plans and are resulting in a shift in spending from traditional network equipment to virtualised (cloudified) network functions. All traditional OSS are adjusting to accommodate the virtual network, along with orchestration. Monetisation will change because of 5G charging technology and CSPs’ efforts to charge for new 5G services.

CSPs are pushing 5G deployments, but with some reluctance. Some are focusing only on 5G new radio (5G NR) for now, but many are pushing on with full 5G standalone (5G SA), which will enable many new services and require much more spending. Vendors must carefully evaluate the pace at which they expect CSPs to be spending.

The COVID-19 pandemic will have only a limited impact on CSP software spending

Our most likely scenario is that the COVID-19 pandemic will only have short-term impacts on telecoms software and services vendors. Our forecasts are based on the expectation that COVID-19 will suppress the overall CSP software and services spending throughout most of 2020 due to deferred decision-making, lack of access to sites and personnel and supply chain difficulties. Overall spending will rebound in 2021 as 5G spending growth returns and CSPs make pent-up decisions to expand the use of automation, virtualisation and cloudification, which the pandemic has shown to be essential to business continuity and efficiency. The pandemic is accelerating many CSPs’ push for digital experience and is resulting in an increase in customer engagement efforts.

Significant change is underway, but not everything will change. Many CSPs will remain focused on their established fixed and mobile connectivity businesses. They will also continue to spend on established software systems: the maintenance and enhancement of systems that are already in place today will account for 25% of CSP software spending in 2025 (Figure 2). However, CSPs will continue to focus on reducing their spending on legacy systems and will move to cloud-based infrastructure that is futureproof.

Article (PDF)

DownloadRelated items

Article

Mobile operators are neglecting sustainability-conscious consumers – a market worth billions of dollars

Article

Semiconductor companies commonly disclose emissions, but lack net-zero targets

Article

Operators have committed to reporting emissions, but large gaps exist in Scope 3 and resource disclosures