Tri‑band Wi‑Fi 7, slicing and AI: multi-gigabit access can help operators achieve higher ARPU and greater loyalty

Multi-gigabit broadband is becoming mainstream worldwide, but telecoms operators face diminishing returns if they compete on access speed alone. Better Wi-Fi performance leads to higher satisfaction levels, which then supports higher ARPU and lower churn. This relationship can be seen from Analysys Mason’s 2025 survey of 19 500 consumers.

Specific customer segments such as gamers and remote workers will drive this upsell. Our analysis shows that these customers prioritise consistent, low-latency, whole-home Wi-Fi over headline speeds.

Our research makes a compelling case that telecoms operators that offer tri band Wi Fi 7 (Wi-Fi that uses 2.4GHz, 5GHz and 6GHz spectrum bands), mesh and application-aware prioritisation (AI slicing) alongside their highest-speed broadband services can more-effectively translate high access speeds into a superior (actual and perceived) quality of experience (QoE). This in turn drives higher Net Promoter Scores (NPSs), lower churn and increased ARPU.

Operator investment in multi-gigabit capabilities risks being wasted without strong Wi-Fi

Multi‑gigabit broadband has been widely deployed worldwide, and sales of Wi‑Fi 7 gateways are increasing, but our consumer research indicates that coverage gaps and inconsistent in‑home experiences are still common pain points for customers, especially in larger or denser homes.

Analysys Mason’s 2025 consumer survey confirms that the in-home Wi-Fi experience, not just raw downstream and upstream access speeds, is now a primary driver of NPS and churn. High-value customer segments, such as remote workers, gamers and large families, are especially sensitive to coverage and latency issues and are willing to pay for demonstrably better in-home performance.

Getting a ‘new and better router/Wi-Fi’ is now consistently reported by consumers as among the top three reasons for getting a new broadband plan, behind price and speed. This trend validates that home router performance is an important lever for improving both QoE and ARPU. Using a new generation of Wi-Fi also helps operators to fulfil the peak speeds that multi-gigabit fibre access promises – customers need tri-band Wi-Fi-7-based routers to reach 2–4Gbit/s Wi-Fi speeds.

Getting a Wi-Fi proposition right drives increased willingness to recommend and reduces churn

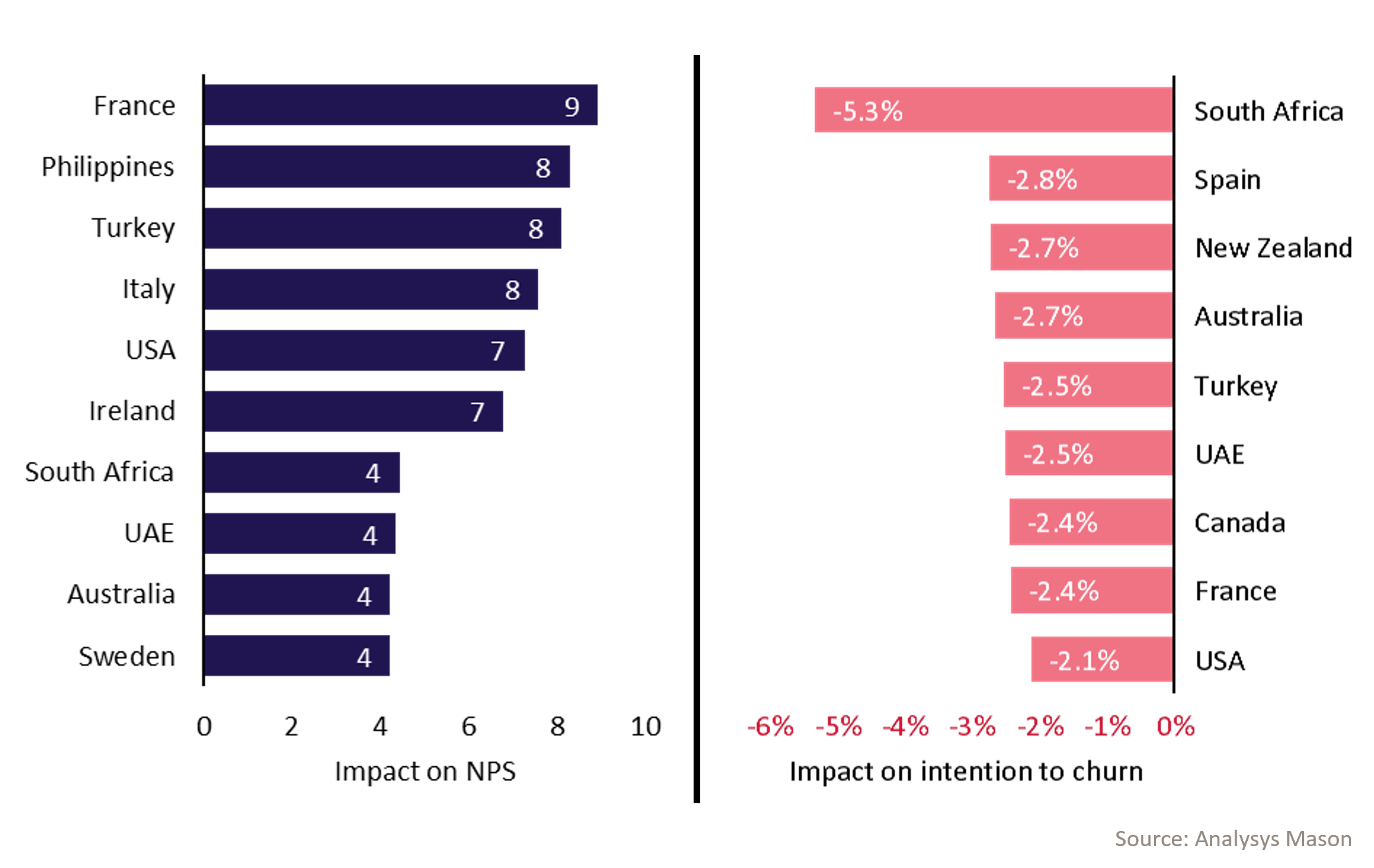

Improving coverage and QoE leads to stronger customer willingness to recommend their service provider and improves retention. We established this by conducting a statistical analysis of the broadband experience of

19 500 consumers across a selection of countries around the world in 3Q 2025. This analysis shows that when respondents are asked to score their satisfaction with their in-home Wi-Fi coverage on a scale from 1 to 5, a one-point improvement in that score (that is, improving a respondent from ‘neutral’ to ‘satisfied’) correlates with a notable increase in NPS and a reduction in intention to churn across multiple countries. This is shown in Figure 1.

Figure 1: The impact of a one-point improvement in satisfaction with in-home Wi-Fi coverage on NPS and on intention to churn, selected countries, 20251

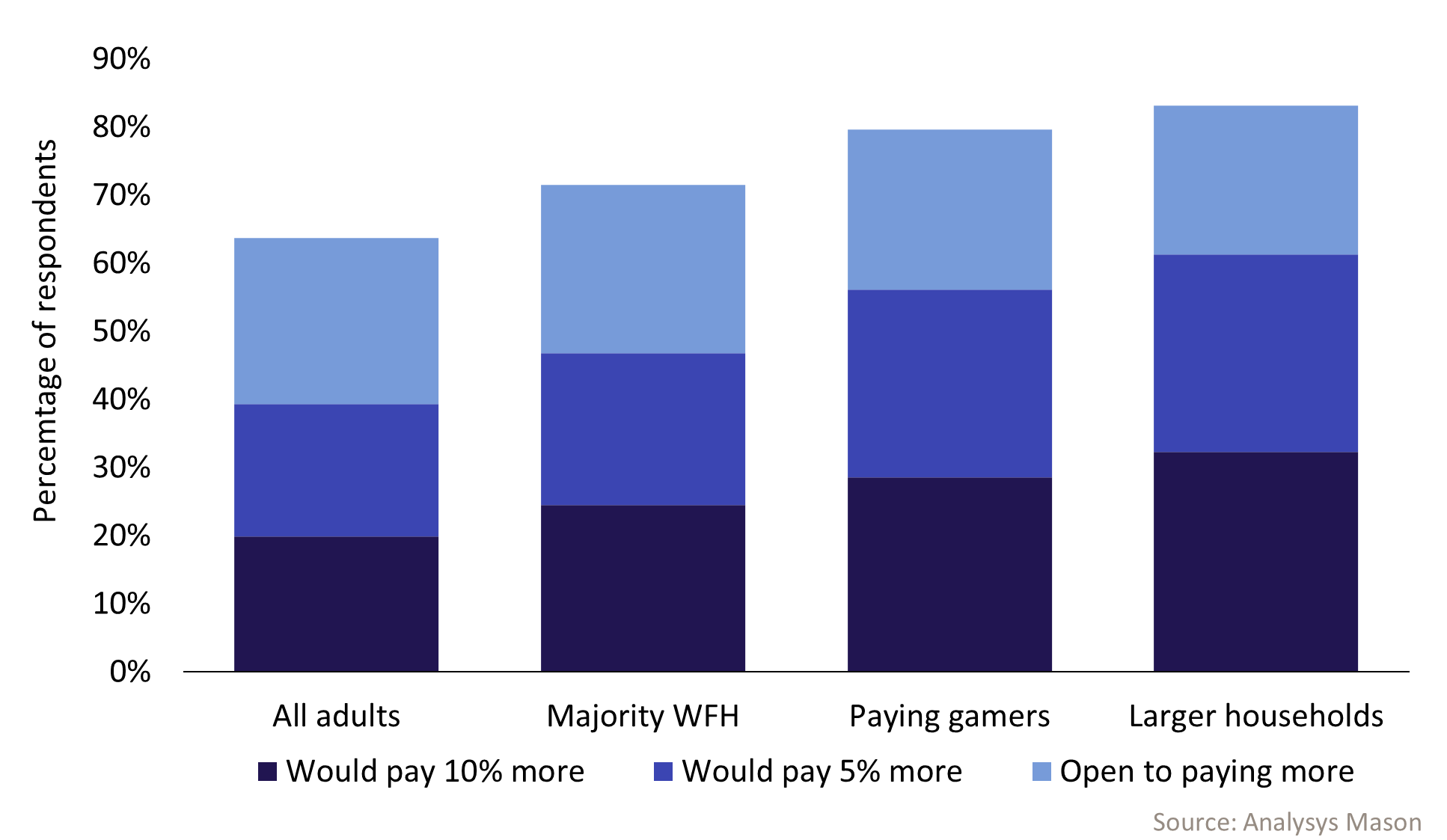

Specific consumer segments are willing to pay more for improved Wi-Fi even beyond existing mesh solutions

Consumers are open to paying more for further improvements to their home Wi-Fi. Across our survey panel, 39% of respondents would be willing to pay extra for better-performing Wi-Fi customer premises equipment (CPE). A further 24% of respondents would consider paying more if the benefits were clearly explained to them. The combined total of the above groups accounts for almost two thirds of all broadband-using adults in our survey.

Mesh solutions have addressed coverage challenges in some of these homes, but current mesh users constitute only a fraction of those that we identified as willing to pay extra for improved Wi-Fi. Across our panel, households with mesh or extenders spend about 16% more per month on broadband, which suggests that improved Wi‑Fi performance could drive ARPU uplift across a much broader customer base by a similar order of magnitude.

Among the two thirds of surveyed adults open to paying more for improved Wi-Fi CPE, we can identify specific target user archetypes that could be monetised with improved Wi-Fi. To establish how monetisable these groups are, Analysys Mason conducted a statistical analysis (a weighted, ordered‑logit with country fixed effects) on respondents’ willingness to pay for a better router. The analysis of this regression showed the following.

- Consumers that were open to accepting a 5% price rise for their broadband access were also around two-and-a-half times as receptive as the average consumer to explicitly also paying extra per month for premium CPE (we tested rental prices that would increase the total customer bill by 5% and 10% per month). 62% of respondents were open to such a price rise. This would particularly benefit operators that charge a separate monthly fee for modem rental.

- Paying gamers (as opposed to casual gamers and non-gamers) were also around twice as receptive as the average consumer to paying more for superior home Wi-Fi. 42% of respondents paid for games, so this is a large target audience with high willingness to pay.

- Remote workers (those that worked from home at least half of the time; 26% of respondents) also had a modestly elevated willingness to pay relative to the panel as a whole (an odds ratio of 0.91, which suggests that they were about 10% more willing to pay).

- Larger households (with 7+ people) were also more likely to invest in better in-home Wi-Fi. 5% of respondents lived in larger households.

- Enhanced Wi-Fi strongly resonates with Gen Z. Willingness to pay declines with age: every additional 10 years of respondent age reduces the odds of paying extra for premium Wi-Fi by about 18%. 22% of respondents were born in or after 1997 and are considered to be ‘Gen Z’.

Figure 2: Percentage of respondents willing to pay extra for a better home router/Wi-Fi, 3Q 2025, worldwide2

Capturing this consumer willingness to pay for a superior Wi-Fi experience requires operators to take a new approach to the home wireless access points and to developing more-advanced technical solutions, which we explore below.

Tri‑band Wi‑Fi 7 and AI slicing can cater to the needs of these valuable user groups

Tri-band Wi-Fi solutions that utilise additional high‑band 6 GHz capacity are nascent but could help satisfy the needs and expectations of ever-more-demanding consumers. By using multi‑link operation (MLO) capabilities, and by operating in bands where Dynamic Frequency Selection (DFS) obligations do not apply, such modern tri-band solutions help sustain multi‑gigabit speeds in more rooms within the home and smooth latency spikes under load.3 Deploying a solution with these features has a number of benefits.

- Extra spectrum and channel bonding improves QoE. Alongside the benefit of having more spectrum over which to transmit data, MLO reduces jitter and queuing delay, which are critical factors for enhancing QoE for gaming and video calls.

- 6GHz enables reduced congestion and DFS-free operation. The 6GHz band avoids DFS radar events, which force CPE to switch channels. 6GHz also currently experiences less interference than 5GHz, improving throughput consistency, especially in multi-dwelling units.

- Tri-band Wi-Fi 7 solutions make the most of end-user device capabilities. Flagship smartphones such as the iPhone 16 and later, and Google Pixel 8 and later, now support the 6GHz band. This enables users to fully benefit from tri-band Wi‑Fi 7’s enhanced speeds and reduced congestion. As more end-user devices adopt 6GHz capabilities, the value of deploying tri-band solutions rises, ensuring that consumers can make the most of their latest equipment.

AI-based traffic prioritisation can also significantly improve the reliability and consistency of Wi-Fi user experience. According to our survey a significant proportion of gamers (up to 43% of gamers in some markets) and remote workers (up to 36% of them) said that they already used some form of prioritisation features. These figures are likely overstated by respondents but suggest that consumers already see application-aware prioritisation features as desirable.

Case study: how Huawei’s 3+3+3 solution addresses this opportunity

Huawei’s tri-band Wi‑Fi 7 solution uses three antennas per frequency band (which the company refers to as ‘3+3+3’). It offers:

- dedicated 6GHz backhaul for mesh, supporting high-concurrency and low-latency applications. Huawei’s tri‑band Wi‑Fi 7 systems can dedicate the 6GHz band for mesh backhaul, which prevents client traffic from reducing node-to-node capacity.

- AI-based slicing to dynamically prioritise gaming, video calls and remote work traffic.

- faster peak speeds than both 3+3 and 4+4 solutions, particularly in environments with multiple users or sources of interference.

- Wi-Fi sensing using channel state information (CSI) protocols, which may open up potential home security and automation applications.

Compared to alternative architectures, Huawei’s 3+3+3 tri-band solution offers a balance of performance and affordability. The company has found that hardware costs are significantly lower than 4+4+4 designs and remain competitive with dual-band 4+4 or 3+3 options, which would support broader adoption.4 For other operators that choose to adopt a similar approach, this lower upfront investment can accelerate payback periods and improve ROI, especially when targeting segments most willing to pay for premium Wi-Fi.

Operators can sell QoE-enhancing CPE in a number of different ways

In Analysys Mason’s Operators are productising quality of experience and turning it into a broadband value-added service, we identify three main commercial archetypes for packaging QoE enhancements.

- The first approach is an explicit QoE add-on, where features such as application-aware prioritisation, mesh Wi-Fi and minimum speed guarantees are offered as a paid upgrade. This typically targets high-value segments such as gamers, remote workers and streamers. The UK incumbent EE provides a recent example of such a strategy: its Wi-Fi Enhancer offers selectable priority modes for different user profiles.

- The second approach is bundled QoE optimisation, where advanced features are included by default for all customers, often to justify premium pricing or to reduce churn. Australian incumbent Telstra’s Internet Optimiser and ACT’s Smart Wi-Fi in India are good examples of this model, leveraging predictive maintenance and real-time optimisation to enhance reliability and customer satisfaction.

- The third archetype is dedicated segment plans, such as gamer or remote worker packages, which offer tailored latency improvements or traffic prioritisation. Operators such as Singtel (Singapore) and Aussie Broadband (Australia) have launched plans with technical enhancements specifically designed for these groups.

Successful implementation requires clear communication of the value proposition, visible user control via apps and alignment with advanced CPE.

Deploying tri-band Wi-Fi 7 comes with further considerations but these can be overcome with careful planning

Deploying tri-band Wi-Fi 7 and advanced QoE features presents a range of operational and technical considerations, but these can be effectively managed with the following proactive measures.

- Spectrum authorisation, particularly for 6GHz bands, may be subject to regulatory constraints in some regions. Most countries outside of China and India now have at least part of the 6GHz spectrum authorised for Wi-Fi. Operators can address 6GHz power limits, for example, by optimising mesh placement and leveraging app-based guidance to maximise coverage within permitted parameters.

- The diversity of devices in customer homes is another factor. Maintaining a unified SSID (i.e. all access points appearing as the same logical network) and intelligent beam steering helps ensure a consistent experience. However, it is also important to communicate to end users that older devices may not achieve the highest speeds, even as overall reliability and congestion improve.

- Home topology, especially in larger or older properties, can complicate installation and optimisation. Professional installation services and app-based self-optimisation tools are proven methods to overcome these challenges, helping to deliver reliable, whole-home coverage and reducing post-installation support needs. These services are also potentially monetisable in their own right, or an avenue to wider support service upsell.

The above considerations are easier for larger operators to resolve. For operators with limited resources, scalable approaches such as app-based self-optimisation and targeted upgrades for high-value segments could still deliver meaningful improvements without requiring extensive pro-installation or support infrastructure.

A number of further limitations should also be kept in mind but depend on country-specific factors. Regulatory uncertainty around 6GHz spectrum, device compatibility issues and the risk of over-promising on coverage guarantees can impact roll-out success. Clear communication, realistic expectations and ongoing monitoring are essential to mitigate these risks and maintain customer trust.

Adopting a data-led, segment-focused approach to deploying tri-band Wi-Fi 7 can enable operators to convert multi-gigabit broadband access into higher ARPU

To maximise the commercial impact of tri-band Wi-Fi 7 and advanced QoE features, operators should take a structured, evidence-led approach to roll-outs and optimisation. We recommend that operators follow these steps.

- Begin by bundling Wi-Fi 7 and mesh solutions with an every-room coverage commitment, supported by an app that enables auto-optimisation and simple prioritisation toggles.

- Target high-value segments, such as price-tolerant households, core gamers and remote workers by using in-bill prompts and device recognition to personalise offers and to drive take-up.

- A/B test and iterate. Pilot new features with engaged segments and use data-driven insights from A/B testing and KPI tracking to support an iterative approach to improving the product. This approach will help to identify the most effective commercial models. As is now often common practice, operators should track key performance indicators including Wi-Fi reliability, NPS, churn, latency and care calls, both before and after deployment. This will allow operators to quantify the incremental benefits of the solution and could inform future product development.

Tri‑band Wi‑Fi 7 with 6GHz and AI slicing is a commercial lever for operators to convert multi-gigabit access into higher ARPU, lower churn and stronger NPS. This analysis validates that many of the segments that matter most to operators are also willing to pay for a better in-home experience. Operators that move quickly to package, guarantee and target premium Wi‑Fi will be best placed to monetise the multi-gigabit era.

Disclaimer: This article was commissioned by Huawei. Analysys Mason does not endorse any vendor’s products or services.

1 Questions: “Please rate your satisfaction with the following aspects of your home broadband service –in-home Wi-Fi coverage”; “Do you intend to make a change to your home broadband service within the next 6 months?”; “On a scale from 0–10 (where 0=not at all likely, and 10=definitely), how likely are you to recommend your home broadband service to friends or family members?”

2 Question: “Would you be willing to pay extra for a better-quality router or modem with improved features (e.g. faster Wi-Fi, better coverage, more security or advanced features)?”

3 MLO allows devices to use multiple frequency bands at once, improving speed and reducing delays. DFS is a regulatory requirement in many countries for Wi-Fi devices operating in the 5GHz band. These channels are shared with radar systems. If a Wi-Fi device detects radar signals, then it is required to automatically switch channels to avoid interference, which can disrupt end-user connections.

4 While Huawei’s solution is used as an illustrative example, the analysis and recommendations in this article are based on independent Analysys Mason research and are not intended as an endorsement of any specific vendor.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Tracker

Fixed broadband and voice quarterly metrics 3Q 2025

Survey report

How home Wi-Fi affects broadband user experience: consumer survey

Video

What to give the consumer who has everything