Verizon and T-Mobile have revamped their unlimited data plans to grow ARPU; early signs are encouraging

29 November 2023 | Research

Article | PDF (3 pages) | European Country Reports| Mobile Services| European Quarterly Metrics| Global Telecoms Data and Financial KPIs| European Core Forecasts| North America Metrics and Forecasts

Mobile operators in the USA are beginning to find success in growing ARPU from customers on unlimited data plans. As discussed in April 2023, US operators had already begun diversifying their unlimited plans, with a view to attracting customers onto premium tariffs.

For example, both Verizon and T-Mobile have revamped their unlimited data plans, with early indications suggesting a positive outcome. These new plans are showing potential mechanisms for raising ARPU, even with a high share of customers (over 50%) already on unlimited data. Other operators should watch these developments closely.

In-depth data on the US mobile market can be found in Analysys Mason’s DataHub.

Verizon is giving customers more freedom with its ‘build-your-own-bundle’ approach

In May 2023, Verizon launched ‘myPlan’, its new offering of unlimited data plans. Customers begin by choosing a base package (see Figure 1). They can then add other services to their package for USD10 per month each, including the Disney Bundle (Disney+, ESPN+ and Hulu) and a Walmart+ membership.

Early results suggest that customers have had a positive reaction to this new offering. Verizon reported that in 2Q 2023, nearly 70% of myPlan customers chose the ‘Unlimited Plus’ plan, which was the highest-value package at the time. Following these results, a third-tier plan was added: ‘Unlimited Ultimate’ offers even more perks on top of the fastest mmWave 5G speeds.

These customer trends are also translating into strong financial results for Verizon. The company reported that consumer average revenue per account (ARPA) increased year-on-year by 4.5% to 3Q 2023. It cited myPlan as one of the main reasons for this increase. Verizon expects ARPA to continue growing as more customers switch to myPlan.

Figure 1: Details for Verizon’s base packages for myPlan and T-Mobile’s new Go5G plans, as of November 2023

| Operator | Plan | Price1 | Selected benefits |

| Verizon | Unlimited Welcome | USD65 |

|

| Verizon | Unlimited Plus | USD80 |

|

| Verizon | Unlimited Ultimate | USD90 |

|

| T-Mobile | Go5G | USD75 |

|

| T-Mobile | Go5G Plus | USD90 |

|

| T-Mobile | Go5G Next | USD100 |

|

Source: Analysys Mason

T-Mobile has maintained its share of customers on its highest-value plan, despite increasing prices

T-Mobile launched a new range of unlimited data plans in April 2023, branded as ‘Go5G’. These plans are an upgraded version of T-Mobile’s Magenta plans, offering ‘premium data’4 and hard-bundled OTT services.

The unique aspect of these plans is the frequency at which customers can upgrade their mobile device. Verizon and AT&T offer customers an upgrade every 3 years. Customers on T-Mobile’s Go5G Plus plan can upgrade every 2 years, while those on Go5G Next can upgrade annually.

In an almost direct parallel to Verizon, the initial launch in April 2023 only included Go5G and Go5G Plus. The latter costs USD5 per month more than Magenta Max, the previous highest-value plan. Around 60% of new customers subscribed to Magenta Max in 1Q 2023, and in 2Q 2023, T-Mobile reported that the same proportion had subscribed to Go5G Plus, despite the higher price. The company was encouraged by customers’ willingness to pay more for a better plan and subsequently launched its ‘Go5G Next’ in August 2023.

AT&T risks losing out on ARPU growth opportunities by not updating its unlimited data offering

AT&T’s approach to unlimited data plans remains, as yet, unchanged and mirrors the previous strategies taken by both Verizon and T-Mobile, so it provides a good benchmark for comparing the success of each approach.

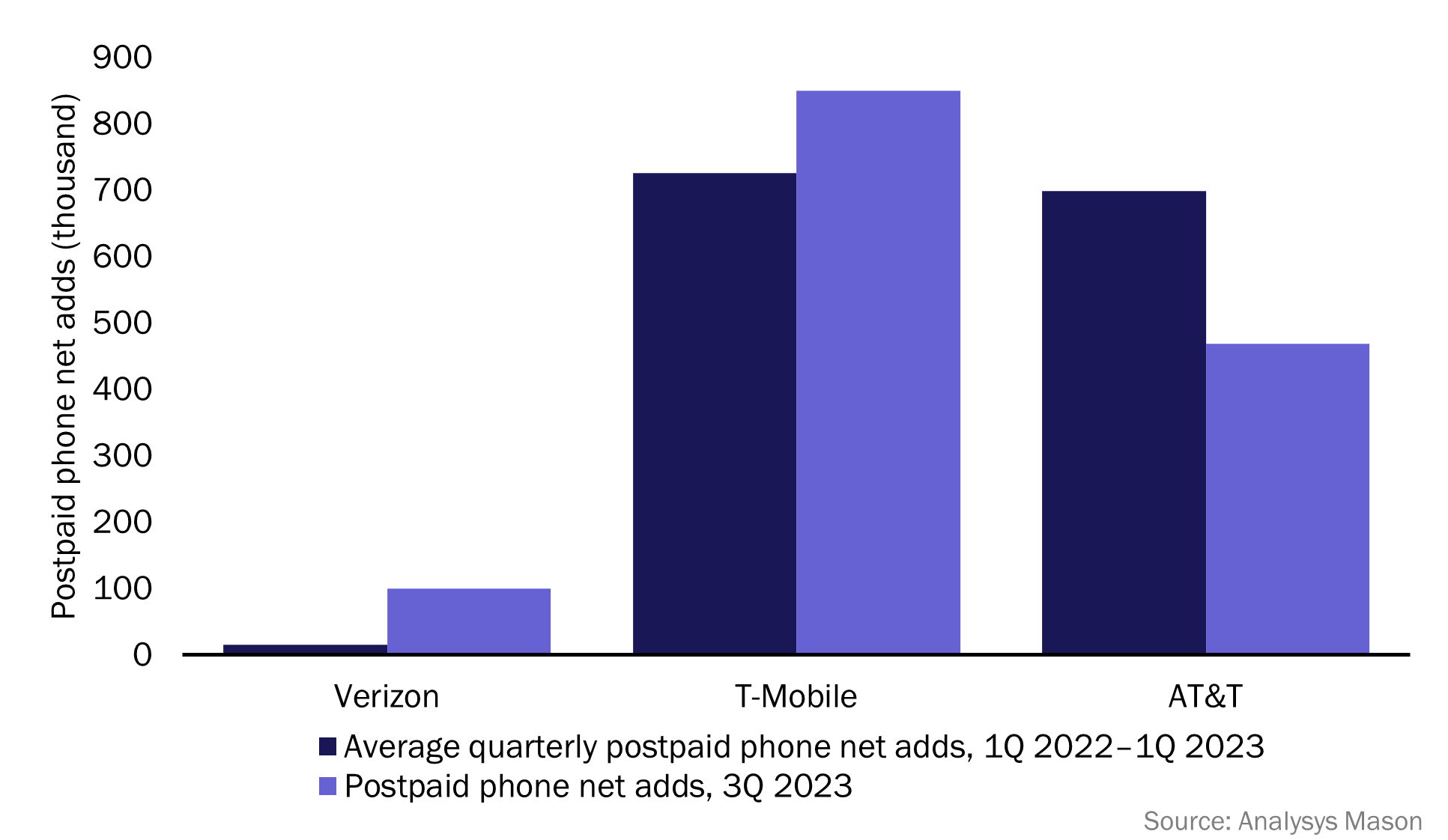

Results suggest that AT&T is beginning to see slower growth than its rivals. It reported 486 000 postpaid phone net adds in 3Q 2023 which is below its average from 1Q 2022 to 1Q 2023.5 Meanwhile, 3Q 2023 figures from T-Mobile (850 000 net adds) and Verizon (100 000 net adds) both represent an increase on their averages from the same period.

Figure 2: Postpaid phone net adds, comparing 1Q 2022–1Q 2023 quarterly averages to 3Q 2023 figures

The data seems to show that Verizon’s and T-Mobile’s new strategies are relatively more successful, but these plans are still new. Mobile operators around the world should pay close attention to the US market. While these strategies may not be the perfect solution, such experiments are a useful guide for others.

1 Prices and benefits are for a single phone line. Offers vary when two or more lines are included. See the Verizon and T-Mobile websites for full details.

2 Hum is Verizon’s connected car offering.

3 Compared to the equivalent Magenta plan.

4 T-Mobile defines premium data as data “where you are prioritized higher than customers who are heavy data users”.

5 Verizon and T-Mobile both launched their new pricing strategies in 2Q 2023 so this is the last full year for which the effects of this are yet to be seen.

Article (PDF)

DownloadAuthor