What is edge computing and why is it important?

28 April 2021 | Research

Article | PDF (7 pages) | Cloud and AI Infrastructure| Enterprise Services

Edge computing is becoming important to enterprises in a wide range of verticals1 that wish to process and store large amounts of data locally – rather than in their centralised corporate clouds or public clouds – for regulatory, security, performance and/or cost-efficiency reasons. We expect edge computing to underpin an emerging generation of applications and use cases that will benefit from close proximity to data sources. Such data sources are becoming increasingly numerous and distributed as more devices of all kinds are connected to private and public networks. This article examines the market drivers and challenges facing suppliers and buyers of edge computing services.

What is edge computing and what is its relationship with multi-access edge computing?

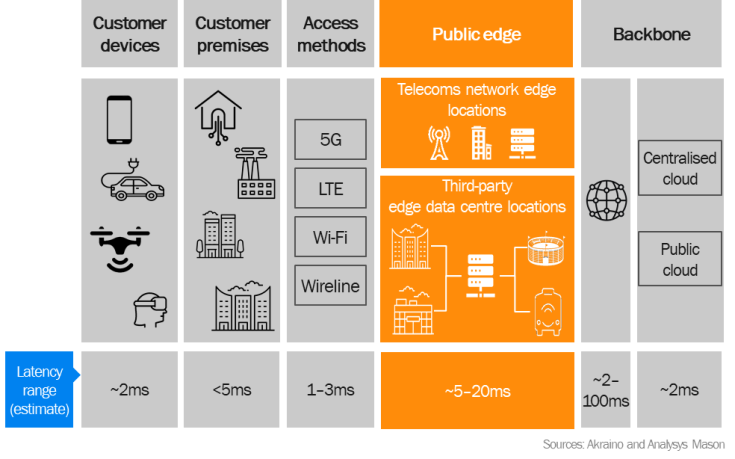

Edge computing is the term used to describe cloud-enabled application and data processing that takes place in multiple, highly distributed locations that are far closer to the sources of application data than private and public cloud computing locations are today. This proximity is typically measured in terms of round-trip latency, so edge computing locations are often 10 milliseconds (ms) or less away from the data source compared with public cloud data centres, which can be more than 100ms distant (as shown in Figure 1).

Both private and public cloud computing take place in a limited number of large data centres that centralise compute workloads to exploit economies of scale. For example, an organisation with multiple production facilities in various countries will nevertheless concentrate its cloud computing facilities in less than a handful of data centres that are shared by all its units. Public cloud computing services are offered from a few hundred locations worldwide, many of which are situated remotely to take advantage of low land values and a lack of contention for energy. In contrast, leading-edge organisations that are interested in edge computing expect to need tens of thousands of locations, both urban and rural, across a single country in future.

Private versus public edge computing. Private clouds provide dedicated processing support to applications and data that belong to a single organisation. Public cloud computing environments are shared by multiple organisations on a multi-tenant basis. The same distinction exists between private edge clouds, which provide edge computing services for a single organisation, and public edge clouds, the compute resources of which are made available on-demand to multiple customers by third-party public edge cloud providers.

Owners of high numbers of potential locations for edge computing are in a strong position to become public edge cloud providers. Telecoms operators match this profile since the delivery of telecoms networks requires them to have large numbers of highly distributed locations at the edges of their networks to house ‘last mile’ networking equipment. This is the equipment that is needed to deliver to consumer and enterprise customers the fixed and wireless access networks that connect their broadband devices, such as smartphones, home routers and enterprise customer premise equipment (CPE). The low-latency nature of telecoms services requires network edge locations to be near customers. Such sites include cell towers and street cabinets, central offices and metro data centres. Figure 1 shows the latency range supported by telecoms public edge computing locations compared with centralised clouds.

Multi-access edge computing (MEC). The 5G network will be a cloud-based network in which key network functions, such as the 5G standalone (5GC SA) mobile core and virtualised RAN (vRAN) functions are specialist software applications that will execute on cloud infrastructure. Operators therefore need to introduce cloud computing to their network edge locations to support such functions. Rakuten, for example, has initially deployed cloud infrastructure to 3000 edge locations in its new vRAN. The same edge computing capabilities that support network functions in operators’ access networks can also be made available to other organisations with the need to run low-latency applications of their own. MEC is an ETSI-defined architecture that enables the co-location of cloud-native network functions, such as 5GC SA as well as third-party applications in operator network edge clouds. Operators expect to charge for access to the compute resources in their MEC (network edge) clouds as a new source of revenue.

Edge computing and private 4G/5G networks. Private edge clouds are often deployed in conjunction with private wireless networks, both to run software-based mobile network functions (such as the mobile core) on enterprise premises and to support IoT and other applications that fulfil the enterprise’s use case(s).

Figure 1: Operators are well-positioned to provide public edge computing locations

What does the edge computing value chain look like?

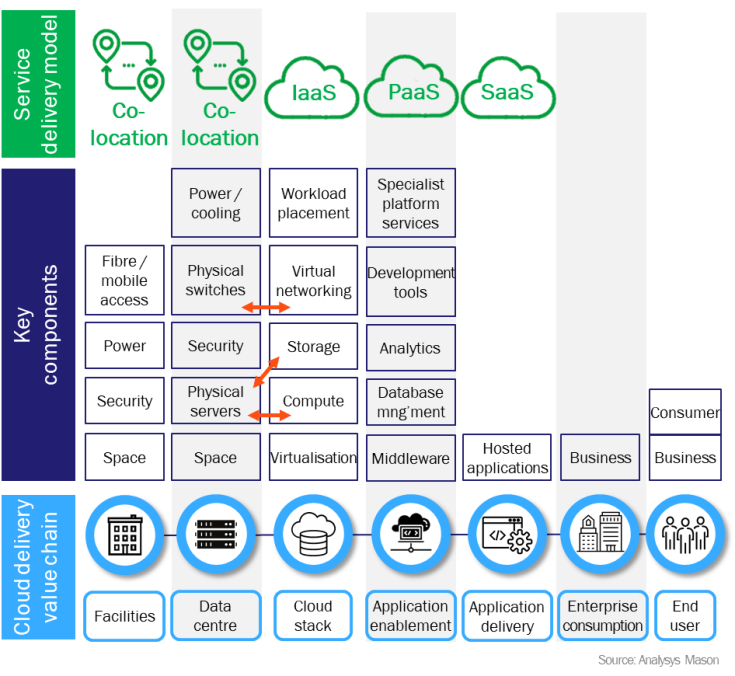

The edge computing value chain has similar elements to the cloud computing value chain. Figure 2 shows the four delivery models that form the edge computing value chain.

- Facilities. In the cloud computing value chain, facilities are synonymous with centralised cloud data centres. In the edge computing value chain, which consists of many more locations, facilities are buildings or land with a primary purpose other than housing data centres. These facilities can include car parks, rooms in multi-tenanted office buildings, retail malls, public venues or an operator’s central offices. Facility owners offer co-location services, including connectivity, power, security and space.

- Data centres. As the edge computing market grows, edge data centre providers are emerging to provide dedicated facilities for edge computing. Increasingly, such companies are acquisition targets for larger data centre providers. For example, Packet was acquired by Equinix and EdgeConnex by EQT. Some facilities owners may themselves equip rooms as data centres or put containers in their car parks that house data centre hardware, such as racks of servers and switches. Others may choose to partner with a provider of data centre equipment, management and connectivity services, as US cell tower company Crown Castle does with Vapor.io. Whether data centre providers are facilities owners or not, they sell co-location services into the edge computing value chain.

- Cloud stack. Edge computing is carried out using a stack of cloud technologies, including a virtualisation layer (hypervisor for virtual machine (VM) support or a container-based management system), virtual networking and storage technologies. The cloud stack makes physical edge data centre servers, storage and networking components available as infrastructure as a service (IaaS). Facilities/data centre owners may choose to build their own cloud stacks based, for example, on VMware or RedHat technologies. Increasingly, public cloud providers (PCPs) such as AWS, Google, IBM and Microsoft are making their public cloud stacks available in versions that can run in edge locations (Outposts/Wavelength, Anthos, Satellite and AzureStack, respectively). They are partnering with external facilities/data centre owners to build out their cloud footprints. Operators with MEC ambitions may use specialist edge cloud stack vendors, such as Robin.io or Wind River, to support edge computing in their network facilities.

- Application enablement services. These are middleware services that run on cloud stacks and which can be used by developers to create/support applications. Such services are delivered in a platform as a service (PaaS) model and may or may not be independent of the cloud stack provider.

- Application hosting. This involves the delivery, in a software-as-a-service (SaaS) model, of applications that have been developed for – or ported to – edge clouds to support business use cases that benefit from access to local compute resources. Such applications are typically provided direct to business or consumer customers by independent software vendors (ISVs). ISVs may hide from customers’ view (behind the application) the details of the edge computing value chain or allow customers to select the edge facilities that will host the application.

The edge computing value chain is more fragmented than the cloud computing value chain because it involves many more/different types of facilities owners. However, it is consolidating quickly as a result of growing interest in edge computing from large data centre owners, PCPs and content delivery network providers, with growing numbers of edge locations and extensive backbone networks that connect them.

Figure 2: The edge computing value chain spans four key delivery models: co-location, IaaS, PaaS and SaaS

Why are organisations using edge computing?

Organisations that have started their digital transformations expect cloud computing to be the prevailing IT infrastructure delivery model in the future. They are moving a substantial proportion of their business IT applications to the public cloud. However, they are wary about migrating applications that directly control their operational processes to centralised clouds that may be geographically distant. They want operational processes to benefit from the advantages of cloud computing, and especially the new technologies that the cloud market is incubating (such as IoT, artificial intelligence (AI), machine learning (ML), robotics, augmented reality (AR) and virtual reality (VR)), but they want to process their operational data on – or close to – their premises for security, regulatory and performance reasons. They also wish to avoid the cost of transporting very large datasets generated by IoT devices of all kinds, including cameras and sensors, over long-distance networks to be processed in central clouds. Instead, organisations want to use edge computing to bring applications, such as AI/ML algorithms, to their data.

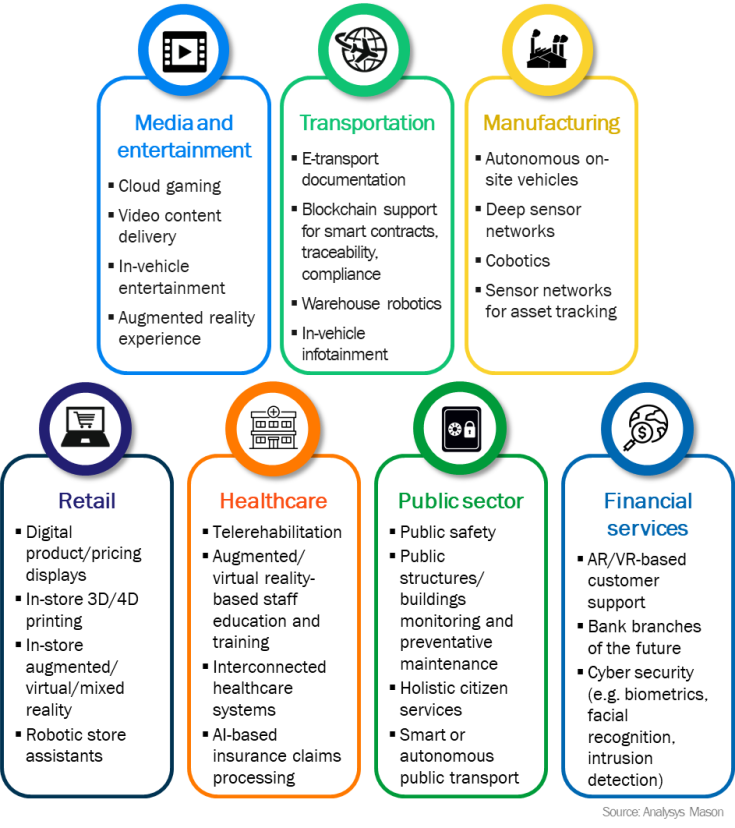

Edge computing is expected to enable a new wave of use cases over the next few years, driven, for example, by the demand for improved access to healthcare, public safety and sustainability, and enabled by the roll-out of 5G networks. Analysys Mason research has found a strong correlation between 5G and edge computing use cases. The COVID-19 pandemic is expected to drive demand for greater automation in public spaces and workplaces, with frictionless shopping and robotics needing edge computing support because of their low-latency requirements. Accelerating consumer demand for home delivery is leading companies to experiment with drones and automated guided vehicles. Analytics applied to image data from these vehicles and in other public safety situations (for example, for hazard or fault detection) are likely to need edge computing because of the volume of data involved, especially if there is a real-time dimension to the use case. Sustainability/green initiatives will encourage use cases such as smart grids, pollution control and traffic management that need edge computing support. Figure 3 shows a sample of the future use cases that large enterprises in seven sectors in four advanced economies (Germany, Japan, the UK and the USA) expect to deliver through public edge computing according to Analysys Mason research.

Figure 3: Key digital use cases for public edge cloud by sector

What is hindering the adoption of edge computing?

Edge computing faces five key barriers that are affecting the development of the market.

- The business case is uncertain. Some enterprises are deploying private edge clouds to support specific use cases, typically as part of larger investments in digital transformation solutions that can include private LTE/5G networks and IoT. The business case for the advanced use cases mentioned above depends on enterprises’ desire to transform customer experience and/or the value of being able to make decisions in real time. Where the business case involves introducing new technologies, such as natural language processing, image processing, robotics and AI/ML, the benefits can be difficult to quantify, especially on an individual use case basis.

- Public edge clouds are not widely available. Infrastructure that supports edge computing (facilities equipped with data centers/cloud stacks very close to customer premises) needs to exist before an edge computing market can evolve. Companies are reluctant to invest in converting suitable facilities into edge data centers or building new edge data centres until they can be sure that there is a market.

- Commercial edge-native applications do not exist yet. Public edge clouds would make it easier for developers to create new edge-native applications and would also make it easier for enterprises to experiment with them.

- Edge computing technologies are immature. Edge cloud stacks and edge computing hardware have different requirements from the technologies built to support centralised cloud computing, and it is taking time to repurpose existing IT software and hardware for highly distributed and resource-constrained edge locations.

- The governance of edge computing is a new challenge. The distributed and often public nature of edge computing locations creates security challenges that need to be resolved. Although local edge computing can satisfy national data privacy regulation, many edge use cases will require access to edge clouds across international boundaries, posing new threats for data governance.

How large is the edge computing opportunity?

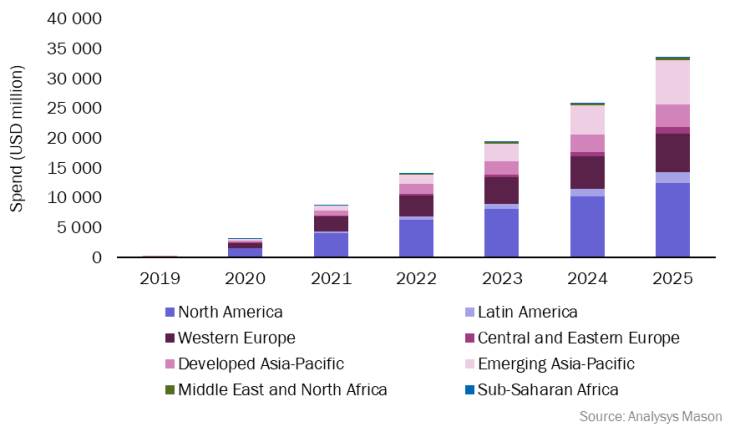

Analysys Mason estimates that the market for public edge computing services (including co-location, IaaS, PaaS and SaaS) will reach nearly USD34 billion by 2025. This forecast excludes connectivity services associated with connecting edge cloud locations and enterprise spend on private edge clouds.

Figure 4: Enterprise spend on public edge computing by region worldwide 2019–20252

1 Verticals include government/public sector organisations, healthcare providers, smart-city administrations, manufacturing, finance, retail, transport and logistics, media and entertainment, and utilities.

2 This data appears in Analysys Mason’s Operator opportunities and threats in the public edge cloud computing market.

Caroline Chappell is a Research Director and heads Analysys Mason's Cloud research practice. Her research focuses on service provider adoption of cloud to deliver business services, support digital transformation and re-architect fixed and mobile networks for the 5G era. She is a leading exponent of the edge computing market and its impact on service provider network deployments and new revenue opportunities. She monitors public cloud provider strategies for the telecoms industry and investigates how key cloud platform services can enhance service provider value. Caroline is a leading authority on the application of cloud-native technologies to the network and helps telecoms customers to devise strategies that exploit the powerful capabilities of cloud while mitigating its disruptive effects.

Article (PDF)

DownloadAuthor

Caroline Gabriel

Partner, expert in network and cloud strategies and architectureRelated items

Article

NVIDIA GTC Paris 2025: digital twins and sovereign AI signal a new era for telecoms infrastructure

Article

GenAI in the network: who is making real progress, and what is driving it?

Article

Operators are set to invest USD77 billion cumulatively in AI cloud infrastructure between 2025 and 2030